This is the 26th edition of Sunday CET, a weekly curation of what’s interesting in the European investment and startup landscape.

Since it’s the Easter weekend, this week’s mail is sent one day earlier. Easter CET :-) Have a good one!

MENU

More money in the market

Interesting bets

Research, data, observations

What others think

More money in the market

🇬🇧 Index Ventures, which is based in San Francisco and London, announces $2bn in new funds for early-stage and growth investments.

🇬🇧 Blossom Capital launches angel investment and mentorship network for early-stage European startups. A la Atomico.

Interesting bets

🇦🇹 European digital investment platform | Speedinvest

🇩🇰 tech developer for precision agriculture | SOSV, Rockstart, PreSeed Ventures, Luminate Venture Corp.

🇫🇮 e-commerce logistics services | €1.5 million | Maki VC

🇫🇷 search engine for international law and arbitration | €1 million | angels

🇩🇪 climate-tech businesses | €5 million | Speedinvest, Cavalry Ventures, angels

🇩🇪 provider of micro-transducer technology | €2.6 million | Brandenburg Kapital, HTGF, Technologiegründerfonds Sachsen

🇩🇪 Github for Hardware | €2.2 million | JOIN Capital, HCVC

🇩🇪 robotics startup | C Ventures, GL ventures, Sequoia Capital China, Linear Venture Capital

🇮🇹 community and platform dedicated to software developers | €6 million | P101, Primomiglio, CDP Venture Capital SGR

🇮🇹 smart devices manufacturer | €2.5 million | LVenture Group, Pi Campus, Al.Pe Invest, angels

🇪🇸 SAAS for media and adverting business using use audio fingerprinting technology | €1.25 million | Adara Ventures, Sabadell Venture Capital

🇸🇪 digital marketplace for therapeuts | $8.4 million | Ventech, Schibsted Growth

🇸🇪 developer of a software platform featuring environmental data | €2.3 million | Norrsken Foundation, Nordic Makers, Max Ventures, GGV Capital

🇬🇧 provider of infrastructure and APIs to power realtime experiences at scale | $7 million | MMC Ventures, Forward Partners

🇬🇧 document collaboration and workflow management platform for the pharmaceutical supply chain | £1 million | Force Over Mass, Seedcamp, Ascension Ventures, Blockchain Valley Ventures, TrueSight Ventures

Research, data, observations

🇬🇧 Angular is doing a survey of the founders about the impact of and response to Coronavirus.

🇩🇪 Pirate did a lil’ hack aggregating remote events announcements.

🇪🇺 VC-Covid 19 Barometer #3 (30 Mar - 3 Apr)

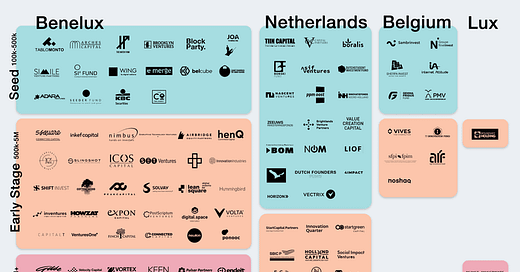

🇳🇱 Benelux Venture Capital Map 2020Q2

🇷🇴 A list with 10 interesting Romanian startups

🇫🇮 Slush cancelled their November event from Helsinki. It was probably the best opportunity to take the pulse of what is happening in the Nordics. Pivoting is not going to be easy but the event has a strong local community around it.

🇪🇸 How the Spanish Government is supporting SMEs and freelancers during the COVID-19 crisis

🇺🇦 Here are some of the companies and wealthy Ukrainians that have launched coronavirus aid programs.

🇪🇺 Which country do you think is handling the COVID19 crisis best?

Btw, a lot of pointing fingers in the Nordics - the national corona brake strategy managed to get Sweden called out by Norwegians as a country outside the Nordic region because it did not follow the same quarantine rules as its neighbours. The Finns are also quite vocal against the Swedes - there’s a lot of history among those guys going as far as hundreds and hundreds of years ago.

🇬🇧 Google Meet and Microsoft teams combined are doing close to 5bn minutes of calling each day. The entire UK telecoms system does about 600m.

🇳🇴 Northzone changed their website - some fresh paint plus standard buzzwords you can find on any VC website, attached to a board with jobs aggregated from one company from their portfolio, probably for now. Looks nice and clean, finally at par with some other top tier European VCs. But - it could have been as well a powerpoint presentation embedded over at Slideshare.

Not trying to pick on Northzone, they are nice, smart guys and all. But I keep wondering when the European investors will discover how to transition from a static, online PR exercise to a digital product powered by knowledge and network, which are any investor’s competitive advantages besides $$. Aka using the technology for leveraging the strengths of a money product wrapped in consulting services. Maybe closer to what those guys are doing. Or those. Or those.

This industry, especially in Europe, is a cohort still living in the 2000s in spite of investing in the future - some nice static pages and a Medium account mostly with press releases make a solid (so-to-speak) marketing effort but is this at par with investors’ customers and their needs? How about using the concepts they’re supposed to consult their companies with but applied to themselves? You know, operating like a company, not like a fund.

I’d give them some years though - Europe is still minor league compared to US, with less competition and hence little need of differentiation. But, after education and healthcare, the VC industry will hopefully be the next vertical disrupted by technology. :D

More:

Which startup sectors are most affected by coronavirus? Data based on the number of layoffs tracked.

Plant-based foods tend to have a lower carbon footprint than meat and dairy. In many cases a much smaller footprint.

As an example: producing 100 grams of protein from peas emits just 0.4 kilograms of carbon dioxide equivalents (CO2eq). To get the same amount of protein from beef, emissions would be nearly 90 times higher, at 35 kgCO2eq.

A good argument starting from the observation of Zoom’s privacy and security issues:

We are using video-conferencing tools in a variety of new ways, from karaoke, to brunches, etc, and creating new kinds of social interaction. But these business focused tools weren't designed for those kinds of social experiences.

These tools were built for conferencing, not for general socializing, and they don’t have enough blocking capabilities or moderation tools to support the kinds of new social interactions that are happening.

Their stance is that ‘disagreements’ can be worked out in an office place. But that’s not how harassment unfolds in the world—work isn’t harassment free, just like harassment can come from friend groups, loved ones, and complete strangers. When a tool or platform allows for multiple people to interact with each other, there will be harassment.

What the future looks like for gamers or what kind of promotional materials Canadian casinos sends to their target customers. Discuss. :-)

That’s actually a paradox of the early stage investment process: everybody follows the same patterns and social conventions when judging founders and opportunities but some of the highest returns are made by outliers not fitting that mold. Food for thought.

People who are on the periphery of society tend to be freer to innovate and change social norms. Outsiders are less concerned with what the in-crowd thinks of them, so they have more leeway to experiment.

In fact, people who don’t fit neatly into a particular group have been found, over and over, to perform better at outside-the-box thinking. Foreigners are often considered strange, but there are psychological advantages to feeling like a stranger. Children who are exposed to multiple languages - perhaps because they were raised in a country far from where they were born - are better able to understand an adult’s perspective, and they may go on to become better communicators overall.

Consumers spent record $23.4 billion (15bn on iOS) on apps in Q1 2020, thanks to being stuck indoors.

In 2019 there were 1,100 new paid (P2P) games released on Steam (the dominant distributor of PC games) that earned at least $10k in the first 2 weeks. Most games that reach that threshold earn $20-60k in their first year.

A pandemic proved that esports is more vital than ever for entertainment

The PPE Index - if you can help or need something, this is a great resource.

Amazon and Apple Strike Deal for Prime Video In-App Purchases and Subscriptions

Foursquare merges with Factual, another location-data provider, in an all-stock deal

How to launch, scale and industrialise your subscription business

What others think

🇬🇧 Why should we save startups?

The case against is simple at the edge - Darwin. The argument in favor is what essentially differentiates EU from USA on a philosophical dimension, making it a better environment for building a business.

But - I don’t believe in governments bailing out startups. People don’t need to be given fish to eat, they need fishing rods to do better and more fishing. I do believe that companies need a stable and predictable environment for planning ahead. That’s the government job.

And yes, it is tough for founders. Having been through this kind of shitty period before - this is the kind of time when little boys become real men. It is up to you to figure it out, and certainly not the government’s job to wave a magic wand.

And since it’s on you, you will notice that most of the people who were around you during jolly times are not available anymore. People who you thought were rational and reliable, not being reasonable anymore. You will hear stupid advice and you will have all sorts of panicking instincts.

But… you are on your own and you will eventually figure it out, no matter how deep you need to cut. The stronger your network, the more chances of survival. And never be ashamed to ask for help - friends, family, peers, the shareholders.

Worse case scenario: you fail and you learn. It is yet another experience that sets you apart from the kibitz-types. And then you start again. That is a true entrepreneur’s life, any ending is a new beginning. Btw, if you fail, it is also important how you do it.

And so this is your fight, not other people’s, even less of the government.

Related:

- The UK government shouldn't set up a bailout fund for startups. That's their investors' job.

- thread + argument

🇬🇧 The Balderton B2B Sales Playbook

🇩🇰 Situation room by byFounders

🇬🇧 Investing via a due dill process done fully remote? The majority of investors are reluctant, to say the least, but hey, they call it risk capital for a reason and it’s a good PR opportunity to get to brag on Twitter. I mean, guys, after all they just raised $2 billion! :D

On a serious note though, there are others in the same position, arguably outliers though. Here’s another dude open to lead series A right now.

🇪🇺 An interview w/ Carlos Espinal of Seedcamp, explaining the pivot from being an accelerator to an early stage investor:

When Seedcamp started, there was a community that was formed around helping founders and bringing the lessons learned entrepreneurship to accelerate their development. So, it made sense. But I think if you look over the last decade, there’s been a lot of democratisation of entrepreneurship knowledge.

The other thing was that there were a lot of new founders who were serial entrepreneurs, and a lot of people became angel investors after they succeeded — and that also added depth to the community.

I think the role that accelerators and incubators played was no longer as important. At the same time, we saw a need for a community and a platform — and that became more important than the strict function of an accelerator and incubator.

As I was saying a few weeks ago - most of startup accelerators are simply not worth it:

As long accelerators are not done by doers but by talkers, it will be hard to build a good program and… YC will remain the best (after 15 years) and will have no counterpart in Europe.

More:

Lots of downtime these days, a good time to catch up with what happened at Upfront Summit.

The cheap deals will become cheaper and the good deals will become more expensive.

Historically, there has been a 25–30% drop in the number of early-stage deals after an economic downtown, and median valuations decrease 10–20% per year for several years post-crisis

The charts below show the number of Seed and Series A deals (blue bars), as well as their median post-money valuations (red lines), in the years before and after the 2000 and 2008 stock market crashes. The top row shows the 2000 dot-com crash, and the bottom row shows the 2008 financial crisis.

Assuming some LP defaults, reserves & 2017-19 pacing speed, expect VCs to slow pace in half.

It is possible to estimate how rapidly funds have deployed their capital over the past five years, and how much capital is reserved for a rainy day. Using both a fund-by-fund analysis and averages across the industry, we estimate that the industry has ~$150 billion of “dry powder,” of which likely ~$76 billion is already earmarked for reserves for existing companies and ~$74 billion is available for new investments.

First Round published a comprehensive 8-part field guide for founders on how to steer through this crisis. This includes:

📝 An 8-part field guide

📊 A scenario planner template

💡 Resources for candidates

📚 Curated list of reads

⚙️ One hub to organize it all (in Notion)How to Walk During an Earthquake - a great collaborative piece put together by a professor asking designers and architects having graduated back in 2008 about their experience for getting a job during an economic crisis.

“Fail fast” is almost certainly the most damaging startup advice. A good explanation:

On the very rare occasion when I beat Peter Thiel at chess, he would smash all the pieces. When I called him a sore loser, he responded “show me a good loser and I’ll show you a loser.”

Show me a founder who thinks it’s ok to fail fast and I’ll show you a failure.

Happy Easter - be safe and be sane!

Thanks for reading 🙌

Reply with submissions, comments, corrections, and ideas.

Created every Sunday by @drnovac. Please share it with people who may find it interesting - thanks!