Is Deliveroo's IPO a flop?

#72

Hola people! I missed you! Hope you took advantage of the Easter holidays and disconnected a little, like I did!

Back in business this week - big welcome to the new subscribers and let’s get straight to a new edition of Sunday CET!

✍️ Observations

Was the Deliveroo IPO really a flop?

It is dubbed as one of the worst European IPO tech in history.

It does not indeed look good because high expectations were met by a public market pricing them at almost 30% off from the initial ask ($6bn market cap at Friday close) and $1bn less than the pre-IPO $7bn valuation in February.

Money was lost and the market consensus is that the whole IPO process was badly timed and mis-priced.

Which is not false. However.

Make no mistake, what we see now is not a true reflection of the company’s fundamentals (which is a PR-fed media refrain). It’s rather a simple result of a manly dispute involving money and egos that took place when negotiations were held during the listing process.

That fight still did not get a resolution.

On one side, we have the people with market power, aka the buy side on the public markets, which btw don’t have to explain not buying a particular stock - they need justifying the buying. As long as their portfolios make money they owe no justifications for their no-trades to their shareholders or anybody else.

On the other, we have a few investors which didn’t make as much money as they expected at the liquidity event. The largest ones are Amazon (which doesn’t really matter in this), 3 American hedge funds (T Rowe Price, Fidelity and Greenoaks) and 3 VC funds (Index Ventures, DST Global and General Catalyst).

And in between - Will Shu, the founder, who apparently caused all this since he wanted some involvement in the matter.

Why did he do that? Likely because he is an entrepreneur first and not an investor first. He trusts the fundamentals of his company and he probably didn’t want to play some old dudes’ games, who have been making and breaking the local stock exchange since, umm, the period before internet was invented?

One other detail: Will Shu is American not Brit. So he, by default, doesn't belong to the cool London boys club either. Which is an old known issue in the City.

And this equation brings us to the main problem, which is structural.

The truth is, later stage investment, pre-IPO, is still very much underdeveloped in Europe.

There is a missing link from series B or C, let’s say, to IPO, that you can easily see in the US market, for example - namely round series D, E or F which mainly involve pension funds and other large asset managers, which also have vested interests in the public markets dealers.

Their later stage involvement is a de-risking process, a validation that a company will smoothly sail towards an IPO, with no surprises, where everybody will make money and be happy.

Should they have existed in Deliveroo’s cap table, it is likely that we wouldn’t have had a CEO situation and unhappy people doing bad things to each other.

That is why I think this whole situation is an indicative image of an old European financial market doing business in the 21st century - sure, it is evolving, but it takes time until dinosaurs are replaced by the new blood.

As for Deliveroo - apart from a group of investors losing money (some amateurs included), the company is fine.

The fundamentals didn’t change over night because of unhappy traders sentiments. Yes, there may be concerns, there always are - they’re called risks and addressing them is part of the journey.

Deliveroo still raised some $2.1bn from the IPO, so they have the financial resources to execute, giving it firepower to take on rivals such as Uber and Just Eat Takeaway.com.

The opportunity in front of them is still sizeable, part of it validated by a bunch of early stage investors, and it is still up to them to grow revenue, become profitable and pay dividends, the only fundamental that makes shareholders happy and can fix the traders concerns.

The ‘how can I help’ VCs

A study was circulated this week in the media showing that the majority of founders don’t really benefit from the expected VC value-add from their investors.

I wouldn’t read that much into it, VCs gotta earn their management fees, and if a relationship doesn't go beyond the standard reporting, some email exchanges and idea bouncing in board meetings - that’s usually on the founder, not on the investor.

It is the CEO who needs to lead in the founders/investors dance. You gotta (know what to) ask in order to get, and you need to be prepared in order to have a VC be useful to you, apart from the money they provide.

The founders job is to ask for specific things that are related to two areas:

i) tapping into investors network - intros, PR, new hires etc

ii) new financing sources - next round, strategic clients, other kind of $ access etc.

Those two items are investors’ competence - they are well-connected finance people with a greater outside perspective, and can relate to many other business cases they have seen, based on which can provide useful advice.

Oh, sure, sometimes some mentoring or pep talks are in order, but other than providing money, VCs job is to consult not make things happen. Due to the intangible nature of consulting work, founders may feel that they don’t make the best of it, especially if they don’t have a clear agenda correlated to some sort of KPI indicating that the VCs are doing useful work.

And yes, there’s also bad apples and investors full of BS, but doubt it is the main source of the percentage gap the said report suggests.

The canny deal maker

Speaking of good founders, FT profiled Alex Chesterman, one of Europe’s best entrepreneurs who, in three years, raised money, built a SH car marketplace business and now flipped it on the US stock exchange via a SPAC.

This is not his first rodeo - he also did Lovefilm, a DVD rental biz he built in the 2000s, backed by VCs and sold to Amazon for £200m and Zoopla, a real estate service flipped in 5 years to private equity for £2.2bn.

The dude is that good also because it is rare to find a founder in Europe mastering the entire cycle from taking an idea over a cup of coffee to a business that he is then capable to structure into a multi billion exit.

That is hard to do and not too many people can pull it off. Three times!

I mean, just look at Deliveroo’s Will Shu, he will not put on the resume his IPO exit skills, will he?

Chesterman is also a very active angel investor, likely one of those guys who does business because it’s in his DNA, regardless of the context.

Do you think that a guy like him would ever complain about the VC value-add? :-)

Twitter wanted to buy Clubhouse for $4 billion.

CH is still adding new users like crazy but doesn't have any stickiness and real reason for people to return to it since the content discovery experience is just horrible.

Last week it announced launching a marketplace feature allowing sponsorships for creators - aka people hosting events being able to get payments from followers. Next step is hosts selling event tickets - not implemented yet as I suspect it has something to do with Apple not letting them handle in-app payments without getting the 30% we-are-not-a-monopoly cut.

But the move seems right - creating an economy on top of a consumer tech is a smart play and this should be at least a temporary user retention fix that could transfer the stickiness problem to event organisers, aligning them with a revenue model.

This direction is what’s most interesting at Clubhouse from a TAM perspective - the ad-hoc opportunity of organising an audio meeting which you can charge for on the spot. It is the low end market for small events, launches, conferences, workshops, trainings, social media influencers, AMAs and even replaces the traditional VC cold pitching sessions. No or low setup costs and no tech knowledge required to be part for a low friction marketplace.

As for the $4bn valuation - that simply reflects a new paradigm shift in the social media, with the hope of a first mover being able to reap sizeable returns from what will be a huge ecosystem in 3 to 5 years.

Meanwhile, CH’s core proposition will soon be commoditised by all the big tech working to launch their own version of it. But they will simply grow the pie, not take from CH’ share.

And when/if this marketplace takes off, expect VC investments in CH-based projects - that’s when CH will become a platform and a16z can call it another home run.

Also note that a16z is very early investor in two of the most interesting consumer trends this years: text (Substack - valued at only $650M) and audio (CH), both marketplace driven. Both will become fundamental social media pillars, at odds with dinosaurs like Facebook and Linkedin.

✍️ Other notes

🇬🇧 Index launched Index Origin, a $200 million seed fund.

Early stage investors I talked to feel threaten by it, but isn’t this like Facebook launching a Clubhouse clone? :-)

🇮🇹 Useful notes on how to ask for intros and, in general, how to diligence the VCs if you’re a founder out in the cold raising.

TL,DR: Strong KPIs will turn the odds and even bring VCs cold emailing you.

🇫🇷 Daphni with a common sense explanation about how competition forced them to use software for gathering market signals.

TL,DR: build your own intel software tool - which btw is different than a quick and dirty Linkedin and Crunchbase scraper.

🇪🇺 AWS prices are obscene.

Hear me out: how about EU builds a decently-priced alternative to Amazon, instead of, say, becoming a VC?

🇬🇧 The UK has never produced a single company that has made 100 people under 45 any money. Why is that?

🇪🇺 I got a lot of feedback and interesting comments on both Klarna’s valuation and Whereby’s. Truly humble and thankful for it - I actually got to learn a ton from it!

A common thread was that my numbers are actually conservative, meaning that, in Whereby’s case, the road to unicorn explosion should take less than 3 years!

🚀 Quickies

🇪🇺 A list of interesting Nordic startups doing electric boats, bicycles, scooters etc

🇪🇺 TechEU dove into their database and captured a list of European unicorns.

🇪🇺 Isabel from Sifted feels sorry for VCs. Isabel is young. :-)

🇩🇪 Lilium’s deck makes for an interesting learning about where the market is going.

🇬🇧 Ditto for Cazoo.

🇪🇺 Europeans and SPACs = pitch the wrong people, they’re quick to tell it to the media.

🇪🇺 An American woman who scammed a bunch of Euro investors is trying her luck in US (thread + article).

🇬🇧 Interesting FT profile of Justin Welby, the head of the Church of England and former finance guy.

🇪🇺 Italian and French banks revive ‘doom loop’ fears with bond buying.

🇬🇧 Scottish castles are rare, huge and very expensive.

🇫🇷 The French are partying like Americans did during the prohibition 100 years ago.

Charts and data

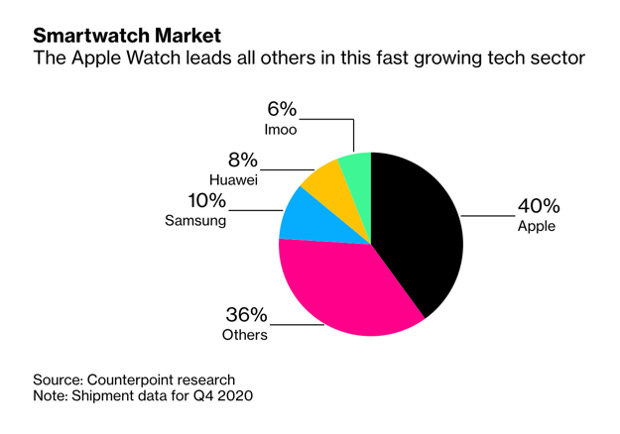

Smartwatch market

Which is which?

Houston, we have a problem!

Data

Of all the estimated 2 million podcasts out there:

- 26% have produced just a single episode.

- 37% have produced 2 or fewer episodes

- 44% have produced 3 or fewer episodes.

- 36% produced 10 or more episodes

In other words, the world of podcasts is full of trials and one-time wonders. Producing podcasts is like writing, it requires consistency over a long period of time. If it’s more than a hobby, that is.

There were 51,600 ebike manufacturers registered in China in 2020, up 83% from 2019. 223,000 companies were in businesses related to the ebike industry. link

African countries which received the most VC funding in 2020

Costco makes essentially $0 in profit from product sales - their margin is the $60/year they charge to be a "member".

Other stuff

We have a global chip shortage situation that could lead to bottlenecks in computer production, including Apple. There’s tons of devices needing a chip for being built.

Samsung bets big on foldable smartphones amid chip crunch.

LG will no longer make mobile phones, closed down the business.

2021 JP Morgan’s CEO letter to his shareholders.

AngelList launched Roll Up Vehicles, a way for founders to efficiently raise from up to 250 angels with a single line on the cap table

How to build a strategy presentation

After 17 years, we finally cracked a $100M churn problem at PayPal.

The job market is not going to be the same - everyone is taking new jobs because the market has reset salaries substantially higher.

Amazon’s next big thing is video-based advertising - they call it T-commerce.

Why kids use filters on social media - to look beautiful, of course.

The best of Yahoo Answers - i.e. how to unbake a cake?

But this American values: land of the free, home of the brave, this I don't know. And then I learn the history of this country. Your slavery, the smallpox in the blankets, how you stole the land from the natives.

And I realize... to be an American is to pretend. Capisce? You pretend to be one thing when really you are something else. And I can do that. Lie. Hide. But what I will not do is pretend we are at peace when really we are at war. Are we at war?

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.