all roads go to Klarna

#74

Happy Sunday, guys!

Warm welcome to the new subscribers! This week’s edition is packed, let’s get to it.

✍️ Observations

Proud to be Romanian

One of the perks of being a Romanian immigrant (I have lived in 8 countries), is that you get all sorts of reactions when people find out where you’re from.

More often than not, in Europe the reactions are terrible - for example, in Sweden, where I live, it’s not unusual that the Swedes instantly label you as being somebody that you’re not. Suffice to say, it is a prejudice that’s part of their culture and there’s little you can do about it. It is what it is.

And so, reading about UIPath as being one of the most valuable tech startups coming from Europe, as they listed in NY, made me so friggin’ proud.

That’s it. That’s the take.

Sunday vs. Klarna

Two weeks ago, a French startup called Sunday raised $24 million, in a deal dubbed as the most expensive seed deal from France, valuing the company at $140 million.

It is a French affair all over, orchestrated by the local investor god Xavier Neal together with Philippe Laffont, a French running a NY-based hedge fund and who lately has started to play with betting on private deals from Europe.

If you don’t know yet, Sunday does SAAS for restaurant customer onboarding, incorporating payments, and with a model that is a cut of the transactions processed.

The founders had the insight as they’re running themselves a restaurant chain from Paris - not only that, but they also actually managed to get 1000 restaurants using their solution, which is remarkably fast.

They didn’t invent anything new, this is the n-th iteration in this market. Tbh, first time I read about Sunday, I was reminded of Snackpass, a similar company backed by a16z in an almost the same deal - $21M seed in 2019.

But that was in Silicon Valley, and the business was tackling a fairly American customer problem. In Europe this is an unusually expensive deal and market behaviour is radically different.

So why the high valuation then?

Well, for once, they solve a big pain in a huge restaurant business transitioning to an offline/online hybrid state. Super vendor fragmented market, with poor legacy software, acting in silos.

Second, the business model is quite attractive since it is virtually risk free for restaurants - they pay for the SAAS if the customers use it. So there’s little friction in Sunday’s sales process here.

Third, the executing crew is experienced, smart and knows what it’s doing.

Fourth, they are active in a market (France/Spain) where paying in cash is still king - this combined with covid will lead to end customers happy to adopt as little social interaction as possible.

And this fourth point brings me to the business risks. Is this scalable outside France/Spain?

The question reflects one of Europe’s problems in a nutshell - is a local solution executed well scalable to an entire plethora of 27 different cultures and markets?

On paper, the size of the market looks good and juicy. However, Europe is crowded already in this space, there’s quite a few other vendors solving this problem locally - a couple of them only announced this week, see ‘Interesting deals’ from below.

And you know who is on top of the list? Klarna. That Klarna that is pushing for growth in multiple markets and is arguably a massively undervalued business. It is selling a similar solution, a one-size-fits-all for all kind of merchants, and a bit pricier than Sunday. For the moment.

Will they collude? Probably so.

How long will it take? Sooner rather than later.

How will that happen? Well, there’s a couple of guys who just paid $24 million to find out.

Klarna, the startup destroyer

Speaking of Klarna, this week they just announced that they destroyed the businesses of quite a few startups that provide carbon footprint tracking.

Why - they will provide a similar service to their vendors, with instant access to 90 million customers, as they just sided up with Doconomy, a Swedish startup backed by Mastercard and a local bank.

Destroyed is a strong word, I know, but it makes for a good metaphor. :D

You can also call it a market validation. Or market education.

But this move is a simple test showing whether the carbon footprint thingie is a nice feature with PR potential, or there’s a business to be done there.

There’s a whole bunch of startups that raised money from investors just because they have carbon tracking at the core of their sales proposition and nothing else to show. And Doconomy, the startup Klarna ganged up with, really does this as a business.

Compare and contrast

Let’s say you look at two assets from the same vertical:

Asset #1 is 15 years old and produces yearly revenue of $274 million, at 50% yoy growth rate.

Raised a total of $225M from investors and is valued $488M.

Asset #2 is 8 years old, brings in $240 million in yearly sales, also growing at 50% yoy.

Raised a total of $200M from investors and is valued at $900 million.

So with all things relatively equal, one asset is valued almost 2X higher than the other. Why is that?

The answer is simple and all of you investor sorts already know it: the asset value prices the future cash flows aka potential not its intrinsic value.

Asset #1 is Mathem, which has a good chunk of the Swedish market and aims to consolidate its position locally. Backed by Swedish investors, just raised.

Asset #2 is Oda (formerly Kolonial), which is big in Norway, and aims to expand in Europe. Backed by Softbank and Naspers, just raised.

What do they have in common, apart from delivering groceries? A Swedish investor.

Europe and discrimination

Robin wrote a passionate argument saying that if you're a woman, your chances of raising cash in Europe are extremely low.

While I don’t agree fully with his expose, mainly because the research it relies on has questionable data and methodology, I do agree with the underlining hypothesis that the European business environment is full of misogyny and, to a much larger extent, of racist discriminators.

Discrimination is one big uncomfortable truth that people seem to accept too easily in Europe and take as a given rather than doing anything about it.

It is one big deterrent of whatever ambitious things you want to build in Europe as an entrepreneur - a hell of a big problem to overcome when you try to scale from country A to country B within the continent, or simply change cities and jobs for starting a different life.

So go ahead and read Robin’s article, it should make you feel uncomfortable.

And keep the conversation going, it is the only way things can change for the better.

The more stories you will hear about it, the more you will understand that our lives are still dominated by the 19th century practices in spite of our daily efforts to build a modern society.

And thank God if nothing of sorts affected you yet, it is just a matter of time. :-)

🔥 Interesting deals

Nordics

🇸🇪 Lendify, an online credit marketplace operator with a loan book of $360M on its balance sheet, was fully taken over in an all stock deal valued at $143 million.

🇫🇮 Virta, developer of an electric vehicle charging platform technology, raised $36 million.

🇳🇴 Ordr, which does SAAS for restaurants, raised $12 million.

🇸🇪 Nhost, which does serverless backend SAAS, raised $3 million.

🇳🇴 Fauna, which does a loyalty network for purchasing green products, raised $300k.

DACH, Benelux

🇧🇪 Deliverect, which also does SAAS for restaurants, raised $65 million.

🇳🇱 A couple of scooter sharing companies secured growth funding: 1, 2

🇩🇪 holoride, which does software for cars, raised $12 million from Swedish investors.

France, UK, Spain

🇫🇷 BlaBlaCar raised pre-IPO money.

🇫🇷 La Ruche Qui Dit Oui!, operator of a farm-to-the-table business (variation for grocery delivery), had Cipio join USV, Astanor and Felix Cap as shareholders.

🇫🇷 Ocus, which operates a photo marketplace, raised $24 million.

🇫🇷 PeopleSpheres, which does PaaS for HR, raised $10 million.

🇬🇧 Causal, which does a web-based tool replacing spreadsheets, raised $4.2 million.

🇪🇸 21Buttons, which does social commerce and raised $30 million since 2015, was acquired by Peoople, a (much) smaller competitor, in a deal expected to bring a combined of $3-5 million in revenue this year.

Romania, Bulgaria

🇷🇴 FintechOS, a SAAS developer of financial solutions, raised $60 million.

🇧🇬 Payhawk, a SAAS platform for payments and expense management, raised $20 million.

Them Eastern Europeans are doing it again. Earlybird behind both deals.

There’s a whole lot more, this week we looked at about 250 deals.

✌️ European startups backed by American VCs

We have built an entire dossier covering the American investors activity in Europe:

- the most representative

- the most active in the last three months

- portfolio analysis of 15 most active.

I believe it is fairly interesting to scrutinise their work in Europe for at least a few reasons.

This is from last week’s Monday CET email, featuring a list of interesting early stage Euro startups backed by US investors.

We send Monday CET every week, you can get it too if you subscribe to Nordic 9. It’s €149 for a whole year and you also get access to dealflow, investors/startups databases and intel reports.

💡 Charts and data

Drones

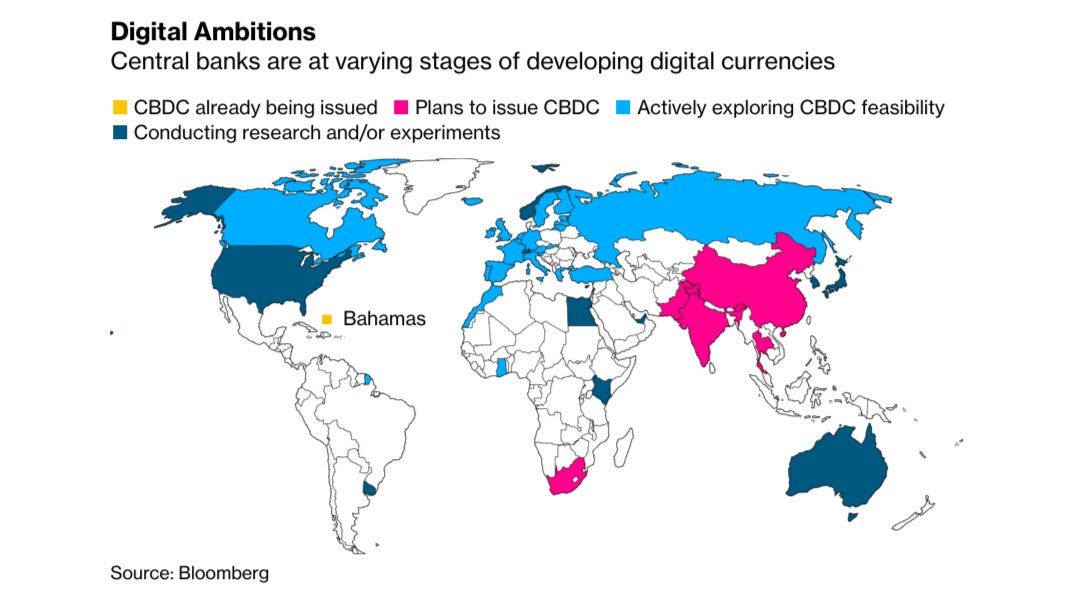

CBCD

🚀 Other notes

🇵🇱 A Polish entrepreneur is complaining that Luxembourg investors don’t get it in spite of calling themselves the Silicon Valley of Europe.

🇪🇸 Spanish entrepreneurs moved to San Francisco 5 years ago, backed by European investors, cashed out in a $300 million deal. That’s the European blueprint, n'est-ce pas?

🇳🇴 A Norwegian court ruled that buying up competitors' names on search engines is not contrary to good business practices. They also called this behaviour as being parasitic:

"Parasite" is an apt characteristic of what happens, but at the same time we believe that the element of parasite is not so strong that advertising practice by its nature will always be contrary to "good business practice”.

🇩🇪 Uber Eats announced it will enter the German market and their CEO exchanged pleasantries on Twitter with the competitor CEO, which happens to be a “monopolistic stranglehold” in Germany. High school stuff, social media is fun.

Btw, last year Uber did from food delivery almost two times as much as from the taxi service ($52bn vs 30bn).

🇩🇪 Zi Germans are conquered from all over - besides the Americans, you know who else is invading Germany? The Turks!

🇬🇧 Amazon announced the opening of Amazon Salon, a 1,500 sq. ft (140m2) hair salon in central London (Spitalfields), where it intends to be trialing the use of augmented reality (AR) and “point-and-learn” technology.

🇸🇪 The Swedes from NAKD (one of the fastest growing fashion D2C in Europe) did a smart thing and launched a marketplace for second hand clothing. They say they will eventually open it up outside their own ecosystem.

H&M also has been doing something interesting in the space for a year already - a member-only shop. Poorly executed and not very successful judging from their comm, but there’s a lot of potential there.

🇪🇪 Smart PR from Wise (ex-TransferWise).

🇬🇧 A British startup raised $6.8 million in venture capital as it intends to release genetically modified mosquitoes into Florida. Not excited about it.

🇫🇷 Good overview about international investors tackling the local French market.

🇪🇺 This week’s drama was in football.

Some old guys doing media business in Europe wanted to make more money than they already do, and found some bankers to align the stars. Had the very same bankers apology afterwards because it exploded in their hands as they didn’t think it through.

I bet that this idea would have worked in the 90s when the media was a top-down funnel and the message pretty much under control - nowadays the market sentiment is widely available and can make and break deals.

🇸🇪 Speaking of football, Daniel from Spotify wants to buy Arsenal from London.

🇬🇧 Steve O’Hear of TechCrunch fame quits the journalist job for a grocery startup. Good luck!

🔊 ClubHouse finally hired a PM in charge of discovery. Employee #37, solid guy. Meanwhile (bad) feedback about CH keeps pouring in. So does the money, as they announced raising $4 billion.

🈹 SaaS companies inside sales quotas

Thanks for reading 🙌

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.