9 new funds and half a billion euros, the ideal European serial entrepreneur and gender-biased investing.

2nd edition of what is interesting in the European investment landscape.

This is the second edition of Sunday CET, a weekly curation of what we found interesting in the European investment tech landscape.

Thank you for subscribing - if you are not a subscriber yet, you can do it here.

MENU

1. More money in the market

2. How others are doing it

3. Interesting bets

4. Data, research, observations

5. What others think

1. More money in the market

🇬🇧 Notion VC has announced Fund IV, with the first close expected at over $150 million

Notion, founded in 2009 and led by Managing Partner Stephen Chandler, is a B2B SaaS investor at Series A stage across Europe. Their positioning is “post-seed VC started by B2B founders”.

The London-based company has assets under management now exceeding $500 million and is already planning to raise a second growth opportunities fund next year.

🇪🇸 Nekko Capital announced commitments for a €100 million new fund to be closed by the end of the year

The commitments were made by Matutes family (owners of a chain hotel business - Palladium), and are part of efforts of raising a pan-european €100 million fund expected to close at the end of 2019.

Nekko Capital, based in Barcelona, was founded in 2017 by Mercé Tell, Josep Santacana and Ernest Sánchez as a continuation of Avet Ventures.

The fund will invest in digital companies based in Spain and the United Kingdom, in verticals including tourism, fintech, insurtech, proptech and mobility businesses.

🇮🇱 Pico Venture Partners closes $80 million second venture capital fund

Pico, founded in 2015 by Elie Wurtman, Todd Kesselman and Gina LaVersa, invests in early-stage startups seeking to upend broken business models in sizable industries.

The company operates from Jerusalem, managing $130 million across two funds and has 15 companies in its portfolio.

🇬🇧 London Venture Partners (LVP) has raised an $80 million seed fund.

This is the third investment fund for LVP and is aimed for seed investments in a new generation of game industry startups.

LVP was founded in 2012 by David Gardner and David Lau-Kee and operates from London and Berlin. Its portfolio of companies have been valued above $18 billion and previous investments include Supercell, Unity Technologies and NaturalMotion.

🇪🇸 Columbus Venture Partners announced a new €70 million fund to invest in biotech companies from Valencia.

🇳🇴 ProVenture Management: €33 million from Trondheim and Stavanger.

🇭🇷 The Feelsgood Venture Capital Fund is the first social impact fund in Croatia worth €30 million, launched in Zagreb.

🇸🇪 Linnéa Capital: €15 million from Uppsala.

🇸🇪 Propel Capital: €6 million from Stockholm.

+++

🇩🇪 Target Global opens office in Barcelona and plans to make 1-3 investments of up to €15M every year.

🇩🇪 Global Founders Capital opens office in Stockholm.

🇨🇭 Unigestion opens Copenhagen office

2. How others are doing it

🇫🇷 KPIs from Kima Ventures, one of the most active early stage investors in Europe

👇Kima, 2010 - 2015

42% IRR on realized

19% IRR on unrealized

22% blended

3,4x TVPI

👇Kima, 2015 Onwards

65% IRR on realized

32% IRR on unrealized

33% blended

1,8x TVPI

👇Series A, 2015 Onwards

240% IRR on realized

33% IRR on unrealized

88% blended

1,9x TVPI

Additional Metrics

👇Kima, 2010 - 2015

0,8x DPI

👇Kima, 2015 Onwards

0,1x DPI

👇Series A, 2015 Onwards

0,6x DPI

For newbies:

Realized IRR is the actual cash return on investments, computed for any investments that returned cash

Unrealized IRR is the same as Realized IRR, but assumes that you receive, on the date of calculation, cash equal to the current value of your remaining investment

TVPI (Total Value to Paid in Multiple) is the fund’s investment multiple and measures the total value created by a fund.

DPI (Distributed to Paid in Capital) measures the amount that has been paid out to investors.

🇩🇪 Methodologies for understanding and measuring marketplace liquidity

Liquidity is the lifeblood of marketplaces. It is the efficiency with which a marketplace matches buyers and sellers on its platform. One could say that a marketplace without liquidity has no real product because the ability to transact on the platform IS the product.

🇩🇪 Do you want to know what a VC’s ideal serial entrepreneur look like?

Exhibit A: Christian Reber previously started Wunderlist and sold it to Microsoft, and now raised $30 million, just a year after closing a $19 million round.

The new gig, based out of Berlin, is called Pitch, a collaborative presentation SAAS still in closed beta and expected to be launched in 2020, two years after having been formally started.

Europe needs badly this type of people and stories.

🇬🇧 LendInvest: Of high-hanging fruit, automation and ‘loan engines’

You can focus on the low-hanging fruit: processes and services that many other players will also be trying to innovate and shake-up, hoping to secure at least a small portion of the promising pie.

Alternatively, you can cast your attention to the higher-hanging fruit, and property is a good example of just that: a part of the market that’s a little tougher to truly disrupt, but one that offers great potential to do something truly innovative and be the first to do so.

🇬🇧 Version One investment overview after launching its third fund a year ago: 1 & 2.

Silicon Valley bonus - radical simplicity

PayPal, Square, and Opendoor have a few things in common: They're all billion-dollar businesses, they're all taking on complicated industries, and they’re all built, in part, by Keith Rabois. Through all of his advice, one thing became very clear: He is obsessed with simplicity.

3. Interesting bets

🇪🇸 Sports and media investment *startup* founded by Gerard Piqué, who wants to change the Davis Cup | €60M | Caixabank

🇩🇪 Learning / knowledge platform for medical professionals | €30M | Partech, Cherry Ventures, Wellington Partners, Holtzbrinck Digital

🇪🇸 Mobile banking alternative w/ 300,000 active users | $25M | DN Capital, Redalpine, Speedinvest

🇬🇧 API for hotel system management | $11M | Stride.VC, Kima Ventures

🇮🇱 SaaS platform providing AI insights improving traffic and safety management operations | $7.3M | SJF Ventures, UpWest, Next Gear Ventures

🇩🇪 Producer of medical cannabis | €7M | btov Partners

🇭🇺 Software developer of a 3D CAD modeling app for iPad Pro | $6M | Point Nine Capital, Lifeline Ventures, Creandum

🇪🇸 SaaS online content and brand protection platform | €5.2M | Nauta Capital, Wayra, JME Ventures, Big Sur Ventures

🇮🇪 Visual code editor helping connecting design work with software development without writing code | $4.2M | LocalGlobe, Frontline

🇮🇸 Open social sandbox MMO for cloud gaming | €2M | Maki.vc, Play Ventures, Crowberry Capital, Sisu Game Ventures

🇵🇱 Algorithms For Quantum Computers | $1.4M | Kindred Capital, Manta Ray Ventures, Firebolt Ventures

🇬🇧 Blockchain-based mutual insurance on a large scale | Version One, 1confirmation, Blockchain Capital

🇩🇰 Autonomous robot for GPS line marking of sports facilities

4. Research, data, observations

🇪🇺 Preliminary data tracked by Dealroom.co for the European investment ecosystem says that Q3 2019 is the second-highest ever since they have been tracking. Key findings for the period:

Investment in the European and Israeli startups reached €9.8 billion in Q3 2019

YTD €28 billion was invested in Europe & Israel in 2019 compared with €21 billion same time last year.

the € growth is mainly driven by larger rounds, smaller rounds are fewer

The UK, Germany, France and Israel received 70% of total VC investment

25 new and €2.7 billion VC and corporate investment funds tracked by Dealroom for the quarter.

🇪🇺 The biggest challenge in business angel activity from Europe is the number of high quality entrepreneurs

a bit strange, as the general consensus is that actually there is more money than projects in the market

🇩🇰 The Internet of Things Landscape in Denmark

🇪🇺 EIF, The Engine of The European VC Ecosystem and The Ugly Duck

There is a tendency that European companies are more capital efficient than in the US, shown by the increase in MOC (multiple on capital) at the time of exit.

This is probably due to the fact that there is almost “unlimited” capital ready for investments in the US, and that US companies generally get more funding before exits, driving up valuations.

For example, when a European tech unicorn reaches a value of $1 billion, the MOC is on average 4.8 and 5.5 at exit.

While the US tech unicorn is the opposite, the MOC at the time of becoming a unicorn is 5.5 MOC, but only 4.7 at the time of exit.

Airbnb in Barcelona is mostly a commercial activity which has direct effects on the supply reduction of long-term rentals as the mechanism at work. Airbnb activity in Barcelona has led to an increase both in rents and housing prices, with the effects for prices being larger than those for rents.

Airbnb paid just €86,000 in taxes in Spain. The company claims to have sales of just €5.6 million in the country.

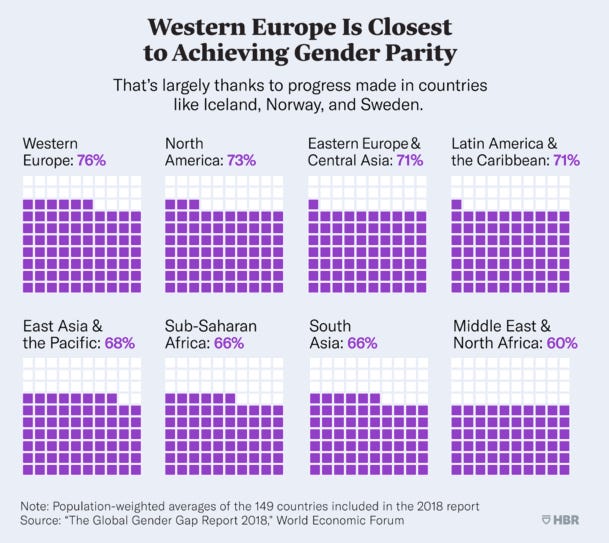

Please keep in mind that the Nordic countries are the most female friendly in Europe.

There are at least two reasons:

In order for investors to fund more diverse teams, they need to exist. The entrepreneurship wave from Europe in the past decade or so is mainly based on tech-biz and fact is that there are not too many females interested in tech. Things have been slowly changing though in the past years.

Europe is a melting pot of cultures and nationalities, where the definition of family and gender roles can vary.

However, let’s not forget that diverse teams tend to perform better than mono-cultured ones.

Europe has generally a more liberal view compared to other parts of the world as it is closest to achieve gender parity. That’s largely thanks to progress made in the Nordic countries.

When it comes to gender parity, the European countries hold half of the spots in the top 10: Iceland (1st), Norway (2nd), Sweden (3rd), Finland (4th), and Ireland (9th).

The U.S. comes in at 51st, China is 103rd, and India is 108th.

Related reading: How VC Can Help More Women Get Ahead

Related event: 🇩🇪 This week Berlin marked the start of the anti-colonial month

5. What others think

🇪🇺 Why It’s So Hard for Startups to Create Wealth in Europe

European startups can’t provide their employees with a stake in the future of their venture without incurring crushing costs and hassle.

For decades, tech mavens in the U.S. have used stock options for employees to spur innovation—and unprecedented wealth. Unlike Silicon Valley, where equity incentive plans have become as ubiquitous as foosball tables and midday yoga sessions, the options culture has yet to take root in many European countries.

An interesting team/product/execution argument writing exercise about Peloton from UK’s Felix Capital, after having been invested in the pre-IPO round (which sounds rather opportunistic than based on a thesis or a VC entrepreneurial bet).

🇬🇧 How we launched Vogue Business, the new global business service from Condé Nast International

After doing about 50% of customer first interviews we kept hearing the same thing - they wanted intelligent, data-led analysis: global trends, tech, culture and innovation.

🇬🇧 What it takes to make a sale (minimum acceptable brand experience)

The customer journey of a sample of one put in a simple and effective theoretical framework.

France rushes into biometric ID systems by November, even though it may violate privacy laws. The system will link biometric access to everything from taxes to government subsidies and utilities.

🇨🇭 Swiss made the torrent downloading legal

Why? Content restrictions by country are unbelievably frustrating and pirating is a better experience. Fwiw, torrent downloads are legal for own consumption in most EU countries but not in UK or USA.

Happy Sunday!

Thanks for reading 🙌

Created by @drnovac every Sunday. Please share it with people who may find it interesting - thanks! Feedback at dragos@nordic9.com.