Howdy from a windy and grey Stockholm.

Hard to believe that about a year ago I was on a plane from Madrid to New York and reading about Milan closing down because of covid. Feels like ages ago and still think we have at least 6 to 12 more months to go until we get to a close-to-normal, pre-covid routine.

Hope all of you are hanging in and dealing properly with the third wave, and try to enjoy as much as possible the early signs of the spring.

This week’s edition is packed, let’s get to it.

Euro intel

❄️ Powder:

🇪🇺 EIF

🇫🇷 Sofinnova Partners

🇫🇷 Quadrille

🇨🇭 Venture Kick

🇮🇸 Brunnur Ventures

🇪🇸 Easo Ventures

💸 Active this week:

VCs: Index Ventures, Northzone

Angels: Cristina Stenbeck, Ralph Mueller

🔥 Interesting deals:

🇬🇧 Hopin. No comments needed.

🇫🇷 vertical farming producer

🇸🇪 DTC seller of insect-based pet food

🇩🇪 digital marketplace for contracting power purchase agreements

🇬🇧 API-based platform for business data

🇩🇪 software digitising factory processes

Strategy

🇸🇪 It’s hard to review what happened this week in the Euro startup land without at least mentioning Klarna raising $1 billion at a 6X valuation since 2019. It now stands at $31 billion.

If you take a step back and look at the big picture, you have to wonder what all this means and what the trajectory looks like in the next 3 to 5 to 10 years.

What is Klarna trying to accomplish and what did the investors see in the company’s plans so that they made their equity bets accordingly?

In other words, is the 31 billion valuation really worth it?

When trying to find answers, the first thing you look at is sizeable markets the company can attack in order to command growth rates on sustainable basis. Hyper growth!

They are leaders in the Euro BNPL sector and started to get legs in US but is that ambitious enough? Is being a BNPL market leader the end game here?

I don’t think so, those are just natural baby steps, market-getting moves, which are a mean to an end. The big picture is different, and this is a chess game, not backgammon.

The low hanging fruit, of course, is attacking more of the financial services sector, a natural horizontal play across segments after Klarna established itself vertically as a significant payment processor. It is a good bet to cross-sell more types of products to the same consumers, on the infrastructure Klarna already built.

However, there is another move in play, a ballsy step that could be a game changing power move.

Klarna built a virtuous loop between the merchants and the consumers and it stands exactly in the middle of it. And this makes you wonder - do they extract all the economic value from this loop? What pieces is the puzzle missing for being a dominant player?

This is the position where you at least diligently think about becoming a market maker in the e-commerce space. Needless to say that e-commerce is a huge market, as sizeable as the financial sector.

If you look closer at those two pillars and at the business fundamentals, you will realise that Klarna’s label as a BNPL company is simply mis-representing what they do and the huge opportunity ahead.

And so, that makes the 31 billion simply peanuts now if you understand Klarna’s big picture in the future. As always though, the devil is in the execution but the upside is certainly there.

Since this is a longer argument than writing a mere email, I put all this thinking into a more detailed report analysing Klarna’s future. Got numbers and pictures too.

The conclusion: long Klarna!

-

🇪🇺 Are you even in the online grocery business if you don’t deliver in 10 or 15 minutes?

Let me get this straight: this promise is not a competitive advantage, not even for a consumer who needs to buy cigarettes or who ran out of toilet paper. Nobody is that guy.

However, whatever grocery startup gets covered in the media these days feels the need to emphasise speed. Not any speed, but super speed, the 15 minute speed.

Delivery is a hard business to build and speed is important, of course, but reliability, for example, is a much more important factor than speed.

Saying that you will deliver at a certain moment and keeping that promise over and over again in any circumstance, is more important than a general 15-minute commitment, which will make your implementation hard to start with.

If those startups were really serious about it they would say “15 minutes OR you get your money back”. That would show they mean it.

Bref, the 15 minute delivery is just a PR flick, a silly sort.

Anyways. The grocery sector is hoooot in Europe - with four o’s, as many as the number of the sizeable fundraising deals announced only this week.

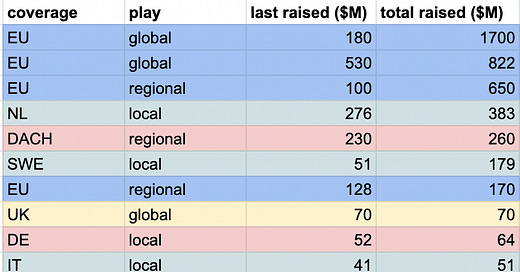

I found it fitting to dig a bit into it - made a list with startups that raised in the last 12 months or so and threw them in a spreadsheet.

By no means a complete one, but comprehensive and relevant to getting an idea about what is going on in the sector.

It looks like this, sorted by the total raised:

So there’s four tiers, at least. The big-pocketed global guys, the locally established, the well funded wannabes and the wannabes.

1. The top 3 bunch operating big are the gorillas to poke, or rather to avoid.

2. The middle tier that raised some money and which needs to put together a quick and dirty model that can be scalable fast. They need significant share to be in competitive position against the top tier.

3. There’s also some local players which raised big amounts and preferred to get deep locally rather that expand horizontally on different geographies.

4. The below 20 category is either focusing on small local market or will upgrade one level up by raising more very soon.

Not listed above but worth mentioning - the traditional players who are not passive at the online opportunity. They have bigger inertia but cannot be neglected.

It’s still a lot of blue ocean in the online supermarket delivery market so competing against each other is not really a zero sum game. Yet.

How will this market configuration look like in one year? How about in 3 to 5?

The fragmentation is big and the value is created in disparate ways, where is the consolidation going to happen? What is the inflection point?

How do you play your cards and how do you define your end game? Do you go deep in one country or region, or expand quick and dirty in selected metropoles?

Will the big cities be enough? Will the small cities be worth marginally for doing business?

How important is the cultural factor? The buying groceries behaviour is different in Madrid versus in Stockholm.

So many questions, variables and strategic moves - it is an interesting strategy exercise, and a bet which a handful of select European and American VCs already made.

The screenshot from above is from a report profiling 21 startups from the on-demand grocery business from Europe and that raised money in the past year.

In the same report you will also find the downloadable excel, including the names of the startups, their profiles and their investors.

Observations

🇬🇧 The UK is figuring out how to create the right context for foreign tech people interested to work for UK employers. They call them highly skilled migrants, as opposed to, I assume, people applying to work as bus drivers or plumbers - un-rightly so since you need quite a few skills to drive a bus or do plumbing either. :-)

Jokes aside, I know, it is what it is, and I get it. But there is a category of people for which this whole needing UK visa thing feels so backwards and frankly a bit disappointing.

After two decades of not really having to think about paperwork across any EU country, the whole visa thing is kind of a big deterrent for those 20-40 years old generations that grew up without it.

You knew you had this cost if you wanted to take your skills to the US but being in US is being in a different world. That is a big life change.

London was and still is Europe, just one hour behind, fish and chips and driving on the wrong side of the road - and now has a US-similar paperwork cost associated to it.

It is what it is.

-

🇫🇷 But hey guys, don’t be sad about London - look, France’s government officially says it has become the number 1 country in Europe for venture fundraising.

If you were a founder with global ambitions from day 1 and looking to raise, how would you rank your fundraising segmentation efforts?

(x) Paris-based investors

(x) France-based investors

(x) London-based investors

(x) Silicon Valley investors

(x) American investors

(x) best in your vertical/stage investors

(x) French-speaking investors

(x) English-speaking investors

Don’t laugh, it’s a serious question. Is there anything France-related in your top 3?

-

🇪🇺 What do you do when you are one of the better American companies and want to grow quickly in Europe?

You simply hire top people from Europe to do it for you. Makes sense, right?

How do you make sure of that? You make an offer that cannot be refused.

The offer is based on an analysis of the opportunity ahead and the compounded growth the prospective employee would contribute to in 3-5 years. The analysis also includes a look at the market and job competition.

And if Americans really want to get that person, they would make an offer at 1.5-2X+ above the market rate, compounded with performance-based incentives, usually a cut of the future value created.

That last part is very important. Americans will want to make sure you say yes because that is the best offer you can get. The offer is about the employee first and getting them committed.

Europeans usually hiring other Europeans look at the local market and if they really want you badly they will offer 1.1-1.2X. They will probably tell you about the number of the holiday days and that you get free coffee at the office, usually with not too much sharing of the future value created.

The last part is not that important. Europeans will want to make sure they are not out of the market and this is the best offer they can make. The offer is about them first.

It is also true that the risk is also correlated - the better the offer, the higher the risk.

European employees usually think in terms of job security whereas American employees think in terms of maximising the money they can make in a year. That is why you hear frequently about stories of American companies letting people go on the spot when they do not perform or when the shit hits the fan.

One final point - this reasoning applies much better to hyper growth situations, when it is extremely important to have strong functional leaders steering the ship and executing against a sizeable opportunity that needs to be won over.

Anyways.

Anecdotes and generalisations aside - after Sequoia recruited Luciana Lixandru from Accel last year, Lighspeed hired Paul Murphy from Northzone.

American VCs really want to do business in Europe - we’ve got a hyper growth situation here, don’t we?

Who is Lightspeed Venture Partners:

Lightspeed is one of the four American investment giants, sitting next to Tiger, NEA and A16Z.

It was founded in 2000 and had 2020 LP commitments announced at $4bn across three funds, covering all stages, geographies and verticals.

In Europe, they have had a partner active in London since 2019 - Lithuanian Rytis Vitkauskas - backed by two other US-based partners - Brad Twohig and Nicole Quinn.

This is the Lightspeed excerpt from a report about the American investors from Europe.

✍️ Other notes

🇩🇪 A detailed list with pre seed investors from Germany - not all roads lead to Rome and not all funds are based in Berlin...

-

🇪🇺 Notes from an European pre-seed roundtable.

-

🇪🇺 Europe has a hub that is a Silicon Valley for Youtubers.

-

🇩🇰 Heartcore made their website cuter, underlining their consumer-focused investment thesis, a clear market positioning they took after the 2019 spinoff from Sunstone.

They also have one of the better newsletters in the Euro VC area and just released their consumer trends report.

-

🇪🇺 Beijing-based Didi is considering rolling out ride-sharing services in markets that could include the U.K, France and Germany by the first half of this year. Already set up a team dedicated to the European market and is hiring locally.

-

🇩🇪 Deutsche Bank and Commerzbank have told new customers to pay a 0.5% annual rate to keep large sums of money with them. Or take deposits elsewhere.

-

🇩🇪 Last year Berlin introduced rent controls. The effect was exactly the opposite they were expecting.

-

🇩🇪 Facebook News coming to Germany in May 2021

-

🇪🇺 The EU is a mess at regulating big tech, part 232629.

-

🇳🇱 The upcoming Dutch elections has 33 parties you need to choose from.

-

🇪🇺 EU, US agree to suspend tariffs over Airbus-Boeing dispute

-

🇬🇧 The top Brexit relocation spot for finance firms is not Paris. Neither Amsterdam. Nor Frankfurt. It’s Dublin.

-

🇬🇧 Good things are happening in Britain - Boris unveiled a £100 million package of policies to help tackle obesity as he himself changed diet and lost “quite a lot” of weight. 14 pounds (6 kg) to be exact.

Charts of the week

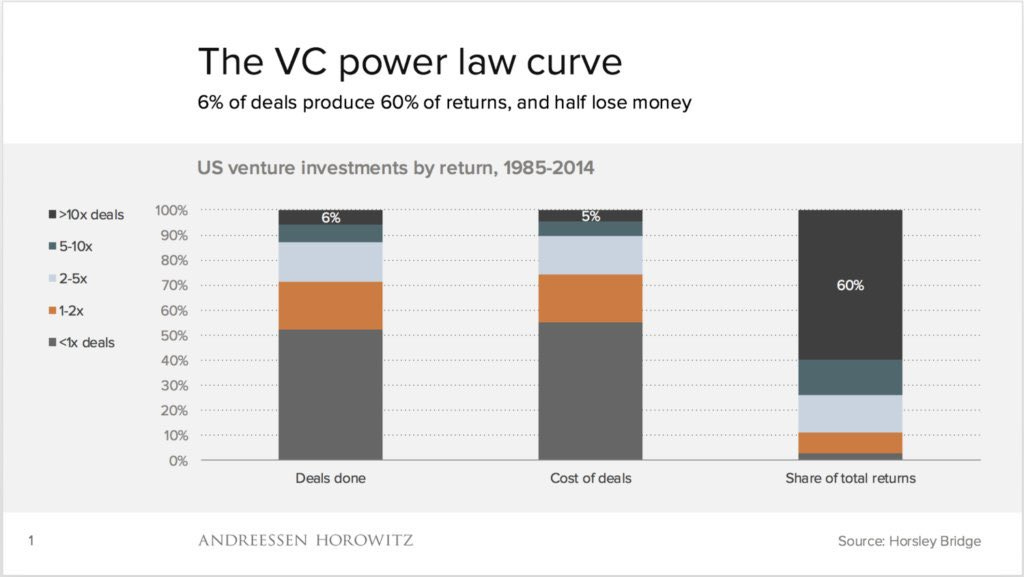

The VC power law curve

The most popular passwords in the world

Other stuff

VC is a mature sector that has to earn the business now and need to do marketing.

Amazon-owned Whole Foods opens online-only ‘dark store’ in Brooklyn

Hey, the email service developed by Basecamp, launched a sort of newsletter publishing service. Très intéressant.

Looks like “Delete Clubhouse” is a thing. I honestly don’t understand how people have so much time to spend over there - here’s an explanation.

This meme had to be done.

The first permitted 3D-printed house is now for sale in New York.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.