Hi - welcome to a new edition of Sunday CET!

A lighter one this week, it’s August in Europe after all - we’ve got fintech startups contending Klarna’s position and Berlin beating the 15 min value proposition for grocery delivery in London.

Enjoy!

Money and market bets

🇩🇪 DvH Ventures

🇩🇪 Elevat3 Capital

🇩🇪 La Famiglia

🇪🇸 e-bike manufacturer

🇸🇪 electric four wheel cargo bike manufacturer (awesome)

🇬🇧 marketplace for professional book writers

Observations, research, data

🇪🇸 SeQura secured a debt facility of up to €50M in the first phase and with the possibility to scale it up to €200M.

SeQura does payment solutions for the ecommerce biz and has an interesting story - it was founded in 2013-2014 by Swedes living in Spain with the objective of cloning Klarna and later flipping the business to it. They were not on their own as they also had VC backing from another Swedish living in Spain (Optimizer Invest).

In total, the company raised about €6 million from Optimizer and Grupo Intercom, which control about 25% of the equity.

Long story short, they put together a nice business serving about 2500 stores, growing double digits yoy and bringing in about $20 million per year, mostly from Spain.

Klarna actually wanted to acquire them last year - the founders were ready to sell but the VC wanted way more than a $100 million valuation, which is more money than Klarna thought it was worth and the deal fell off.

And so now they took debt for building more business on their own - but instead of expanding in Europe, they intend to go to other Spanish speaking countries such as Mexico and Colombia.

Also notable: there’s another little startup, also based in Spain (Alicante) and also developed by Nordic people, Danes this time, and which wants to compete with Klarna by charging half of their commissions. They’re not on their own but together with Clearhaus, which invested in them. The target markets: Spain and Norway.

Clearhaus is a medium-sized Danish payment processor and has 20k merchants as customers. For context, Klarna has about 10x as many. Btw, Klarna is not active in Spain.

It is a fascinating emerging space, still in very early innings and very-very fragmented in Europe, all players solving similar problems but in discrete parts of the value chain and going from different directions. And, of course, chasing market share and growing the pie. Until a player like Apple or Square comes and changes the rules of the game by providing a credit card, POS software to merchants etc - Apple still not active in Europe btw, Clearhaus implemented Apple Pay for them in the Nordics.

Other notable plays from the big guys - Paypal bought iZettle in Sweden 2 years ago, Square just bought Verse in the Spanish consumer payments market, Lydia just raised $45 mil in France from Tencent, Alipay is quite active in Europe, etc. and I am sure I am missing a whole lot of others.

🇩🇪 You know what seems cooler than London’s Weezy GTM promising to deliver groceries within 15 minutes? One similar promising to deliver in 10.

Gorillas, based in Berlin and founded this year by Kagan Sümer and Jörg Kattner, is a grocery delivery provider offering an aggregate supermaket products range delivered to consumers within 10 minutes of ordering.

10 or 15 minutes of course don’t make a difference, the fundamentals are the same while the markets are differently sized - arguably people living in London are about 3 times as many as in Berlin.

And, btw, Gorillas just raised venture money from local investors, just like Weezy. Two is a tango, it looks like the beginning of an European trend.

Anybody reading this old enough to remember Webvan?

🇩🇪 Imagine you built a travel business operation, an online one that compares the best hotel deals and airlines, lets users add recos about their experience and ultimately providing consumers with holiday solutions.

The business makes money by selling leads, or reselling airline tickets or hotel accommodations. Or even advertising.

You talk to suppliers to give you good deals, you build a clean valuable product showcasing the content for customers and spend a lot on brand, marketing an differentiation.

Once you have all these in place, you’d probably build the asset’s home page (aka the entry side of your business) as simple as possible. Maybe, say, showing content snippets, adding useful links guiding users to the value points you created for them, and maybe a big search box to help find useful information.

It makes sense, right?

And now once you established this operation and you have some success, imagine that there is somebody else coming up with the same idea as you did. Now, competition is good and healthy but here’s the twist: their implementation involves scrapping all the content from your asset, for which you worked so hard to curate and aggregate, they store it on their servers and put their own search box and useful links as a mean to front their own business model which btw is exactly like yours and targeting the very same customers.

You would be pissed, wouldn’t you? Somebody else takes advantage of your work and makes business off your back. And you don’t get a dime out of it.

The name of this somebody is Google, which is by far the biggest data scrapper in the world, taking the content properties from others in the name of good SEO and usability for users and putting its own business model on top of that.

The search box, the maps, the assistant et all are just free tech products fronting off the content scrapped from other people’s assets. Those free products are just like another home page for your asset. But for Google’s benefit.

Combined with analytics and the ad business + chrome and android they form the today’s internet monopoly, probably one of the most powerful in the economic history. This is Google in a nutshell - scrapped content fronted by nice free products and a powerful ad machine on top.

That is why the Germans, and not only, are so pissed at them and are filling a cartel complaint against Google at EU, accusing them of stealing content and data.

And that is why Google needs to be regulated pronto.

🇪🇺 The pet vertical was quite hot a couple of years ago in Europe - both DTC commerce and veterinary tele-health. Doesn’t seem too hot now that EQT is dumping its position in Musti Ja Mirri after holding on to it for 6 years.

🇩🇰 Labster raised a down round of $9 million which they call a strategic growth check and made to bring on GGV in order to strengthen the company’s position in Asia.

Last time I checked, equity selling to a VC was not a common practice to expand to Asia. China is a difficult market though and this biz devel tactic can be as good as any I guess - Jenny Lee, a Shanghai-based partner with GGV, will take a board seat at Labster.

Labster raised $21M last year.

🇪🇺 The volume of exits by private equity firms across the Nordic countries in Q2 2020 fell to its lowest point in more than a decade.

🇪🇺 Speaking of which - if you’re interested in the Nordic investment and startup ecosystem, this is probably a good way to become familar with what is going on, made by yours truly.

🇩🇪 Things at N26 seem a bit out of control.

🇪🇺

I can’t imagine a European company buying WhatsApp for £19bn with just 30 employees or Instagram for £1bn with no revenue.

Europe is still that place where VCs or even angels fuck up the captables by taking more than 50% of the equity at very early stages and limit the startups growth, and hence their own upside.

🇸🇪 Looks like one of Karma’s founders and acting CTO is looking for new assignments (translation: he was let go). Karma, which operates a food waste marketplace for restaurants and grocery stores, raised $12M exactly 2 years ago and last year made a bit more than $1M in sales. The corona thingie surely didn’t help them improve their financials.

🇮🇪 How to maximise FOMO while raising VC - a read that reminded me of the tactics I learnt in high school to get more girlfriends and laids.

🇬🇧 The Guardian cannot run their business model the way they want because of Apple. Specifically Apple rejected their app in the App Store because they forbid having Single Day payment options. (more about this below)

🇬🇧 Timeout will exit the US and resume print distribution only in London, where the title appeared on Tuesday for the first time in six months, Madrid and Barcelona.

The company will instead focus on its digital platform and food markets.

The group is unlikely to resume printing in the US and Portugal, with other territories under review by management. link

🇪🇺 Tech EU and EU-startups are both looking for readers feedback to get their products to the next level. Sifted is hiring a research analyst. Competition is good. And fun. :-)

🇮🇱 Yvel had a custom order from a wealthy Chinese entrepreneur from Shanghai of a respiratory mask that costs $1.5M.

The mask is made of 18k gold and set with 3,608 natural diamonds at a total weight of 210 carats. It is also based on the N-99 respirator, a face mask that claims to filter at least 99 percent of airborne particles.

Shoutout to Rodolfo, who keeps track of masks stuff.

🇩🇪 Racism is also a big European problem, the German edition.

🇮🇹 Italy would be the most likely of the "Big Four" member states to consider exiting the European Union if Brexit proves to be beneficial to Britain.

If.

🇪🇺 Bucharest, Dublin and Belfast in a top 10 tech cities of the future list made by FT 🤔

🇫🇷 Baking Bread in Lyon - for a newcomer to the city, a boulangerie apprenticeship reveals a way of life.

Other stuff

Story of the week is Epic fighting Apple and Google for forcing users to use the in-app payment system and thusly getting a 30% middleman cut.

Here’s what the Epic’s CEO is saying:

we’re fighting for the freedom of people who bought smartphones to install apps from sources of their choosing, the freedom for creators of apps to distribute them as they choose, and the freedom of both groups to do business directly

The story is larger than that, of course, on one hand it is costly to ensure a curated malware-free experience for downloading apps (Apple’s claim for charging 30%) and on the other it seems unfair that Apple should charge for services that do not require Apple’s resources and forcing developers to use Apple’s payment as a gateway in the name of security.

I don’t think the main problem is having to pay a distribution fee or the number per se i.e. 30% but the fact that the number is not worth it in the value creation breakdown, as Apple mostly acts as a dumb greedy middle man.

That number should reflect the value Apple creates in the ecosystem of the products it distributes and there’s hardly a way to calculate a ROI close to that value.

The problem is that Apple Store grew and now has scaling problems - the way it was envisioned by SJ 10 years ago simply doesn’t fit the way business is done today. Things have evolved a lot in a decade. Btw, this also applies to App Store’s byproducts, the Analytics, the ASO and ASA, which are badly implemented, far from being at par to how business is done today.

This head-in-the-sand, our-way-or-the-highway attitude of Apple from its monopoly position will only further alienate developers and business people altogether and at some point a change needs to be made.

That point seems to be now.

Apple is increasingly altering business models (see Guardian’s example above), shaking down entire industries, and in some cases using its power against direct competitors (hello Spotify).

In Europe we have Spotify pushing, a month ago it was Hey, Airbnb, Tinder and ClassPass, 2 weeks ago Apple (and Google, in the same position) had a chat with the US Congress about anticompetitive conduct, and now we have Epic, also joined by Facebook btw, which chimed in and complains about it. Now we have a party.

Obviously Epic is more financially equipped for a fight (they actually sued in a court of law) and better prepared too.

Exibit A:

…which is a stab at:

Side by side for your viewing convenience:

🎰 IAC invested in MGM Resorts International - MGM, besides its leadership in leisure, hospitality and gaming, is an area that currently comprises a tiny portion of its revenue–online gaming.

We believe MGM presented a "once in a decade" opportunity for IAC to own a meaningful piece of a preeminent brand in a large category with great potential to move online.

The current pandemic brought revenue (though not expenses) to a temporary halt, and required MGM to repurpose cash it had wisely stockpiled for share repurchases to instead defend the solvency of the company. The good news is, we believe MGM has enough cash and access to capital to make it to the other side competitively stronger.

When the world returns to normal, MGM will be just as capable post-pandemic as it was pre-pandemic in servicing visitors in over 35% of the Las Vegas Strip's available rooms, plus eight regional properties across the US, two in Macau, and hopefully in Japan. The 34 million members of MGM's loyalty program still have their M-life Rewards, and we're confident that many are eager to return to the properties they love.

And when Las Vegas fully re-opens – even if it must wait until a vaccine for that to occur – we expect it to roar back: a new NFL team, a new stadium, a drivable destination, and months of pent-up demand could drive a powerful resurgence.

Barry Diller, IAC’s brain, is a media man, smart savvy exec dealing with digital media properties since 2000. The entire letter to the shareholders is outstanding.

🛒 Scribd buys SlideShare from LinkedIn for an undisclosed sum.

Scribd isn’t taking on any new employees as part of the deal; instead, its existing team is taking responsibility for SlideShare’s operation.

Why would they take Linkedin’s people - Linkedin is one of the most buggy and cluttered digital asset you can find on the internet.

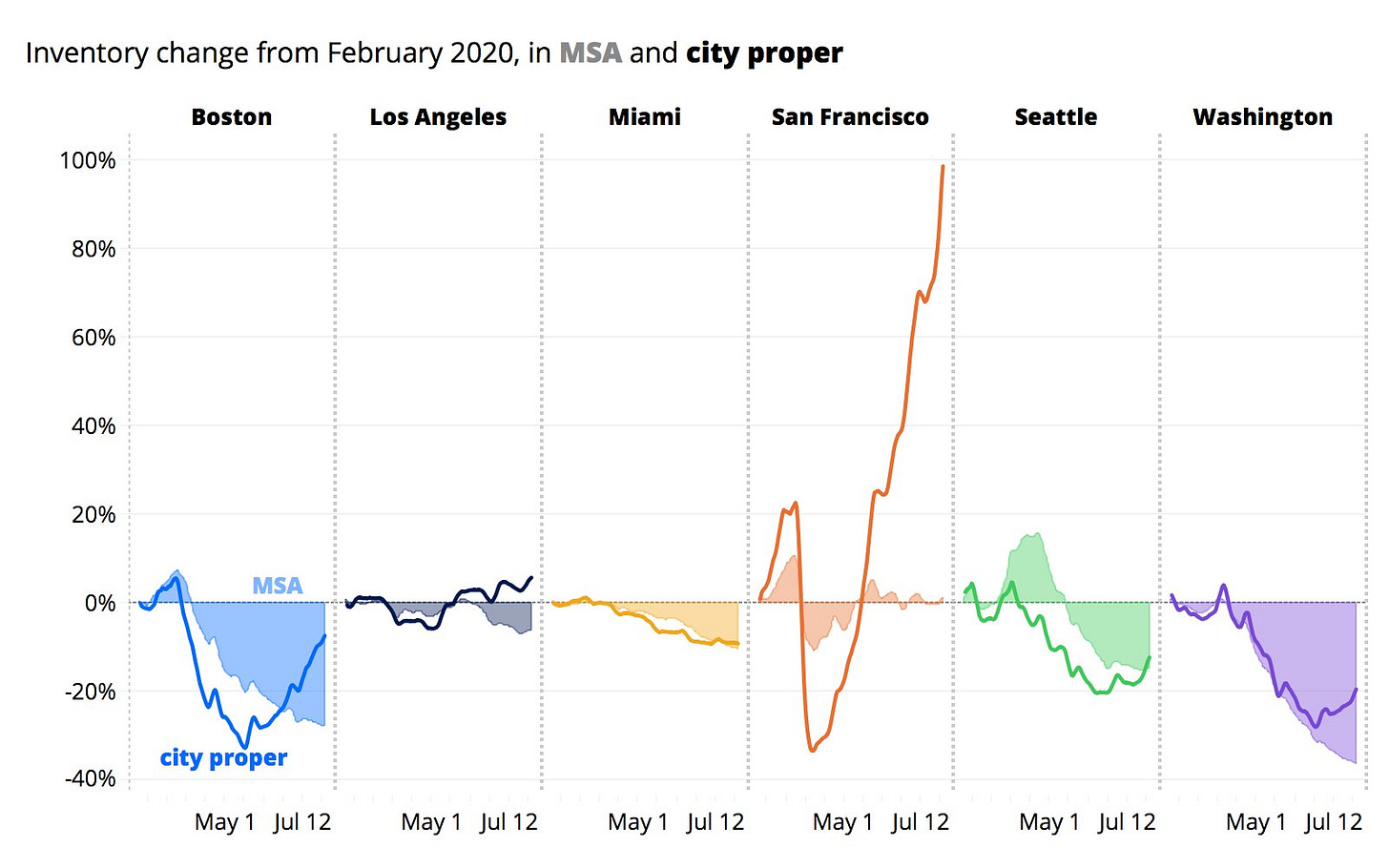

🏠 Looks like there’s a a lot of houses for sale in San Francisco nowadays. And, in other San Fran news, the Creamery was closed down for good. If you’re in tech and have been to San Francisco, you know this is a big deal.

📊 As always, when you make data analysis about a market, the data sources are the difference maker (especially if it is dirty).

Here’s a good example of conflicting data about the US early stage venture market.

Interesting links

At US Open line calls will be made by Hawk-Eye Live to reduce the number of people on site during the pandemic.

GaryVee’s message is what so many desperate people want to hear right now. It’s also dangerous.

YC gives 20 equity-free grants of $10k to eligible companies part of a build sprint.

AMC is reopening its theaters next week with 15-cent tickets

NASA and SpaceX target October 23 for first operational astronaut launch

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac. Please share it with your networks and encourage your colleagues to sign up here - thanks!