Howdy,

Welcome to Sunday CET. 10 weeks into the year, and just when you think that everything in the world should get on predictable basis, you get a Silicon Valley Bank-like event that makes you wonder whether this is yet another Black Swan setting up the premises for a complete reset of what we found normal back in 2020.

Let’s look a bit into it.

The bank run

The context

The whole hysteria started with a regular announcement of SVB raising $2.25 billion while also selling some of its assets at an almost $2 billion loss, which led to a bank run fuelled by VCs advising their startups to withdraw the money ($42 billion in withdrawals on Thursday alone, leaving it with a negative cash balance of about $958 million by the end of the day), which also led to the bank shares plummeting some 50% and the bank actively seeking a buyer. Everything culminated with the Friday’s close announcement and the FDIC taking control of the bank, creating the Deposit Insurance National Bank of Santa Clara to pay out insured depositors up to $250k, backed by an extra dividend of an undisclosed value.

250k is a small number though and north of 93% of the bank's $161 billion kept by 37k customers in deposits are higher and uninsured anyway - the very reason for which bank runs happen. Those numbers are important - SVB is the go-to institution for VCs which in turn brought in the startup founders as customers. What makes it more complicated is that the bank was not only just their startup's bank & lender, but also provided personal mortgages and other financial services. Very sticky situation.

The problem

The concentrated customer base is actually one of the main drivers causing it to crack on a stress test such as a bank run. What you want, as a bank, is a certain amount of diversity among your depositors - when one segment goes crazy, like it happened this week, the others are presumably a bit more insulated from the panic. And, on one hand, truth is that nobody on Earth is more of a herd animal than venture capitalists, but on the other, let’s be honest, if you’re a startup you need to ensure the capital of the company is safe so that you can stay alive and of course you need to take your money out ASAP, with or without VC advice. And yes, the VC-backed startups world has its technicalities:

You are the Bank of Startups, and startups are a low-interest-rate phenomenon. When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off. Your clients who were “obtaining liquidity through liquidity events, such as IPOs, secondary offerings, SPAC fundraising, venture capital investments, acquisitions and other fundraising activities” stop doing that. Your customers keep taking money out of the bank to pay rent and salaries, but they stop depositing new money.

LT bonds unprofitable at market value (i.e. the bank assets) against the deposits and startups not generating revenue while using up their runway + the VCs not putting more on the bank since the LPs raising has fallen dramatically = SVB’s need of liquidity. This actually sounds like bad business management that was supposed to be covered by a capital raise. Add to that the strange coincidence of the CEO cashing out stock and options for $3.5 million just a week ago - what gives? Do you believe in this kind of coincidence?

The SVB competitors took advantage, of course (got a couple of “diversify your funds”offers in my inbox either), and the whole SVB market shock generated a bigger contagion sentiment, as all of the American banks have lost over $100 billion in stock market value in two days, with European ones losing around another $50 billion in value.

The British exposure

SVB is America's 16th largest bank and its exposure in Europe is low, with less than 20% of its deposits coming from non-American customers. SVB is active in the Nordics, Germany and the UK, where it’s been running as a wholly-owned subsidiary of the US bank since last summer, with its balance sheet ring-fenced, meaning that the US has no ability to pull assets from the UK.

Just like in the US, the money deposits are also insured only up to £85k - alas, I have startup friends who were unable to make transfers from London’s SVB, while the London SVB manager said on Friday before business close that they’re processing payments and still operating service.

The tweet was deleted in the meantime as it was just PR talk - SVB UK had actually applied for £1.8bn of liquidity and on Friday AM the Bank of England put it into insolvency, meaning that the firm will stop making payments or accepting deposits and it would allow depositors to be paid up to £85k from the deposit insurance scheme. Liquidators will manage the remaining British assets and distribute them to creditors, including large depositors.

This containment should have certainly prevented the panic of a local bank run, which would not have been ideal in an already difficult British macro context - no bank, no matter how solvent, can survive a full scale bank run. It’s important to note that compared to the Americans, the Bank of England didn’t mention any extra dividend and the 85k is likely hardly enough to cover expenses for a customer base estimated at a few hundred British startups. The situation is fluid though and everything depends, of course, on what will happen in the US in the coming days.

A few things to ponder, regardless:

If the SVB brand survives, will Euro startups ever be working with SVB? British VCs would like them to alas words cost nothing and that can be just a collective PR showoff for the government. Or not - keep in mind that SVB is also an LP in many VC funds, and it is the VCs that usually have startups work with SVB in the first place. One hand washes the other.

No matter the outcome, will Euro startups work closer locally with Europe-based offices of American banks again? You certainly need to deal with an American bank if you expand to the US but now the reflex will be to switch to ‘too big to fail’ banks not really equipped to help startups. Even if it’s Goldman you will be wary and scrutinise closely - SVB had excellent street cred and was a good startups partner yet put everybody in the ecosystem at serious existential risk because of utter incompetence. Besides, being 100% dependent on one would raise some questions, see the next one.

If your Euro startup worked with only one bank and that was SVB (understandable if your VC wired your money there and/or SVB is one of the more active venture debt sellers in Europe anyways), why don’t you have a secondary local one as a hedge? Yes, it’s convenient and sometimes cheaper to work with only one bank but hedging is a good practice, as well as a yearly business analysis of dealing with your banks in conjuncture with the optionality of getting parallel offers for other financial products. I mean, don’t do what Greek the Freak did, but you get the idea.

If you raised a hefty VC round, does it make sense to keep all the money as a bank deposit? It’s 2023, there’s solutions to put (some of) it to work that require minimum overheads and low admin costs. You don’t need a CFO for that, just some entrepreneurial spirit.

How about giving neobanks a chance, embrace the future and see how’s that working out? Old banking institutions are greedy, traditional bastards by default, see what the fresh blood has to offer.

What happens next week

The majority of founders trying to build meaningful companies have their entire rounds deposited with SVB. Not only the equity money, but also more have taken on debt - and if you had debt with SVB, covenants restricted you from opening other bank accounts and transferring funds without paying off said debt. So they’re in limbo with the money stuck in a closed entity whose future is uncertain. To make matters worse, startups have no idea if they'll make payroll next week - and people not getting paid on time will certainly not help with mitigating the panic. Employees don't have the slightest clue what's going on and most of the investors still have no idea which companies are impacted or if LP funds are safe. It ain’t pretty.

A best case scenario means SVB gets bought and business becomes business as usual (w/ the obligatory Elon Musk plot twist). The worse is related to how the American government is handling the situation in order to contain it, namely covering money (or not) for the SVB customers either by selling assets or owning them over (they’re not failing, just unprofitable today) - thousands of startups with severe liquidity problems seems like a narrow incident that can spread like fire if not handled properly.

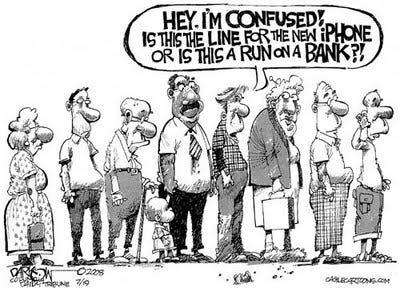

In Europe this is not as impactful as in the US, but even so it could have serious repercussions for an entire ecosystem, particularly in the UK. My guess is that the Brits will do good by the SVBs customers while treating the American entity separately and solve it promptly by Monday morning because not doing so will be more costly for a government already in a fragile position - takeover moves are already made and talks were held yesterday. In the US though this whole situation represents not only the largest bank failure since Washington Mutual in 2008, but also the second largest failure ever for a retail bank in the United States. It is a major business fuck-up and not even the damn bots are capable to figure what comes next.

Related reads

The top ten largest SVB investors includes a Swedish pension fund - Alecta, which more than doubled its holdings during the past year with a holding worth $605 million, pre-crash. That exposure is less than 1% of their AUM.

How the SVB implosion happened and why it was self-inflicted.

Fun Peter Thiel conspiracy theory - his Founders Fund was the first to advise getting out, and they have a sizeable portfolio of neobank/neofinance products that he can in turn recommend.

SVB’s risk isn't an existential crisis.

SVB made the responsible decision to strengthen its financial position with a cap raise. Where things went terribly wrong was the communication.

SVB’s China JV operations are healthy and stable.

Zero interest rates messed the banks business.

The collapse of Silicon Valley Bank highlighted the risks posed by "underwater" long duration bonds. Who else in the global economy holds a lot of underwater bonds?

UK resources for those impacted by Silicon Valley Bank’s collapse.

Odin Silicon Valley Bank crisis resources.

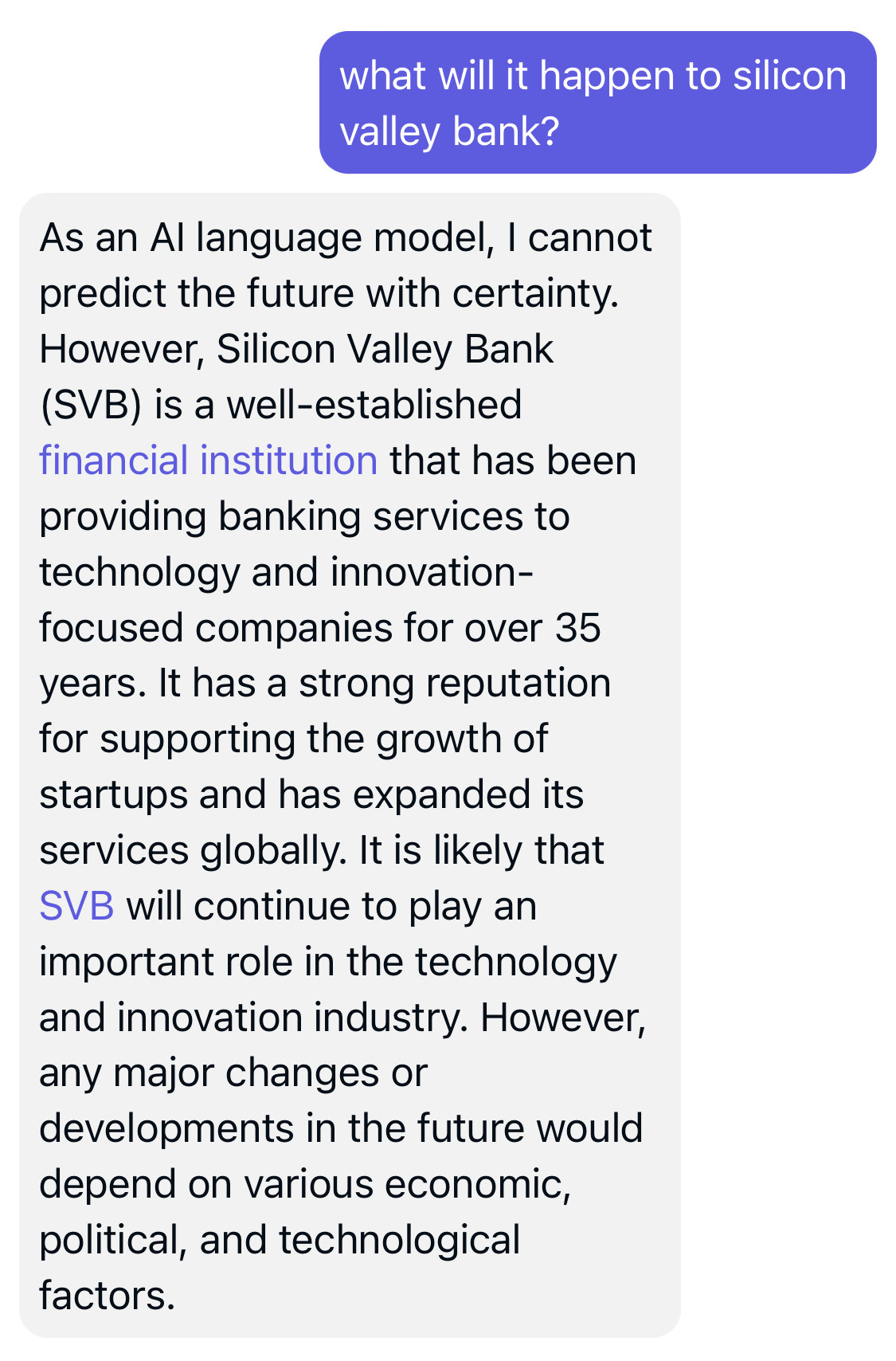

Sport business as an asset class

It is a business that attracts attention and which still has a lot upside, if only by considering the anecdotal fact that football clubs management is a traditional job in an European corrupt environment run by people in their 60s, not really grasping how they can use tech to turbo boost the revenue drivers. The other thesis is that owning and running a football club is just a front-office kind of thing for other operations - not entirely false, this is how the Russian oligarchs bought their respectability in the British society, for example.

Related: CVC paid $150 million for a 20% stake in the Women's Tennis Association.

Cheat Sheets

Average and median investment deals by stage (quarterly for 2020-2022)

The reports are available for Nordic 9 customers. Become one from here.

Good to know basis

How to

👉 Finding investors sweet spot - they all have one

👋 Build trust before asking for intros - but how do you do that

🤔 Investors still high on web3 - contrarian

✍️ Female founders share their top tips - basic stuff

📈 Exploring product-market fit - good read

Data

🇩🇪 German angel investors report - in German

🕸️ Business breakdown by city - awesome data viz

🎶 In 2022, 41 million vinyl units were sold compared to 33 million CDs - it’s the Gen Z and millennials.

Also notable

👋 Interesting Euro deals this week: C-Resiliens, Klimate, Lithium, Violet, Sunrise + some 30 other early stage curated for the intel piece we’re sending tomorrow in the AM to the N9 customers. Most of those deals are not in the media → zero noise, 100% signal, sign up now to get it too.

☝️ Euro startups at YC - 3 weeks to go to the YC demo day, so I had a quick look over the Euro batch. Some notes:

30 startups this winter, mostly coming from the UK, Germany and France.

There’s also three Swiss startups (all doing AI stuff) while the Nordics have only one rep, coming from Denmark (Sorted Tools).

There’s also one startup from Hungary - Tailfin (usage-pricing SAAS) and one from Spain - Invopop (invoicing management SAAS)

3 of the British startups are coming from Manchester and there’s another one from Cambridge.

Most of the startups, not surprisingly, are hardcore software developers incorporating (and selling) AI into their apps. Keep an

AIeye on Anarchy, Ivy, Quazel and Waveline.I was also intrigued by Map3 (seasoned team doing back office, checkout and API across crypto custodians), by Rollstack (embedded data and viz for slides & docs platforms) and by Forfeit (which takes money from consumers if they don't complete tasks/habits). BabylonAI also has an interesting team - a Bulgarian and a Lebanese, both technical - but not sure about the market of the product tbh.

All in all, not a bad batch at all, Europeans can produce good stuff, the trick is how they bring it to market, as always. The whole list is available here.

🎪 Outsized returns requires more than indexing the market. Investors are seemingly worried that AI has become the next inflated thing, as the bubble has moved from crypto deals to AI investments because, well, the money has to be put somewhere and not kept in the bank. That is not untrue, money has to be deployed, demand is higher than supply and that reflects on deal prices, on one hand, and on the other, in any emerging market, if you are a good VC you need to find and invest in founders with vision driving the market aka the game changers.

Doing so in uncharted territories requires conviction over spreadsheet crunching, is hard and poses a lot of uncertainty - actually, this gold digging is what makes this business interesting, because nowadays anybody is a money manager and can index the market just to be able to call themselves venture capitalists. Startups done by game changing founders that become multi billion companies are rare, and they’re usually funded by equally visionary investors. Or by accident - not by market indexers.

🤘 Investors business models. If you think that being a venture investor means making a lot of money you’re not wrong but just because they should doesn't mean they could. Truth is that some of the VC firms are not able to even return their funds alas it’s tough, man, the market is murky and requires navigating through a risky and increasingly competitive environment - a VC is a type of professional investor whose job involves multiplying money from buying into high risk early stage startups usually providing returns within 5-10 years. If this sounds complicated, the money management job can be more sophisticated than the VC job description though, here’s what the high end side of being an investor looks like:

The 25 highest-earning hedge fund managers made $21.5 billion in 2022, making last year’s total the third highest, after 2020 and 2021. This works out to an average of about $860 million each.

The median manager earned $570 million — the fourth best in 22 years — and the seven highest earners all made at least $1 billion.

The top hedge fund earners are mostly the big institutionalised multi-manager funds such as Citadel*, Millennium and Point72. Their model involves running multiple portfolios with complex modelling of the alpha of the market rather than taking big bold bets based on gut instinct, which is rather close to the way the VC is done.

And this seems to be the direction the high-end VC market players are heading to as well, with the likes of Andreessen, Sequoia et all moving from the traditional model of one-startup-that-returns-our-portfolio models towards a portfolio of portfolios taking risks in multiple market segments. In part it is understandable, the VC-backed startup world has become crowded and super competitive and the market simply cannot accommodate the huge funds that have been raised for it. Question is - will VC remain the core of their business, if they aspire to the above market leading returns? Because, at the end of the day, the VC job is a high conviction business correlated to the market evolution whereas the institutional portfolio manager model needs to provide steady returns every year, regardless of where the market is in the cycle.

* Here’s a good read on Citadel, whose most of the team is based in London.

👏 High conviction bets. Speaking of conviction investments, Sam Altman of the (now) OpenAI fame took all his liquid net worth and put it into two companies: Retro Biosciences - biotech aiming to add 10 years to the average human life span - and Helion Energy - a nuclear fusion company. He invested $180 million in the first and $375 million in the second. Kinda different than betting on quick grocery delivery startups, huh?

AI eats the world

⚡ Google requires generative artificial intelligence to be incorporated into all of its biggest products within months.

🤖 Google announced PaLM-E, a multimodal embodied visual-language model that integrates vision and language for robotic control:

When given a high-level command, such as "bring me the rice chips from the drawer," PaLM-E can generate a plan of action for a mobile robot platform with an arm (developed by Google Robotics) and execute the actions by itself.

💲 OpenAI rival Anthropic raised $300 million in funding at a pre-money valuation of $4.1 billion.

🦆 DuckDuckGo launched a beta version of an AI search tool powered by ChatGPT called DuckAssist.

👌 Poe by Quora is lit, I find myself using it more often than I would like to admit.

☝️ Noam Chomsky and others about the false promise of ChatGPT.

Closing notes

🎶 Spotify has a new design - part TikTok, part Instagram, and part YouTube - and is used by 534 million MAUs. Meanwhile, Apple is launching a classical music app.

⚙️ TikTok launched Project Clover in Europe as the company seeks to assuage politicians’ fears over Chinese surveillance by keeping European user data in Europe and allowing a European security company to audit its data protection controls.

⚽ Paris Saint-Germain, the French soccer club, is interested in buying Stade de France, the country's largest sports stadium with a value of around €600 million.

🗡️ Meta is doing a Twitter competitor codenamed ‘P92’ that will be interoperable with Mastodon. Because why not.

📱 Apple captured eight spots in the list of top 10 best-selling smartphones for 2022.

🇩🇰 Danish bank Coop refuses to open accounts for non-Danish speakers (Swedes make it difficult for foreigners too btw).

Now, imagine you have to switch banks from SVB and you need to deal with those clowns.

🇦🇹 Austrians make good money out of the Ukraine war. Raiffeisen made €3.6bn in profit in 2022, compared with €1.4bn in 2021. Of that, €2.2bn, more than 60%, was attributable to businesses in Russia and Belarus, up fourfold from 2021.

🤔 Elon Musk is building his own town outside Austin - a Texas utopia along the Colorado River where Tesla employees can live and work.

✈️ A reporter flew 40 hours NY-Singapore-NY to see what it’s like in the first, business, and premium economy classes on Singapore Airlines.

🍣 Three people in Japan were arrested in connection with sushi terrorism.

🍸 SunnyD Vodka Seltzer is here.

Did you find this email useful?

Great, will forward • Good • Meh

Dedicated to my mother.

Thanks for reading! Please send me your thoughts or comments by hitting reply.

If you would like to sponsor this newsletter, please get in touch. I am bit biased, but Sunday CET is a great way to reach investors and founders from Europe.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.