Good morning. Writing this after a long day on the slopes in the country side so no time for editing it out or mincing words. As always, open for discussing it further (and taking complaints :D).

Enjoy!

Euro strat

❄️ Powder:

🇨🇭 Blue Horizon Ventures

🇩🇪 Heal Capital

🇩🇪 APX

🇬🇷 Phaistos Fund

🇪🇺 The Chinese Ant Financial is planning a fintech fund based in Berlin (they’re hiring too)

🔥 Interesting deals:

🇩🇪 co working spaces operator in 7 German cities + Vienna

🇪🇪 cargo bike manufacturer

🇫🇮 two Finnish gaming companies announced getting funded 1, 2

🇩🇪 no-code CMS built on top of Airtable

🇳🇱 very cool marketplace w/ 1 million users and 60% US-based revenue

🇬🇧 another marketplace, this time for booking caterers and other suppliers to events organizers (and a darling of quite a few local angels)

🇩🇪 eye-tracking SAAS that just pivoted from security biometrics to remote user testing.

🤓 Observations:

🇳🇴 Good VC business

Northzone cashed out its entire equity position in Kahoot for exactly $153.2 million. This is a last tranche in an offload process started after getting Softbank involved in the company 4 months ago.

Northzone were investors in Kahoot early on, circa 2015, sold some of the holding when Kahoot went public on the local market from Oslo in 2019(-ish) and then re-upped their position in a $62 million worth of stock deal early last year.

Not a bad return, huh?

It is not a coincidence, here’s some other selected Northzone’s portfolio companies:

Trustpilot - last valued at $1bn, NZ entered via a $4.5M series A in 2011.

Klarna - last valued at $10bn, NZ entered via a $80M secondary in 2015 at $2.2bn valuation.

Personio - last valued at $1.7bn, NZ entered via $12M series A in 2017

fuboTV - last valued at $4bn, NZ entered via $55M series C in 2017 (led)

Tier - last valued at $1bn, NZ entered via €25M series A in 2018 (led)

Hopin - last valued at $2bn, NZ entered via a £5M seed round in 2020.

FuboTV is the only non-European from the stack.

Also important - the funds they invested from:

2010 - Northzone VI €130M

2014 - Northzone VII €250M

2016 - Northzone VIII €350M

2019 - Northzone IX $500M

The returns of each of the above deals covers the size of a fund, more or less. This is what good VC business looks like, we actually made a detailed profile those guys about a year ago.

🇪🇺 We touched a bit last year about the big disconnect between politicians and tech people, and their need to regulate because the politicians are simply too far behind in terms of knowledge and ultimately control of what the tech companies do.

Here’s a little something from what I wrote last summer:

The tech ecosystem has developed tremendously in the past 15 years, in spite of the shitty politics from across both ponds.

That is the very reason for which governments want to regulate Google and Facebook. The gap is so big between the two worlds that the politics is out of control.

More regulation and protectionism will not narrow it down, au contraire, it will force tech to be more creative, they invent things for a living after all. And yes, US is a very different beast than Europe but smart people adapt.

Apart from the money and power plays, it is unclear if the European protectionism is not also about jealousy.

You know, that sort of provincial feeling of being an European decision taker capable of making things happen when seeing that all the interesting tech companies are still coming from the US.

After all, internet regulations from the EU, instead of being focused on the market needs, seem to be dealing in a good part with how American companies are doing business. And it is not really a secret that legislation is made because the Americans are too powerful on the local turf not because, well, there has to be some proper economic incentives so that the market would work efficiently and the consumer would benefit from buying locally more often than not.

And so, I was not too surprised when I read the following:

Clubhouse violates European rules and the requirements of the General Data Protection Regulation (GDPR) are not being met. The entire data protection architecture of the Clubhouse app shows that the service has evidently grown too quickly and does not meet the requirements of the GDPR.

If you don’t know yet, Clubhouse is an audio-based social network launched last April and which raised money pre-everything at $100M valuation a few of months later. Because this is how they do business in the US.

Long story short, Clubhouse exploded in Germany in the past couple of weeks when it also reached the #1 spot in App Store. And it looks like not only VCs are learning from it but also the local authorities are quick to scrutinize them, as per the above quote taken from a data protection officer from Germany and employed by the EU.

The service has evidently grown too quickly - did you get that?

Maybe my German is poor and there’s something lost in translation (zu schnell gewachsen) but uhm, isn’t grow quickly what a startup should do? How quickly is too quickly, is there some sort of EU guidance about it?

Jokes aside, what this guy is seemingly bothered about - Clubhouse is using one of the oldest growth hacking tools in the book: it forces users to share their address book if they want to invite other people into the app. If not, a user can still use the app as he or she pleases.

And if you used Clubhouse, you’re quick to see that the permission ask is quite explicit and straightforward, and works like any banal mail marketing tool does before uploading your address book for sending them emails. (i.e. Mailchimp)

I mean, let’s be clear, I don’t like this technique as a user either, but if I don’t, it is my choice not to use the service or its feature anymore, it’s as simple as that. And if I am an idiot and I am spamming all my address book with Clubhouse invites (an edge case but for the sake of the argument) and those recipients deem my invite unuseful and hemce spam, and then reporting me so, then maybe Clubhouse is liable to take action due to people complaining, and if it doesn't, maybe then we have a case of an outside dude to have a look into it and evaluate the situation.

This is how a normal market works, doesn’t it?

The whole thing is still declarative, in the media, and it is also true that maybe this guy has never ever done growth marketing either. [Narrator: he has not].

Not done with the jealousy argument just yet.

Speaking of the EU business understanding the times we live in and the startup/VC business in particular, here’s another quote, from Michael (btw, if you’re into Euro VC and don’t follow Michael yet, you should):

Recently an investment director of a European govt LP told me he thinks GP upside should be capped and that it’s not good for GPs to be too financially successful as it “upsets the balance of things”, and that some US VCs are too successful and powerful.

Too successful and powerful.

Would you be comfortable in your company to work for decisions makers with this type of attitudes? Discuss.

PS. They want to be VCs too.

🇷🇴 If you are curious like me, you may find it interesting to learn that there has been about 100 investment deals made in Romania in the past 2 years.

That is a significant number, considering that 5-10 years ago VC was mostly something people read about on Techcrunch (there was no tech.eu either :P) and tech events were about social media marketing.

Since then a few interesting projects happened, exits too (yes, UiPath), resulting in quite a few of spillover effects, including the emergence of a secondary startup hub in Cluj Napoca, at par with the capital Bucharest.

Most of the Romanians tech entrepreneurs though, as many as there are, still prefer to build a proof of concept locally and then move out in order to sell it to London-based or American investors. If you don’t move out, you are at disadvantage - btw, there’s quite a few great Romanian founders active throughout Europe. VCs too.

Back to the Romanian ecosystem - here’s a whole report of what is going on in the country.

⚡ Quickies:

🇪🇺 2020 in 20 graphs about the Nordic startup and VC ecosystem

🇪🇺 More differences between EU and the US in the VC/startupland, in a nutshell: stock options + raising investment funds

🇪🇺 Euro VCs discovering the oldest trick in the book: how to build sales funnels. Thanks to Luciana from Sequoia. :-) The Sunday CET #52 mention might have played a small role in bringing awareness too, from what I am being told. :D

Btw, here’s a list of VC scout programs.

🇫🇮 Balderton sold one of its portfolio companies from Finland to Apple, according to a gossip published in the local media. Their site is offline, which is typical for an Apple post deal, and the Finnish media usually doesn’t publish gossip.

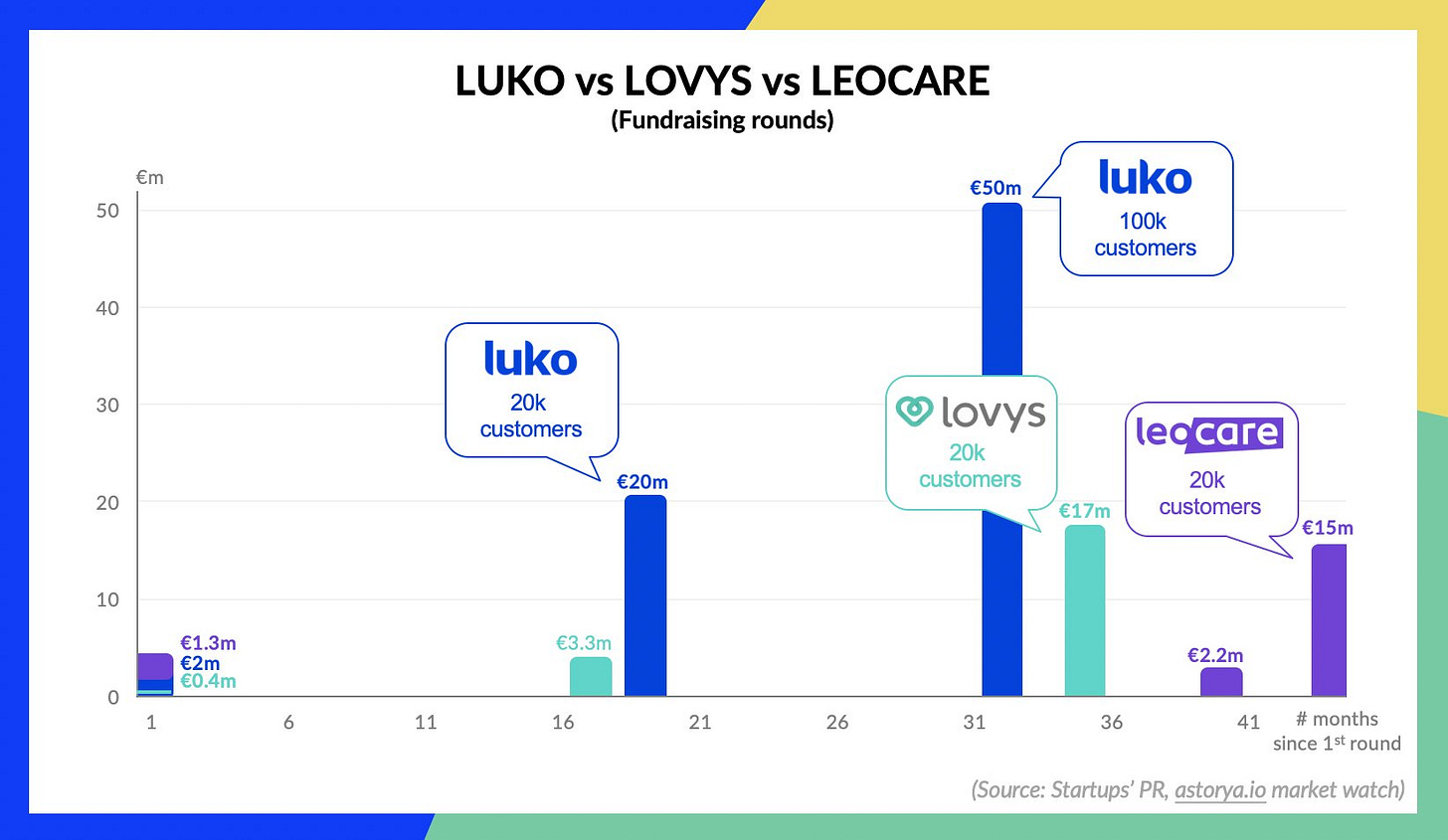

🇫🇷 Two similar neo-insurance companies announced raising money this week: Leocare -€15M and Lovys - €17M. Florian then did this:

🇪🇸 The Kibo Ventures 2020 Year in Review

🇫🇷 A good read for VC wannabes about a kid who did what it takes to get his dream job in the VC business.

🇩🇪 Apropos of this, in 2020 Thrasio exceeded $500 million in sales and generated over $100 million in profit.

🇸🇪 H&M started a service for clothes rental for one of its brands. They also announced a paid member-based exclusive ecommerce service a few weeks ago.

🇫🇷 Google made official the deal with the French publishers, whereas they pay for the right to index and scrap their media content. Here’s why they do it.

Otoh, Google threatened to make its search engine unavailable in Australia if the government approved legislation that would force tech companies to pay for journalism shared on their platforms.

They’re in denial, they have made too many enemies and still think and act as if they’re the smartest media company in the room.

🇩🇰 Denmark's six largest media companies are launching a joint appeal call on the government to make Denmark a pioneering country when it comes to regulating Big Tech.

🇫🇷 A new bookstore has opened in Paris dedicated to large-print texts to cater to visually impaired clients. The store is the first of its kind in the French capital

🇪🇸 At 76%, Spain has the highest ratio of home-ownership in Western Europe after Malta. In Germany only about half of people own their own homes.

Graph of the week

Brits, EU and migration

Bonus: 4000 years of world history - states, nations and empires.

Other stuff

Speaking of good VC business, a16z, probably the best VC in the world, announced doubling down on their content and backing what Ben Evans has famously twitted years ago that a16z is a media company with the VC as a business model.

There’s tons of hot takes written on the topic and far from my intentions to add yet another one - I would just dully note that the VC is a business of reputation and referral and the content is the strongest driver supporting those.

And I would also humbly suggest replacing from Ben’s quote the word media with knowledge. If you’re in VC or a founder building a company and haven’t read at least one article written by those guys since 2009, you likely haven’t done your homework properly.

Forbes, the media website mostly known as a former print magazine, announced launching a newsletter platform allowing journalists to create their own paid newsletters.

Exactly like Substack, but managed by media people.

Their fine print:

Writers split subscription revenue for newsletters 50/50 with Forbes

Writers also receive cut of ad revenue with Forbes, with no cap on potential earnings

Forbes (or Substack for that matter) needs to bring in more traffic that should convert into paying subs that should justify the enormous 50% cut - even the Substack’s 10% is arguably high. And in this case the money for the tool providers is not in the tail but in the head.

We’ve seen this NL exuberance before, when we had blogs and social media workers who now call themselves influencers and the truth is that only the professionals will resist, as with any new emerging medium that sooner or later will professionalize and chase scale.

Bonus related link: Rolling Stone seeks 'thought leaders' willing to pay $2,000 to write for them.

Toronto is not the next great startup scene. Neither is Waterloo, or Vancouver, or anywhere in Canada.

Netflix says 64% of its customers live abroad, and 83% of new customers in 2020 came from outside US/Canada.

Regional breakdown:

U.S./Canada 73.94 million

EMEA 66.70

Latin America 37.54

APAC 25.49Rather than buy a single pay TV bundle, future fans will likely subscribe to three or four streaming services that include sports, switching some of them out during off-seasons (especially football), making 12-month programming calendars critical.

Shutterstock did a great overview of the design themes to look out for this year.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.