$50M fund for Armenians, how a Swedish app failed to scale a successful op, fashion waste value creators, the new seed and pre-seed landscape.

#5 edition of Sunday CET

This is the fifth edition of Sunday CET, a weekly curation of what we found interesting in the European investment tech landscape.

Thank you for subscribing - if you are not a subscriber yet, you can do it here.

MENU

1. More money in the market

2. How others are doing it

3. Interesting bets

4. Data, research, observations

5. What others think

1. More money in the market

🇪🇸 Investment managers are looking to deploy $4bn in the Spanish markets

🇦🇲 Aybuben Ventures launches a $50M fund for Armenian entrepreneurs worldwide

🇪🇸 Bankia has announced the creation of 'Bankia Fintech Venture', a fund through which the entity will invest up to 20 million euros over a period of five years in fintech projects

2. How others are doing it

🇪🇺 Europe’s doctor apps, compared

Sifted made a good overview about the telehealth sector across Europe.

What is fascinating though - a related story about the background story of Min Doktor, a Swedish company which has failed to scale across Europe because of a different capital raise strategy than its main Swedish competitor (Kry), strategy which ultimately turned against them.

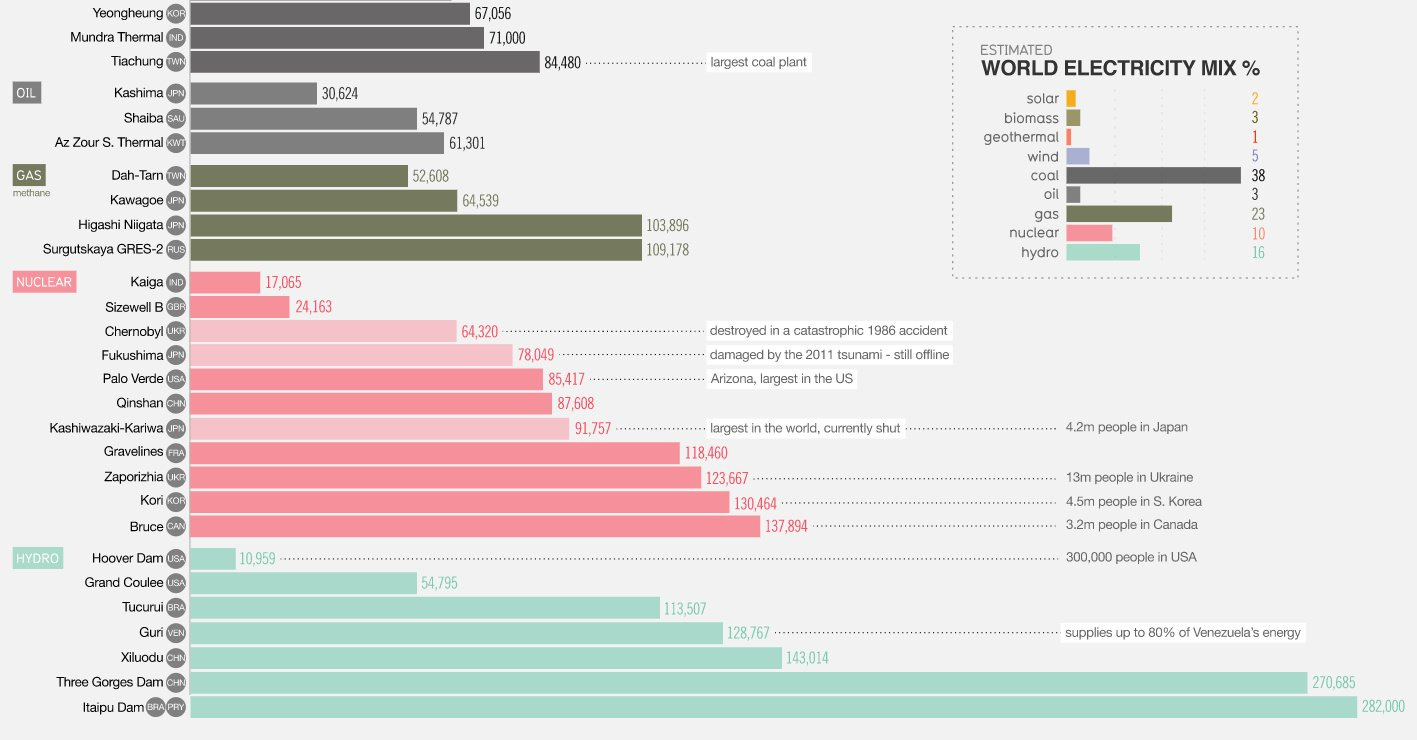

data comparison from here

In a nutshell, Kry is backed by a range of pan European professional investors and has already expanded in Europe, with a substantial presence in Spain, Norway, France and the UK as well as Sweden.

On the other side, Min Doktor is backed by Swedish investors only, with a solid 42% of the company owned by a strategic player, which is active in the local retail market (Ica Group through its pharma biz Apotek Hjärtat).

Min Doktor secured a strong position in the Swedish healthcare market, but failed to open new markets across Europe, after piloting its services in the UK, France and Holland.

The problem in this kind of cases is the lack of money and knowledge and, as Apotek Hjärtat was not interested to fund the expansion, Min Doktor was turned down by other international investors as it is not an attractive investment project at this stage.

EQT Ventures, a Swedish professional investor with European ambitions and also part of Min Doktor, declined to make a follow-up investment because it did not want to turn itself into a private equity buy-out company:

“We are not a majority investor and we follow that principle pretty hard. We want to be one of several backers of fast-growing companies. Had we done another round, I believe we would have become majority owners,” Jörnow of EQT said.

Good food for thought.

🇪🇸 How does an M&A contract look like?

Suma CRM details its process of dealing with selling their company (in Spanish) and also made available a first draft of their legal contract (in English)

🇸🇪 This reminds us of Erik Byrenius Startup tools - a set of standardized documents (term sheet, shareholders’ agreements, employment agreements, NDAs) adapted for the Nordic countries legislation. Very useful for startup people.

🇩🇪 The Lilium Jet flying taxi completes first phase of flight testing

🇪🇸 Mobility service providers, the Spanish edition

In Spain, Uber is working to integrate taxi service and public transport into its platform, so that its users can buy metro and bus tickets.

Renfe, the state-owned company which operates freight and passenger trains in Spain, wants to do the same thing.

🇬🇧 Naspers spinoff Prosus launched £4.9bn cash bid for taking over UK group Just Eat.

The bid was rejected. The offer was 20% higher than an earlier merger offer from Dutch rival Takeaway.Com.

🇩🇪 TaskRabbit announced that it will launch in Germany in November.

The Americans were acquired by IKEA in 2017, connecting consumers with "Taskers" to handle everyday home improvement tasks and errands. In addition, TaskRabbit provides furniture assembly service available through selected IKEA stores in these areas, and through IKEA's e-commerce website.

Part of a larger European growth strategy, Germany is the fifth country where TaskRabbit operates, with services already available in more than 70 major metropolitan areas in the United States, United Kingdom, Canada and France.

🇩🇰 The Zero Waste Pullover by Son of a Tailor

Danish designed garment that takes a stand against fashion industry waste - we will see more and more companies focusing on waste in fashion, Infinited Fiber or Trustrace are good examples of this.

Bonus:

3. Interesting bets

🇦🇹 Austria

a European competitor to Google News | Raiffeisen Innovation Invest, CatVentures, Pulp Media

🇫🇷 France

IoT technologies for manufacturers | €1.5 million | Breega, Irdi-Soridec, Frédéric Salles

smart data platform for data scientists | €1.34 million | IT Translation Investment, Crédit Agricole Alpes Développement (C2AD), business angels

chatbot development platform adapted to the needs of CIOs | €1 million | angel investors

🇩🇪 Germany

provider of solutions that predicts material properties using quantum computers | €2.3 million | UVC Partners, HTGF, btov

provider of information and services for expectant mothers | €1 million | BrückenKöpfe Management GmbH, MediVentures GmbH, W&W brandpool GmbH

🇱🇹 Lithuania

online gaming platform | €2.5 million | InReach Ventures

🇳🇱 Netherlands

e-sport business for amateur and semi-pro gamers | €5 million

🇵🇹 Portugal

maintenance and facility management software to use NFC technology to make buildings and maintenance operations smarter | €3 million | Indico Capital Partners

🇸🇪 Sweden

SAAS helping companies with better employees onboarding | $820k | Icebreaker VC

🇨🇭 Switzerland

plant-based meat that mimics the taste, texture and mouthfeel of animal meat | CHF 7 million | Joyance Partners, Blue Horizon Corporation

🇬🇧 UK

marketplace for shared experiences | $60 million | Draper Esprit, Northzone, SIENNA CAPITAL LIMITED

AI-powered workplace learning platform | £2.4 million | Fuel Ventures, angel investors

modular app dev platform to build web apps | €1.2 million | Pentech, Charlie Songhurst

4. Research, data, observations

🇪🇺 Europe’s top tech startups to know (Sifted.eu)

🇫🇮 A study of the Finnish Fintech landscape

Bonus:

5. What others think

🇮🇱 Is Winter coming for startups?

🇬🇧 The Tech CEO Success Model: the Top 5 Leadership Pitfalls

🇩🇪 The importance of customer segmentation in SaaS

🇬🇧 Managed Marketplaces: redefining e-commerce

🇫🇮 How Conversational AI Is Transforming the Customer Journey

A discussion about chatbots with experts in the field

🇬🇧 How to easily explain to a VC what type of startup you are building

🇪🇺 Can Europe Be Saved From Demographic Doom?

For politicians, the crisis of meaning among European youth isn’t an issue worth addressing. They see declining birthrates as a natural result of post-industrialized economies, where people living comfortable lives do not feel the need to have children. And importing a new generation of young people from abroad seems like a convenient solution to an aging European population that isn’t able to sustain itself.

We are now entering a new era of consumer internet which is centered around 2 new dimensions: privacy and digital consciousness.

🇬🇧 Very good interview with Matthew Clifford, the CEO and founder of Entrepreneur First

Happy Sunday!

Thanks for reading 🙌

Created by @drnovac every Sunday. Please share it with people who may find it interesting - thanks! Feedback at dragos@nordic9.com.