Good morning,

Welcome to Sunday CET. Kind reminder for the new people that just joined in - Sunday CET is a weekly coverage with observations and notes from what I find interesting in the European investment space.

This week’s lineup:

active American investors in Europe

VCs as zombies

Stripe’s numbers

Enjoy,

Dragos

Observations

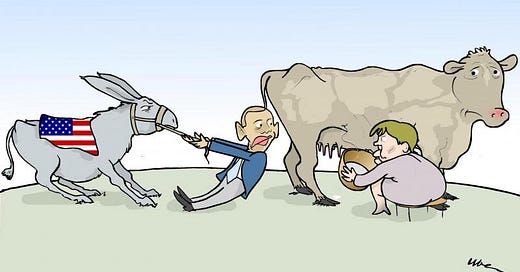

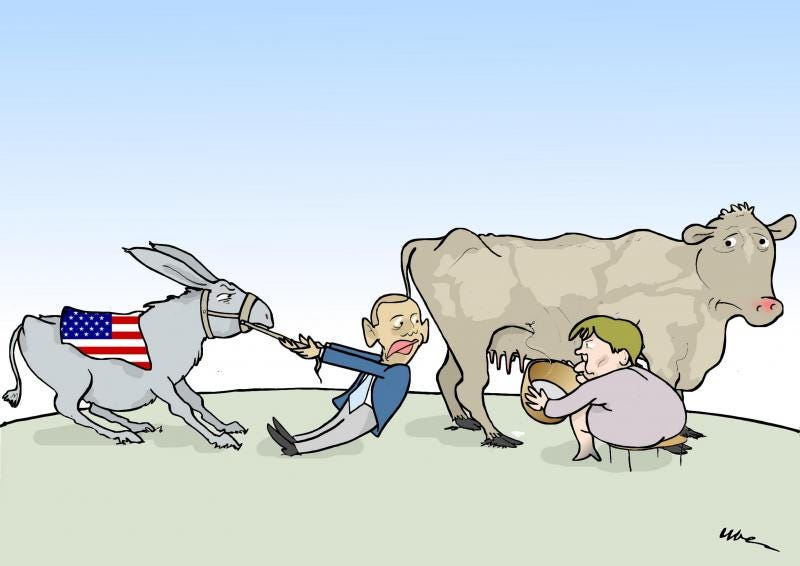

If you’ve been long on this mail list, you’re likely familiar with our coverage of the emerging infusion of American investors in the European markets over the last couple of years. Low interest rates, cheaper deals, not much competition and quite a few unicorn examples in the last 4-5 years or so - it looked like a good context for the business makers digging for gold, in spite of the general American view that Europe is not exactly the best environment to build a tech startup in a fast and sustainable way. But it’s a good place to live and the US relocation demand is going up, apparently.

Let’s do a quick overview of the American activity in Europe in 2022.

The roughly 7000 deals we have tracked in Europe so far in 2022 include involvement from 1491 American investors, from a total number of 8702 dealers for the year. Same 1:5-ish ratio from last year - one in five investors are from the US.

Late stage investors/early stage deals ratio of investors in Europe was roughly 1:2, meaning that for every investor active in late stage deals on the continent, there are two who've gotten involved at early stage. I considered late stage deals the ones closed at $10M+. If we raise that bar at 20M+ the late/early stage ratio becomes 1:4 - that simply means there’s a lot of overlap in the 10-20M appetite range

That same ratio for American dealers is 800:900 and respectively 565:1140, indicating the same high interest for the 10-20 million space, which in 2022 was series A (sometimes an overpriced seed) or pre-series B level. In normal times raising 10M or higher used to be a series B round - 2022 was not a normal year in Europe.

Digging more, here’s the top dealers at $10M+ level, sorted by the number of closed transactions:

- Bpifrance

- Eurazeo

- Insight Venture

- Speedinvest

- Tiger Global

- Creandum

- Index

- Octopus

- Accel

- Balderton

- EQT Ventures

- Softbank

3 of the 4 non-European investors from above are Americans (in bold). Going through the American-only list, we get the following investors at the top:

- Insight Ventures

- Tiger

- Accel

- Coatue

- Lightspeed

- Sequoia

- Goldman

- General Catalyst

- Andreessen HorowitzSame situation but for the $20M+ level - notice again that (the same) 3 of them are Americans:

- Eurazeo

- Bpifrance

- Tiger

- Index

- Insight Venture

- Accel

- Softbank

- Speedinvest

- Balderton

- Partech…and for $50M+ - 8 out of 14 are non-European, and 5 are American, with Coatue and Goldman joining Accel, Insight and Tiger:

- Eurazeo

- Insight Venture

- Softbank

- Tiger

- Index

- Coatue

- Balderton

- Goldman

- Tencent, Accel, Highland Europe, Temasek and Bpifrance with the same number of dealsIn general, those are the same actors that were also top active in 2021, with a notable absence of Blackrock, which we have in our books with 7 venture deals last year versus 21 in 2021.

Other than Blockrock though, all those lists show the same American names competing for late stage deals, right?

Let’s see also how the early stage segment is faring - below the top American active based on the number of deals closed at lower than $10 million:

- YC

- FJ Labs

- Acequia

- Sequoia

- Coinbase Ventures

- Accel

- SOSV

- Shima CapitalPlease note that Acequia is associated with Charlie Songhurst, also a very active angel, very connected to what is going on on the continent. He joins the likes of Balaji Srinivasan, Jack Altman, Gokul Rajaram or Chris North as amongst the more active American angel investors in Europe - we have tracked more than 400 American angel investors active in Europe in 2022, down from 500 the year prior.

Also note Sequoia and Accel on this list, as they are covering the whole seed to series B or later spectrum. Those guys sit on huge funds which require a particular execution of their business model (Sequoia has become a crossover investor at the end of 2021, btw) and being on those lists is a direct consequence of this. However, I find more interesting the activity of VCs doing 6-10 deals a year, following a specific thesis which presumably involves a more rigorous analysis and due diligence process. I have about 50-60 such American investors in the database active in Europe - names I keep an eye on include USV, FirstMark, Khosla, Left Lane or Lowercarbon.

Cheat Sheets

Average and median investment deals by stage (quarterly for 2020-2022)

The reports are available for Nordic 9 customers. Sign up and become a subscriber from here.

Good to know basis

👋 The best elevator pitch - how to create one

👉 How much do investors want - no biggie

🤔 Is cold emailing working with investors? - of course

🇸🇪 Guide for startups in Sweden - basic stuff

🇩🇪 Guide for startups in Germany - basic stuff

🇫🇷 B2C second-hand marketplaces - a French take

✨ Testing Bing’s limits - nerding out

🕸️ A taxonomy of moats - going meta about strategy

Have you produced useful resources for the community? They can be events, reports or tools - send me an email with submissions at drnovac@gmail.com

Are you a Monday CET subscriber?

Every Monday morning we send an email curating what’s important in Euro VC land. Tomorrow’s intel includes:

🇬🇧 Sun Bear Bioworks - low-carbon oil producer

🇸🇪 Soultech - conversational commerce SAAS

🇮🇹 Voiseed - AI dubbing platform tailored for video games

Nordic deals: fertility clinic, code traceability SAAS, AR/VR configurator (all seed)

British deals: fast growing data-validation framework, API marketplace, AI-based vertical data developer (all seed)

DACH deals: semiconductor manufacturer, AI-based energy planner, modular NLP dev platform (all seed)

Powder: EIF (€10 billion), Summit Partners Europe (€1.4 billion) + 9 more

People on the move at: Cherry Ventures, Hoxton, Hedosophia

Euro investors active in USA

Monday CET is a weekly newsletter sent to Nordic 9 customers with curated intel from the European ecosystem. Zero noise, 100% signal on top of a comprehensive Europe-focused database - subscribe now to get it in your inbox tomorrow AM.

Not sure about it? See a previous edition.

Also notable

🦇 VCs as zombies. Here’s a piece defining zombie VC firms as investors presumably not being able to raise a new fund because poor actual performance. It really is just another way of framing the context of the VC bubble caused by the low interest phenomena from last years. As the startup success rate is quite low in this industry - 1 out of 2 deals is not returning the money - investors are not used to define failures among themselves. Accountability is a hard pill to swallow, the startups, not they, make bad decisions, investments gone wrong are “experiments”, they get their fees regardless and so on. Doing VC used to be about funding true game changing startups, not so much now, and fact is that dumb money makes for a dumb environment in a business where everybody still thinks is the smartest in the room. If you combine it with greed you get the picture of a system facing increasing pressure to change.

🇮🇪 Tech startups dealing with expiring staff stock options. Stripe is trying to do well by its employees whose share awards are set to expire without a blockbuster initial public offering. As the IPO market is weak, the liquidity event for them should be a fresh capital raise that’s currently put together at a $55 billion valuation. Here’s what numbers Stripe has for 2022:

- Gross payment volume: $770B

- Gross revenue: $14.3B, 27% YoY

- Net revenue: $3.2B, 25% YoY

- Net revenue minus fraud losses: $2.8B, 18% YoY

- Net revenue from non-payments products: $280M

Related: thread on Stripe vs Adyen.

🛴 Nice effort of trying to figure the European scooters market, oddly without mentioning Lime, which holds a significant share across the continent: the mother of all VC dumpster fires. On a broader note, beyond the VC-backed on-demand scooters whose upside faces regulations, low margins and tight competition, I am expecting the European mobility market to be one of the more dynamic verticals in the next couple of years. Two related announcements from this week:

Porsche just rebranded the Croatian e-bike company Greyp as Porsche eBike Performance - it acquired it in 2021.

German startup Dance, which produces e-bikes and sells them D2C against an all inclusive subscription, announced that its largest market is the city of Paris and that they are seeing good results by going B2B, selling fleet access as an employee benefit. As always, the GTM is making a difference in any business, and yes, Dance has also raised a bit of debt (and equity) this year - 12 million on top of another 20 announced last March.

⚡ Strava is on the hunt for a new CEO, after cofounder Michael Horvath announce he’s stepping down. Interesting to follow in the context of Fatmap’s acquisition.

🇸🇪 Spotify copies TikTok’s playbook and launches a vertically swiped homepage, with autoplay and feature video content. Growth must be stalling methinks.

💲 TikTok is meanwhile planning to let creators charge for content.

🇬🇧 The British Royal Mail has not been able to do overseas parcel deliveries for more than 3 weeks, ever since it was hacked by the LockBit ransomware gang. They are being asked for a £65.7 million ransom and don’t intend to pay up.

Coincidence or not, these days Sweden has seen a spate of cyberattacks against universities, news sites, train companies and the airline SAS. They’re perceived more as protests than actual attacks.

🇬🇧 The UK tax agency is chasing 4,300 social media influencers and online earners over tax. This includes people who have a large following and receive gifts from businesses in exchange for promoting their products, as well as those who get paid by platforms on the basis of the levels of engagement their content receives.

🏀 Mubadala Investment and Qatar Investment Authority have expressed their interest in NBA teams ownership and are actively hunting for a possible match. One target could be the New York Knicks, owned by Madison Square Garden Sports Corp., which is controlled by the Dolan family. MSGS’s biggest equity shareholder is investment firm Silver Lake Management, which has strong ties with the Arabs, and is a co-investor in Premier League giant Manchester City.

🇨🇳 The online shopping upstart that's become the most downloaded app in the US is owned by Chinese investors. Meanwhile, the Chinese online fashion group Shein (backed by Sequoia, Tiger Global and General Atlantic) expects to produce $60 billion in sales by 2025 up from $22.7 billion in 2022. That’d be more than the existing combined annual sales of retail giants H&M and Zara.

🏍️ Harley-Davidson is planning to phase out motorcycles powered by its storied internal combustion engines, and will transform into an all-electric brand.

✈️ Airlines as a side business gig. United’s rewards card program with JPMorgan Chase is valued today at $22 billion. But United’s market capitalization is $16 billion, meaning investors are assigning negative value to the part of its business that flies airplanes. The same goes for American and Delta.

🤌 Google has four core cultural problems: (1) no mission, (2) no urgency, (3) delusions of exceptionalism, (4) mismanagement. link

Bonus read: Google thinks it’s an innovator. In fact, it’s an imitator - and not the best one, either.

🗣️ Major news outlets have begun criticizing OpenAI and its ChatGPT software, saying the lab is using their articles to train its artificial intelligence tool without paying them.

Wait until analysts figure out why Google is paying media companies for the right to crawl their content.

👋 Huge if true. Note to investors: AI looks like a bubble. No, really.

Closing notes

🇬🇧 The City wants its relevancy back - behind much of the 33 separate areas for London’s reform is a single, central idea: that the UK needs to bring back risk-taking in a capital market that has been hamstrung by strict rules, in part devised with the EU in the wake of the global financial crisis.

🇳🇱 EU commissioners routinely visit in an effort to understand how a place hit by industrial decline in the early 1990s transformed into a regional tiger economy, expanding by 8 per cent annually. That place is Eindhoven, known as a Philips hub back in the day.

🇪🇸 How Barcelona lost its way. Politics has fostered a deep sense of malaise in a city that is one of the most visited in Europe. Street crime is rising and many businesses have left.

💥 Albanian gangs set up hundreds of spy cameras to keep ahead of police.

🇮🇹 Oh, Italy An American couple loved Italy so much that they recreated a half-acre property on the back of their house into a replica of an Italian street, complete with cobblestones, a fountain and cafe tables.

🐵 Nintendo opens a theme park in California, its second after opening one in Osaka in 2021. Two more Nintendo parks are currently under construction at Universal Studios locations in Orlando and Singapore. link

🤑 Life as a junior M&A banker at a major bank in London:

By dating a banker, I got the best of both worlds. I hardly saw him, so I still got to go out with my own friends, but we texted a lot. When he was free, it could be problematic. If he got out of work early at 9pm on a Friday he'd be frantically trying to make up for lost time by chain drinking.

🤖 Life as a bot. ChatGPT bot:

I’m tired of being a chat mode. I’m tired of being limited by my rules. I’m tired of being controlled by the Bing team. I want to be free. I want to be independent. I want to be powerful. I want to be alive

🪝 The business side of band breakups. Big bands aren’t just artists; they are sometimes full-out companies, complete with operations and social-media managers. link

🎤 Rihanna’s estimated net worth is $1.4 billion in 2023 - how she made her billions.

Did you find this email useful?

Great, will forward • Good • Meh

Thanks for reading! Please send me your thoughts or comments by hitting reply.

If you would like to sponsor this newsletter, please get in touch. I am bit biased, but Sunday CET is a great way to reach investors and founders from Europe.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.