Good morning and welcome to Sunday CET.

Let’s get to it.

10 things you need to know

Want to learn what's up and coming in European SAAS? - scan the SAAS deals made by the angel investors in Q1 and produce a cheat sheet listing the most interesting of them.

The most valuable European company is LVMH, which was just priced at $500 billion this week. It’s the first European company to reach that milestone - controlled by Bernard Arnault, currently standing as the world’s richest man, with a net worth of $200 billion. Dude’s been CEO since January 1989 (that’s a 34 year tenure) and still not ready to let go at the age of 73.

It’s all conjuncture, of course, since on one hand, the big American tech companies faced a blood bath on the public markets and, on the other, the French are selling status and luxury products, which typically perform better than other sectors during an economic downturn. Also notable, three of France’s top 4 most valuable companies are luxury brands - LVMH is a portfolio collection of such brands and pretty much a representative story for the European business of the 20th century. Its history and Arnault’s going about it are explanatory to a certain extent of how people do business in Europe.

Related:WSJ promptly profiled the man, mostly generic PR stuff.

Bonus question, from Rod: who is the next Bernard Arnault and where can i find this person? My guess is that his name is Xavier. You don’t need to find him, he will find you. :-)

Future fashion unicorns from Europe. Hard to imagine that LVMH’s jewels will be soon challenged by a consumer fashion brand, from Europe or elsewhere, as the company is not only active in the M&A market, but also has a few startup antennas via various investment vehicles i.e. 1, 2, 3, 4, 5.

Alas, here’s a few incumbents, well-funded local startups contributing to various parts of the value chain out of Europe, with a bunch of investors ready to flip their assets to the likes of LVMH:

🇱🇹 Vinted - raised $560 million from Lightspeed, Accel, Insight Venture Partners, EQT Ventures

🇫🇷 Vestiaire Collective - raised $425 million from Vitruvian, Softbank, Tiger

🇫🇷 Ankorstore - raised $420 million from Coatue, Eurazeo, Index, Tiger and, you guessed, Aglae Ventures.

🇩🇪 Chrono24 - raised $200 million from, again Aglae, General Atlantic, Insight Venture.

🇳🇱 Otrium - raised $160 million from Index Capital, Eight Roads, Bond Capital

🇬🇧 Lyst - raised $144 million from LVMH, Balderton, Accel, 14W

🇪🇸 Recover - raised $100 million from Goldman Sachs and Story3 Capital.

… and some up and coming promising value in selected portfolios:

🇬🇧 Me+Em - $80 million from Highland Europe, Pembroke, Venrex

🇬🇧 Worn Again - $50 million from H&M, OC Oerlikon

🇬🇧 Pangaia - raised $50 million from Valor Capital, Dreamers VC

🇸🇪 Material Exchange - $35 million from Molten, Day One, Norrsken, InventureThe state of grocery Europe 2023 - by McKinsey. Warning: research contains the obligatory AI-saves-the-industry plug. NB: at least it’s not web3.

Capital allocators US vs Germany - risk takers vs trend followers

The US pension funds account for 15% of the investor base in the German VC funds compared to 27% in American VC funds.

German pension funds account for less than 1% of the investor base in German VCs.

That’s just another way of saying that the European startup scene has changed dramatically after the Americans started to pay attention to it.

Stripe and the UK - not bad:

London is Stripe's number one city in the world: no other city has as many businesses powered by it.

More than half of the UK’s towns and cities grew their payment volume on Stripe faster than London over the last three years

There are 89 other towns and cities in the UK with companies processing over £100M a year on Stripe as well, 3x more than in 2019.

VC Reports:

200+ early stage deals in Europe in Q1 2023 - AI, deep tech, web3, climate et al selected from 1500 startups that got funded in the first three months of the year.

Founders toolbox:

Euro intel: this week’s curated deals include early stage funding for:

→ the European ChatGPT alternative

→ customisable AI for CPG and retail

→ AI for turning content description into code

→ and a whole lot more. High signal, zero noise - get it too.

Also notable

🇬🇧 UK blocked Microsoft’s $69 billion Activision deal.

Activision’s reaction is weak:

The ruling contradicts the ambitions of the UK to become an attractive country to build technology businesses and were a disservice to UK citizens, who face increasingly dire economic prospects.

Microsoft’s is weaker (they’re mad actually):

We’re, of course, very disappointed about the CMA’s decision, but more than that, unfortunately, I think it’s bad for Britain. There’s a clear message here: the European Union is a more attractive place to start a business if you want some day to sell it. The English Channel has never seemed wider.

Being mad is seemingly the only PR answer - it looks like the political backchanneling didn’t work and we’ve switched politeness to an antagonist UK vs EU position now. It’s interesting that this narrative assumes that the EU will be favourable of the merger when it will present its own findings next month - but what happens if the EU denies the deal as well? Will it become an un-attractive place to do business in over night?

The background context is that after Brexit, the British regulator CMA is now responsible for decisions on some of the biggest cross-border mergers, which previously would have been decided by Brussels. This whole merger thing is still open for negotiations until the end of the year when the appeal of the CMA’s decision will be judged by an independent tribunal.

The deal appears to have become more political than market-related and the current outcome will deter the whole activity of the tech M&A market, already weak and illiquid - there’s no reason to build business and relations in London if the market is bad for business, the logical step is to flee to the US. Otoh, nobody seems to acknowledge that there is actually some sound rationale behind the blocking decision as it may as well be a reflex of preventing situations to having to deal with one actor getting too much market power via a big-tech merger - such as well-documented power plays of Google or Facebook. Which situations are a pain in the ass to correct, let’s be honest, and a reason of becoming a core governmental tech focus, distracting both the UK and the EU from creating a competitive business environment driven by tech. Instead they’re only reactive and police whatever context combining tech and Americans they run into.

Related:

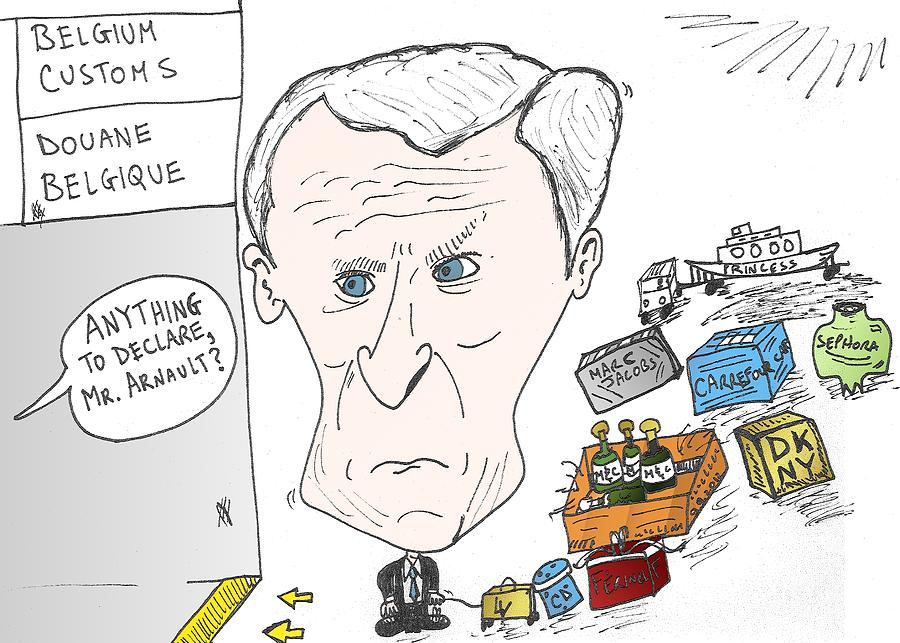

The UK capital markets are not functioning well at present - liquidity is one of the problems. Over the last 3 months only 150 UK plcs traded more than $5m/day - whilst all the S&P500 & almost all the Stoxx600 did so. As investment funds consolidate & allocate to large index funds scale being illiquid is a problem. This can be seen in valuations.

Speaking of reactive, the British PM Rishi Sunak said that his recent Silicon Valley tour for courting investors was accompanied by a PR stint called Unicorn Kingdom. If it sounds silly, well that’s because it kind of is - trying to be serious on this, if you dig through the 45 investment opportunities listed as available in the UK, you get three tech related, three related to VR (!) and one related to space. And no, no AI.

🇪🇺 The European Payments Initiative, an EU committee setup to come up with a rival to Mastercard and Visa, acquired the Dutch payment system Ideal with the aim of making it the standard payment solution across all European countries.

Ideal handles 70% of all e-commerce transactions in the Netherlands - it is a product managed by Currence, formed in 2005 as a result of an initiative by eight Dutch banks.

The target is to implement it also in France and Germany since the countries don’t yet have a standard payment system for e-commerce.

The follow up of this deal is interesting as harmonising a system that works is a daunting task in an ever fragmented European ecosystem, and the EU heads are not really famous for successfully using or implementing tech for making people’s life easier. One way to they could go about it is to make it political and forcing it onto the market - but the private market is different, and a top down approach for product adoption is not working like, say, when you’re regulating the market because you’re jealous on non European products used by the said market because they’re simply better.

Also notable, the Nordic countries also have been trying to implement a similar layer on top of their regional banks for at least 5 years and failed, as they couldn’t agree on common grounds aligning local egos. Or, perhaps, the EU just opted for buying the Dutch instead.

Learn intel you won’t find anywhere else

Get curated intel from the European startup ecosystem in your inbox. No noise, all signal - start with a free trial 👇, cancel anytime.

Briefings

🇮🇹 ChatGPT is back in Italy after meeting watchdog demands.

Will the Italians:

- move on and behave like a happy Fonzie, now that they were acknowledged?

- move the goalpost and come up with new requests?

🇪🇺 This is what ChatGPT considers the most notable thing about each country in Europe:

🦖 Generational change - Michael Bloomberg is lining up succession of his $94bn fortune made out of the business of money.

🛎️ Inflation bits:

if the price of an individual monthly streaming subscription were adjusted for inflation, it would cost $13.25 instead of $10.

Spotify would like to raise prices this year.

McDonald’s, PepsiCo, Kimberly-Clark etc.

We’re preparing for a mild recession this year, they say. I say the worse is yet to come.

💪The New Finance Rich List - Bloomberg’s daily ranking of the world’s billionaires as of March 23 (some London names in there too)

💲 JPMorgan unveiled an AI-powered model used to detect the tenor of policy signals from the central bank’s messaging, statements and speeches going back 25 years.

₿ Is the Bitcoin comeback for real?

🚗 Automakers are starting to admit that drivers hate touchscreens.

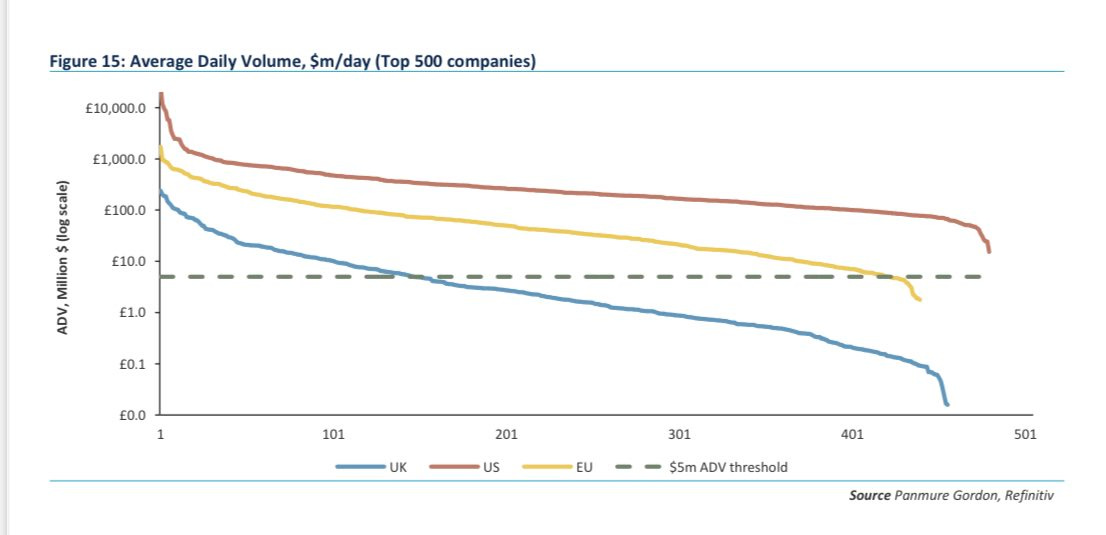

❄️ How the world is spending $1.1 trillion on climate technology.

🤔 Bluesky has made it into the MSM while Twitter is slowly turning into a Linkedin-like collection of failed real life gurus selling pseudo wisdom bits for dummies. If there’s demand, there’ll be supply - creating a marketplace for it is how Musk wants to extract value from it, a rather singular smart move since he took over. The problem with Bluesky, on the other hand, is that it’s managed by Jack Dorsey, the same guy who massively contributed to Twitter being in its current degraded state.

Closing notes

🇬🇧 Shark Tank, US vs UK (can be Europe easily):

US founder: i need a million to expand our organic dog treats globally

Mark Cuban: say less

UK founder: i solved cancer

Random investor no one has heard of: oy sorry mate don't see the opportunity

🇬🇧 Britain is dead:

To the extent that the UK is governed by a partnership between the aristocracy and the bourgeoisie, it is an aristocracy that is not aristocratic and a bourgeoisie that is not productive. The old administrative upper class no longer wields power through land or patronage. The commercial middle class produces little of innovative value, its most prestigious sector being the servicing of other states’ surplus funds through family offices and merchant banks in London.

🇪🇺 Everybody within the EU knows that the sanctions against Russia are just for show as there’s little impact on how Russians are dealing their business. Here’s an example.

🇬🇧 A network of couriers who jointly smuggled more than £100 million of criminal cash in suitcases from the UK to Dubai was found guilty following a trial of one of the largest money laundering scams ever recorded. In less than a year, the couriers flew more than 80 flights, carrying cases full of drug money. The group communicated on a Whatsapp group called Sunshine and Lollipops.

🇬🇧 Are the Brits racist? Yes but *not the most racist*. They have made a study to prove it: the UK fares better than the US when it comes to racist behaviour (p 42).

🤌 Dutch sperm donor who may have fathered 550 kids is ordered to stop by the judge. The 41 years old musician will be fined up to €100,000 if he donates sperm again or if he advertises or in any way promotes his services as a donor.

Bonus link: more Dutch culture.

🤭 Not all dates are created equal:

📺 More than 60% of Netflix subscribers watched Korean shows or films in 2022 - so Netflix plans to invest $2.5 billion over the next four years to produce more K-dramas, movies and reality shows.

📽️ The Succession (the show) economics unpacked (spoilers alert).

📌 What happens when Dave Chappelle buys up your town?

🏘️ Living in a Frank Lloyd Wright House: the iconic architect designed hundreds of residential properties in his career - seven homeowners talk about the ways Wright’s work impacts their lives.

🤖 The deeply human love stories of people and their sex dolls - in 2023 thousands of men (and women) are forming lifelong relationships with AI-powered dolls.

🤔 Folks use AI for dating help and come up with killer opening lines and responses to potential matches. If dating is sorted, what can AI do for scoring then?

🥱 I’m in that camp too - for many people, the idea of stopping work is a nonstarter, an inevitable path to boredom, ill health and a life devoid of meaning.

🧈 Do you refrigerate your butter?

💲 Your favorite celebrity street style photo is probably an ad.

⚽ The Tottenham Hotspur players have offered to reimburse fans who attended their 1-6 thrashing by Newcastle United on Sunday.

Do you like Sunday CET? You’ll love Monday CET!

Start with a free trial, cancel anytime. 👇

Did you find this email useful?

Great, will forward • Good • Meh

Thanks for reading! Please send me your thoughts or comments by hitting reply.

If you would like to sponsor this newsletter, please get in touch. I am bit biased, but Sunday CET is a great way to reach investors and founders from Europe.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.