Hi,

Welcome to a new Sunday CET.

Let’s get to it.

Euro strat

❄️ Powder:

🇫🇷 Orange Ventures

🇩🇪 DX Ventures

🇧🇬 LaunchHub

🔥 Interesting deals:

🇩🇪 online and offline combo of veterinary services via an online platform

🇸🇪 AI-based code analysis software tool

🇳🇴 DTC vertical insurance provider

🇫🇷 SAAS for risk analyzing in the insurance business

🇷🇴 SAAS startup for the fitness industry

🇩🇪 SAAS for mobile inspection robots

🇩🇰 cookiebot as a service

🤓 Observations:

🇪🇺 Here’s a fun read about how rich Europeans “should” invest in tech instead of hotels in order to have Europe catch up with the US and China in building the world’s biggest consumer internet companies.

It’s fun because it seems written under a false and perhaps misunderstood perception about how rich Europeans think and behave.

Let’s try to deconstruct a little:

Rich people invest to get more rich.

When they think about what to do with their money, wealthy individuals don’t care about Europe vs US vs China.

They also don’t really care about the next wave of deeptech companies, the world’s biggest internet companies or who the greatest entrepreneurs are.

Or, if they do, they do it opportunistically in terms of getting a piece of it or a shortcut that can help replicate a successful pattern to get rich quick - that is basically Rocket Internet’s story.

But, in general, rich people don’t really care about changing the world, or making it a better place, or about the climate change, for example, or about what people like Greta Thunberg say (they usually make fun of her in closed circles).

They won’t get involved in this kind of stuff unless they have a specific interest or for public perception, a collateral skin in the game such as friends/peer pressure or a Gone with the wind’s Rhett Butler redemption moment (that’s how the Klarna guy did Norrsken VC in Sweden, for example).

They first and foremost care to multiply their money with sizable returns and hard assets like real estate, hospitality or boring manufacturing are easier to comprehend than bold visions of innovative stuff.

Getting rich by investing in innovative stuff is very hard. And risky!

The easiest and most straightforward way to get rich is to buy something cheap and sell it more expensive, as fast as possible and as often as possible.

However, investing in innovation or new tech means a different behavior and way of thinking, as it hasn’t been done before, therefore there’s a lot of unknowns and risks and no clear path to return. The probability of good multipliers, if any, is very low and that is why the good VC business is terribly hard in spite of an apparent glam and being seemingly easy accessible. And fact of the matter is that European wealthy people have little experience with this kind of deals.

Historically throughout the past hundreds of years, the European rich have mostly made money from information asymmetry i.e. buying cheap and selling high or other ways that may or may not have involved conquering countries and doing other crazy stuff that’s in the history books but that’s the topic for another discussion - when you have done this for a long time, it is hard to change your modus operandi and mindset.

That is why now they may be reluctant to take risks investing in things that have never been made before, their behavior is intuitively influenced by a different pattern that involves familiarity.

And yeah, tech is cool and aspirational, founders are awesome, and we have dedicated media hyping up the VC industry and fancy presentations claiming that the continent is the most entrepreneurial ever but facts and data shows that i) the risk appetence for tech startups of most of the HNWI from Europe is low and ii) the quality of the Euro startup output is still quite far from what can be achieved.

Rich people usually are investing in their comfort zone.

That means in things they can understand and they can explain over the dinner table to their family.

They are usually risk averse and feel threatened by disruptions, preferring the status quo.

Unless they are professional investors or working with ones they listen to, it is hard to find rich people willing to take risks outside their cogent scope, with sometimes the exception of some sort of blind faith in people they trust or they love.

And btw, being rich doesn’t necessarily mean that you know how to be a good investor or that you understand how the world works. Au contraire.

(Most of the) Rich people in Europe come from wealthy families already.

Euro rich people didn’t become wealthy over night or in a few years - they are usually part of family businesses which are decades or centuries old, sometimes with nobility titles associated to their status.

It is a different world, where rich kids inherit wealth as opposed to create it via innovation.

They are usually taking over the family businesses, which is part of a long-tenured and closed establishment, very traditional and which doesn’t usually have room for outsiders.

Besides the wealth, they inherit their parents’ Porsche, relationships and rolodex, and this involves very little risk taking and thinking outside a certain paradigm, no matter how expensive their business school was.

Europe’s story doesn’t include too many 30 years old entrepreneurs that just took their company to the stock exchange or sold it to Google.

Most of the European successful entrepreneurs are in their 40s or 50s, a few generations later than the digital natives, and with a lower risk appetite to challenge the establishment.

Compare this to the US where old companies like HP, IBM or Oracle, are being constantly challenged, or being replaced by the FAANG, which are also now being replaced by kids in their 20s building a new tech startup in the their parents bedroom.

Related - in Europe, the newcomers, as many as they are, are usually eating the lunch of the rich people family businesses - if they decide that it is worth keeping their startup company in Europe and not flying over to the better US environment.

Lunch protection is also why there is a strong push against the American tech companies under the form of regulation, see the following point.

Europe is all about control.

Because of the generational old family businesses controlling the rules of the game, the market is mainly focused on keeping things the way they were as opposed to disruptions. Families are usually making business with each other and it it difficult for outsiders to get a sit at the table, because they simply don’t belong.

That is why Europe has businesses or industries with zero sum games or with incremental upside yoy as opposed to the American obsessive growth focus, also in part an explanation for the lower European M&A liquidity.

It is an inherent dichotomy between investors focus of backing the building of new biz changing the existing state of order and the current common economic European interest of people resisting this via non-free market means such as the excessive regulation.

All the regulations (and what is coming now with the DSA is part of it) are just a reflection of those influent money dealers looking to tightly control the market. It’s mostly a power and money play, don’t be misled about the PR spiels.

-

So yeah, when you have over for dinner your rich uncle owning half of the hotels from the Riviera, and tells you about Elon Musk, he likely knows about him because he drives one of Elon’s cars not because Elon changed a few industries upside down. Or, just as well, they might have had a drink or two the other night. :-)

🇪🇺 This week there’s been a piece of research circulating through media revealing the worst kept secret in the Euro startup (and freelancing) world: the Baltics are the most friendly startup countries in the EU.

This is actually a very interesting aspect of doing business in the EU - if you run a tech business that sells digital goods, you can benefit from and use the fiscal rules (taxes) asymmetries within the EU countries.

Terms and conditions apply for each case, of course, but a half a day of proper research on the topic can produce a lot of $ savings especially very early in the life of a company.

And it is not only the stock options friendliness that make the Baltics attractive, but also the absolute tax numbers that can vary from country to country, a particular case for all Eastern Europe countries, or even tax heavens that countries like Malta, Cyprus, Andorra or Luxembourg can provide.

In Romania, for example, the corporate tax is 16% of profits and instead of a profit tax a startup can opt to pay as little as 3% from their revenues if they make less than 1 million euro per year in turnover. And the dividend tax is 5%. Those numbers are among the lower in the EU, where they can get as high as 35-40%+.

⚡ Quickies:

🇪🇺 What happened in the Nordic investment market in December 2020.

🇳🇴 Norwegian startup investments in 2020 review

🇬🇧 One third of new European VC funds were raised in London over the last two years. Not exactly a surprise since most of the European deal flow happens in London.

🇬🇧 Weezy raised $20 million in a round led by les américains, 6 months after being pre-seeded with £1 million. We talked about this.

🇹🇷 Speaking of which, Getir, an on-demand delivery startup that raised $38 million last year -- most of it from the personal investment vehicle of renowned VC Michael Moritz -- is in talks to raise around $100 million at a valuation north of $800 million.

🇪🇺 Btw, lots of crazy later stage deals in Europe in the past months, with more risks taken than in previous years. I think it is a good thing, just a bit unusual for Europe.

Maybe it’s because the market is flooded with money, maybe because Americans are more aggressive and the market is more competitive. Maybe both.

🇫🇷 Medium acquired a French digital book platform, made their CEO VP Books. The French were backed by Kima, Expon and angels and raised about 3 million.

🇪🇺 The European commissioner for the internal market is perplexed by the fact that a CEO a tech company with no democratic legitimacy or oversight can pull the plug on POTUS’s loudspeaker without any checks and balances.

Not sure why it is hard to understand that a private business can terminate an user account if that user violates the TOC.

🇮🇪 4 Irish banks created a joint venture in order to develop a payment app and compete with Revolut.

🇬🇧 Estimated up to 1.3 million foreign born residents left UK in the past year.

🇳🇱 In an effort to clean up its image, Amsterdam aims to restrict a key tourist attraction: its coffee shops.

Only Dutch residents would be allowed to enter the cannabis-dealing outlets under a policy proposal, which could come into force as of next year.

🇬🇧 As remote work becomes the norm, Londoners re-invigorate the country house market market after a malaise in that sector that has lasted for more than a decade.

🇳🇴 Amazon pissed off the Norwegians for making it difficult to cancel Prime.

🇪🇺 The European Food Safety Authority green lit the sales of snacks, protein bars, cookies and other foods containing insects as ingredients.

🇬🇧 The UK government's AI Roadmap.

🇸🇪 The Pirate Bay, the most censored website in the world, started by kids, run by people with problems with alcohol, drugs and money, still is up after almost 2 decades. Parlor and gab etc have all the money around but no skills or mindset. Embarrassing.

🇫🇷 Paris Mayor Anne Hidalgo gives green light to £225m project to turn Champs-Élysées into 'extraordinary garden'

🇳🇴 A funny story about how the Norwegian pop group A-ha was critical in the introduction of electric car incentives in Norway - that is, if you’re old enough to know what A-HA is :D.

🇩🇪 Inside the Forgotten Ghost Stations of a Once-Divided Berlin

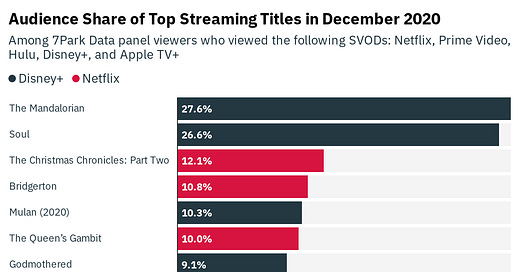

Graph of the week

Disney kicks Netflix ass

Other stuff

Rules of thumb that simplify decisions.

The business breakdown of a retailer selling mostly via Amazon.

Advertisers found an even more annoying way to push ads down your throat: pictures in pictures.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

Uganda ordered all social networks blocked in the country ahead of elections in the country.

There is a high likelihood that we are witnessing the visible emergence of the government-IT infrastructure complex.

Some sperm banks are running low so women are joining unregulated Facebook groups to find willing donors, no middleman required.

Should Facebook and Twitter Have Banned Donald Trump? A Conversation With Ryan Mac of BuzzFeed News

k

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.