45 months to unicorn

#70

Hey guys,

A lot of new subscribers this week, thanks and welcome to Sunday CET, everybody!

Let’s get straight to it.

Euro intel

❄️ Powder:

🇫🇷 Big Idea Ventures

🇬🇧 Illuminate Financial

🇨🇦 Inovia

🇮🇸 Iðunn

🇸🇪 BioGaia Invest

🇸🇪 Framtid

💸 Active this week:

VCs: Target Global, Coatue, Hoxton Ventures

Angels: Niklas Östberg, Hiten Shah, Jean-Charles Samuelian

🔥 Interesting deals:

🇬🇧 consumer marketplace built on top of a mobile app combined with a VISA debit card.

🇦🇹 app-based payment card backed by Mastercard

Really like the model of building utility, preferably using software, on top of providing a classic banking account service backed by a household name such as Visa or Mastercard.

A similar example that comes to mind is ikigai, which offers a basic banking service with a Visa card, incorporated in a sub service for wealth management i.e. an investment portfolio account providing affordable personal investments Robinhood style (think robo advisors).

🇩🇪 carbon farming startup

🇸🇪 social network for climate action

🇩🇪 social network for cancer patients

🇩🇰 B2B marketplace for residual and waste products

🇸🇪 D2C producer of probiotic skin care products

🇪🇸 SAAS for veterinary services

✍️ Observations

Why did P9 invested $12 millions in Whereby?

🇳🇴 My favourite piece of news this week comes from the Nordics, where I happen to live and where a bunch of Norwegians that go by the name Whereby built a video tool that competes with the likes of Zoom, Microsoft, Google and Cisco.

The news is that those guys raised $12 million series A from an Euro VC house and a group of high profile angel investors.

If you’re not into B2B video SAAS, the space may seem boring and crowded but a quick scan of the fundamentals will quickly show the opposite. The lower end of the market is wide open for grabs.

The overall video-enabled software space is growing like crazy (estimated at double digits growth CAGR by the end of the decade) and the macro starts to align i.e. cheap tech, WFH, offline verticals starting to adopt video-based solutions etc.

This made me curious to look beyond the PR of the deal.

And so I did dig into fundamentals and discovered that Whereby has the potential to become a unicorn in about 3 years.

45 months to be more precise. Less if the FOMO is worked out right. Now, sure, this is not Hopin-like fast, that is an outlier, but pretty fast compared to an European average.

I crunched numbers, played a bit in Excel and used some strategic thinking, all wrapped up in an easy-to-read, handy material produced over at Nordic 9.

The video SAAS market in Europe

🇪🇺 Speaking of the video SAAS space, it is not a new topic in Europe, particularly since we are coming all the way from 2003 when Skype was founded.

The writing was on the wall, the pandemic just transformed an upward demand trend of using video conference tools as a WFH mean into a hockey stick.

In addition, multiple vertical spaces like recruiting, social commerce, telehealth or VR (yes, it’s back) are just a few domains I noticed European founders are working on.

We had a look at about 100 Euro deals made in the past 12 months and produced a report profiling 21 of the more interesting early stage startups from Europe. 4 of them are from Norway btw and the list doesn’t include Neat, which Zoom already took an interest in.

The online grocery situation in Europe

It is fluid.

🇩🇪 Gorillas in talks to raise money from Tencent and DST at $1bn+ valuation

🇬🇧 Dija acquires Cambridge startup Genie to support UK expansion

🇮🇱 Stor.ai raised $21 million in an extended Series A to enter markets in Europe.

🇬🇧 Jiffy raised £2.6 million in seed funding from LVL1 Group.

And more.

The big grey area from the square from the right is why VCs have gone crazy and pay for our toilet paper discounts.

Opera starts to show that it’s serious about financial services in Europe

🇳🇴 Opera hired PayPal veteran Allen Hu to run its fintech arm.

Allen Hu used to work for PayPal in the US for 10 years, where he was regional head of Global Core Payments.

Prior to that, he gained expertise in fintech as a venture partner in Sequoia Capital China, where he focused on investments in the fintech sector.

And pre-Sequoia, he was the general manager of Baidu Pay, the COO of Ping An FinTech, and the deputy general manager of TenPay, a Tencent company, where he launched WeChat Pay.

In other words, he is solid, here’s why they hired him.

European assets are cheap af

🇪🇺 KKR eyes Europe’s fertile hunting ground for tech deals.

Same goes for General Catalyst supporting the Greek ecosystem - its MD is Greek and they made about 20 deals in Europe in the past 12 months or so, including Hopin and Cazoo.

From the American VC investors in Europe report:

General Catalyst was founded in 2000 in Cambridge, where it's HQ-ed, and has multiple offices on both American coasts.

In 2020 it announced $2.3 billion in fresh money and in Europe they were quite active in 2020, having been involved in early deals such as Teooh, Finom or Remote and in bigger transactions such as Contentful, Cazoo or Monzo.

Also notable, they started 2021 with a new Europe boss, the London-based executive Chris Bischoff recruited from Swedish Kinnevik.

In the words of an American friend of mine who is an investor: European assets are cheap af.

EU wants to have the cake and eat it too. So far it only has money to bake a cake.

🇪🇺 It looks like the EU’s understanding of privacy is simply just taxing US companies.

If we cannot create value, let’s destroy value kind of thing.

This in the context of which more American tech companies are succeeding in getting fines related to GDPR overturned or struck down. And now it seems that the European regulators may simply not have the resources to fight platforms’ appeals.

You don’t need to read Sun Tzu to know not to start a war unless you are sure you can win it.

Being unable to have a consistent understanding of the tech world

+

Throwing huge piles of money at the local ecosystem

=

Hope that something will stick after all.

We’re basically looking at the work of a bunch of politicians who all of a sudden think are good at tech business, over night, just because they get to play God with people who changed the world with their tech, bossing them around. And, the last glamorous cherry on top, they being VCs too now.

If you think you’re a leader you need to act like one and what EU is showing is far from being it. I know those words may sound harsh and everybody is friends with the money dealers preferring to look the other way rather than speak, but this is just like in the vaccines case, a similar stance where Europe is nothing but a mess.

Media business on the internet seems easy but it’s not

🇬🇧 FT’s digital content revenues are now bigger than all its other revenue streams combined and more than three times print advertising.

Looked a bit into FT’s model a while ago tbh, what they do is rather difficult to replicate in the media world, even taking the long term view.

FT is in a later stage of a longer transition period - one act of moving from print to a cross-media product portfolio based on tech combined with another from being acquired by a Japanese owner to an existent status quo, pigmented with some acquisitions and new product launches.

And even though FT seems to produce economic value in a consistent way, there’s still many head scratchers out there.

And while FT is a great brand and a good business, I would argue that, in general, there’s no particular blueprint or too many good models to learn from a media industry in constant disarray and which constantly looks with jealousy at tech business while trying to build different types of products.

Not an easy discussion and rather long, requiring a bit of strategic thinking combined with tech strategy and brand/product consistency.

And btw, you will never see clickbait titles or tabloid-like articles in FT. There is a reason why - unless you are in the tabloid business, that is a sign of being clueless about B2B media business. Even BI changed their act after being acquired by Axel Springer, and now their product is comestible.

✍️ Other notes

🇮🇱 There’s VCs out there who actually do treat branding in a serious manner. Compare and contrast.

-

🇪🇺 Early stage VCs don’t seem to be interested in SPACs in Europe. That is because SPACs are investment vehicles produced by other type of investors.

-

🇸🇪 Ikea has turned its catalogue into a podcast series. During the 13 episodes (4 hours!) you can hear a woman describe every single image and read every line of copy from Ikea’s 286-page catalogue.

-

🇪🇺 UEFA is in advanced talks with the European Club Association, a group that represents more than 200 teams, over creating a joint venture that would control all media and sponsorship rights for contests such as the Champions League and the lesser Europa League.

Share the pie or lose it - they finally got it right.

-

🇪🇺 Here’s a list with Amazon seller acquisition companies from Europe.

-

🇭🇺 How Seon vetted Creandum in order to let them invest in their series A.

-

🇸🇪 EQT Ventures added a new partner in San Francisco.

-

🇸🇪 Why Spotify should buy Epidemic Sound - not sure it’s the Swedish way of doing business but it does make a lot of sense.

-

🇪🇺 Tuesday it’s YC Demo Day. You gotta be present if you’re an investor, there’s quite a few Euro startups pitching that I am aware of.

-

🇬🇧 A look at podcast companies in the UK trying to fund shows outside the BBC's ecosystem, using an influx of cash and inspired by the medium's success in the US.

-

🇸🇪 Spotify did a marketing tool, aimed to explain the artists the economic breakdown of their work.

-

🇫🇷 The French opened an investigation into Clubhouse.

Maybe they want to regulate it, maybe they just want to clone it because they cannot produce original ideas… Mystery.

-

🇬🇧 Matt is speculating about Stripe’s last round *negative* dilution.

-

🇬🇧 There’s an old joke that consultants are like seagulls - they fly in, make lots of noise, mess everything up and then fly out. That’s pretty much what tech has done to media industries - it changes everything and then it leaves.

Ben explains why.

-

🇩🇪 Speaking of Ben, Morning Brew bought ads in his last week’s newsletter.

MB is the newsletter-based media business that in five years since launch got acquired by the German Axel Springer for $75 million.

-

🇮🇹 Italians creatives with furniture.

-

🇮🇹 Also Italians, with a workaround to help Brits in exile. Bravo!

Charts of the week

Europe is just a gathering of villages

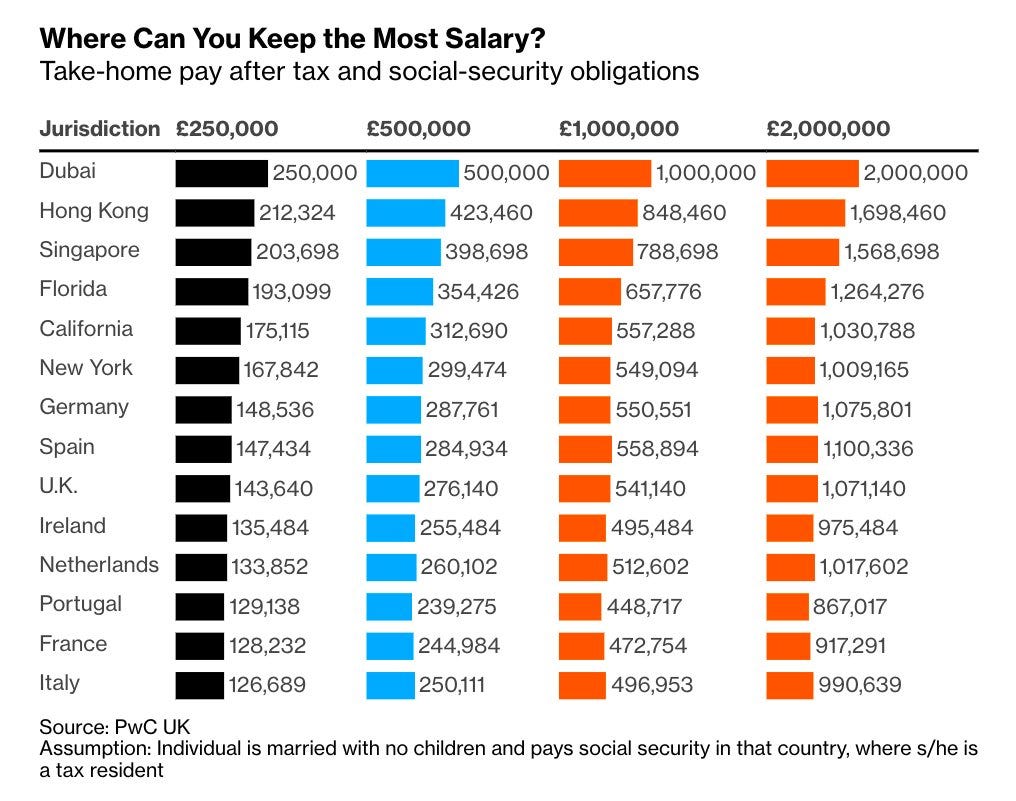

Where in the world can you take home the most pay after taxes?

Other stuff

NFTs are a dangerous trap. Yup.

Substack tries to be both a platform - where it simply sets up a place for anyone to write anything and steps away - and a publisher - where it makes choices about the kinds of writers it wants on Substack.

You will attract a lot of hate when building stuff that changes paradigms.

Gucci just dropped their first ever 'digital-only' sneakers, designed by Alessandro Michele.

Buyers can 'wear them' in social media photos, similar to how you'd use a face filter, or they can wear them on their avatars in VRChat & online game Roblox.

Alexi McCammond, who is 27 and Teen Vogue editor-in-chief, parted ways with her employer Conde Nast for some tweets she posted 10 years ago, when she was 17.

The story is longer though. But do you remember what you tweeted 10 years ago?

Sequoia sent a memo urging founders to be positive.

The market is full of investment money but doing business in a terribly recession-hit environment is more difficult than forecasting it in excel. Appreciate the encouragement though.

Keith Rabois of Founders Fund fame who recently moved from San Francisco to Miami is forming a Miami-based company called OpenStore that intends to buy a number of small e-commerce businesses.

Rabois is working with another new-to-Miami transplant, Jack Abraham of the startup studio Atomic

Why Clubhouse is doomed to fail. Not wrong.

First year analysts from Goldman put out publicly a presentation complaining about having to work 105 hours a week.

Back in my day, everybody knew that either investment banking or management consulting required 100 hours a week work stretches. It was a default you’d compromise for in order to get a career shortcut that would take you to a $500k/year job in 5 years.

If you want a balanced take about it, read this.

How the New York Times A/B tests their headlines.

Also the NY Times discovered Thrasio and its clones raising huge piles of money.

Facebook and News Corp have a deal in Australia meaning that Murdoch single-handedly beat Google and Facebook.

You just need to understand how big are G and F’s interests in crawling media assets if they had to reach a compromise with Murdoch.

Facebook is building an Instagram for kids. Creepy.

Tinder is giving away users pairs of free mail-in COVID-19 tests - one for them and one for a Tinder match. Great marketing.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.