Hi - welcome to a new edition of Sunday CET!

Here’s what’s in store today:

MENU

More money in the market

Observations, research, data

Books

Interesting stuff

More money in the market

INVESTORS

🇬🇧 One Peak Partners

🇪🇸 Axon Partners

🇮🇹 Lumen Ventures

🇫🇷 Diaspora Ventures

🇪🇸 Hello, World

+

🇸🇪 EQT is pedal to the metal in Europe - just hired Carolina Brochado from Softbank to launch a growth fund positioned between Ventures and Private Equity.

BETS

🇷🇴 object recognition software

🇬🇧 eco-friendly detergent subscription service

🇸🇪 social network for girl coders

🇪🇸 3D printer manufacturer

🇭🇺 digital aircraft maintenance solutions

🇩🇰 robots for land surveying on sports fields and roads

🇨🇭 developers of an offline/online next word prediction engine

🇪🇸 personal genomics company

Observations, research, data

MICRO

🇪🇸 Inveready and K Fund are heading the list of the most active investors from Spain in the first half of 2020.

🇵🇱 Poland’s top seed investors to know

🇩🇪 Tier Mobility founders Lawrence Leuschner and Matthias Laug donated their shares to the charity fund Blue Impact.

Leuschner owns 13.6% of Tier, about EUR 40.8 million, and Laug has 4.8%.

🇸🇪 The Soundcloud founders made public their new startup: an e-bike subscription service named Dance. 59 euro per month all inclusive.

E-bikes is probably going to be the next hot microbility vertical that a lot of venture money will be invested in - the manufacturing end of the value chain is already heavily invested.

Micromobility, especially in Europe, is in its first inning of emerging development, at the intersection of the adoption of the electric-based vehicles, car banning in most of the capitals centers and a sense of urgency of using tech for climate change purposes. The scooters today are just a tease of what the public infrastructure will look like.

E-bikes have the advantages of being a cheaper asset than a car and a more comfortable, practical and reliable mean of transport than a scooter. It is a sweet spot for consumers.

In time, an e-bike will arguably become a commodity, when DTC competition will pick up. Manufacturers still need to get at economies of scale for a decent unit economic - fwiw, the global e-bike market is expected to grow from $17 billion in 2017 to $27 billion by 2025.

A subscription operation looks like an interesting opportunity to build a biz based on the right product, at the right time and by leveraging product and distribution network effects and virality. It is a much better model than the on-demand scooters preponderantly use nowadays, as it mitigates risks such as client stickiness, vandalism and city regulations.

Dance needs to solve for the consumer frictions and hidden costs associated with buying (i.e. choosing a suitable one and setup) and the total costs of ownership (i.e. maintenance, theft, gears and consumables etc) providing an outstanding experience and support.

The defensibility should come from strong brand and community around the business which can translate into a revenue line (just look at what Rapha did with their club). As Dance solves this, the lock-in, up-sell, and after market will be some of the main upside drivers. It's a strong marketing play, with the brand and its values aligned with the consumer proposition.

🇸🇪 Speaking of micromobility, here’s some data I found in the Swedish media (paywalled) detailing the car-as-a-service model breakdown for Volvo’s M service:

- period: 2018 - mid 2020 (30 months). The numbers are aggregated.

- 70k registered users (nota bene: not payers!)

- 5 cities: Stockholm, Gothenburg, Malmö, Lund and Uppsala

- investments of SEK 640M ($72M)

- losses of 400M ($45M)

- revenue 242M ($27M)

In case you didn’t know, M is an on demand car service operating on a hybrid model: roundtrip, station-based, with a subscription fee and pay-as-you-go-expenses on top.

The user number is from a longer period actually, since M was launched in 2019 as a rebrand of and replacing an initial service called Sunfleet, which was 30% cheaper - the transition likely generated churn.

Quick back on the envelope:

at a monthly ARPU of $500 we get almost 5000 customers. Since the revenue is cumulated, the number is lower than that.

a fleet of 1000 cars @ $30k accounting value at a monthly ARPU of $500 is covered by 5000 users, before SGA expenses.

parking spaces, fuel and insurance are also big items on the income statement.

The obvious difference between car-as-a-service and ebike-as-a-service is that instead of having to optimize for an ARPU spread over a $30k asset during a 3-4 years lifecycle, you optimize for a $2000 asset at a 2-3 years lifecycle.

And so, for a fleet of 1000 e-bikes at $2k a piece at a monthly ARPU of $59 (Dance’s fee) you need less than 3000 users to cover inventory. In a sub model you don’t have to budget parking/docking or fuel but you will need to account for extra batteries.

Just some simple benchmarks for further modeling and assumptions.

Here is a more detailed analysis about the car as a service breakdown in the Nordics I did some time ago.

🇩🇪 It can take 18 years from interning to becoming a partner in VC in Europe. Your mileage can vary as you can also get from associate to partner in 4 years.

🇫🇷 Idinvest Partners transfered in a secondary transaction 12 of its European & American investments from its venture portfolio, including Deezer, Forsee Power and SightCall, to a newly established Idinvest Growth Secondary Fund.

🇳🇴 Adevinta acquired eBay’s Classifieds business unit in $9.2B deal. Aggressive M&A was Adevinta’s growth strategy from the beginning, ever since it was demerged from Schibsted and listed in 2019. Gonz mapped out nicely the geo distribution of the new asset portfolio.

🇪🇺 Twitch started working with four soccer clubs - Real Madrid, Arsenal, Juventus and PSG - as it launched a standalone sports category. As part of the partnership, each club will produce exclusive and interactive content for Twitch.

🇩🇪 The future of manufacturing - manufacturing is one of the last bastions of enterprise SAAS.

🇸🇪 Where great marketing can take you - Oatly’s story in a thread.

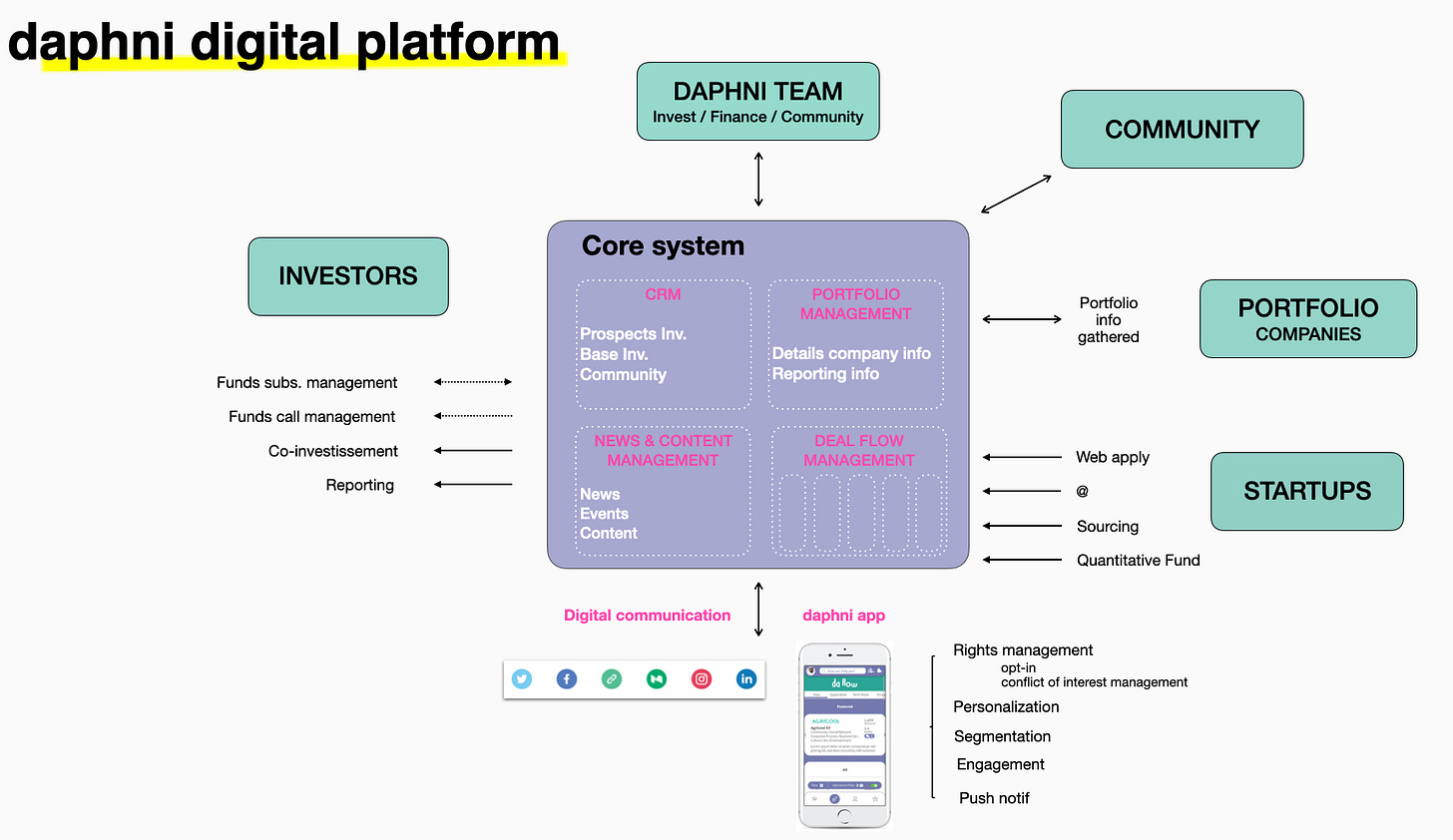

🇫🇷 Daphni made public the way they think about their digital platform.

It is remarkable to see an Euro VC laying this out - the challenge is investing in a setup built from scratch vs. outsource trendy fancy tools hoping they stick together and get to operational efficiencies. The opportunity is bigger than an efficient ERP as displayed above though, we talked about this a few times and Dapnhi seems to get it.

Daphni is one of the new kids in Europe’s old and traditional VC playground - they invest early stage out of a first 150 million fund raised in 2016.

🇸🇪 Here’s a 2017 analysis of government venture capital decision-making meetings in Sweden about the types of language that VCs used over a two-year period. Things have changed a bit since then but not that much, the study was made pre-metoo movement fwiw.

🇸🇪 Spotify launched video podcasts, enabling podcasts to include a video. I’m very long on Spotify.

🇪🇺 Slack has filed a formal antitrust complaint against Microsoft with the EU, accusing it of unfairly bundling its rival app Teams with its Office 365 tools. Here’s why.

🇬🇧 News Subscriptions – and the Lack of Alternatives

🇸🇪 IKEA is launching vegan Swedish meatballs.

MACRO

🇪🇺 Sixteen banks from Germany, France and three other euro zone countries want to build a "truly European" payments system in order to :: checks notes :: take on Mastercard, Visa, Alipay and Google.

The so-called European Payments Initiative aims to become a digital payment solution that can be used anywhere in Europe and to supersede the fragmented landscape that currently still exists.

Non-European players account for two-thirds of non-cash payments.

More than 50% of retail payment transactions in Europe are still done by cash today.

By 2022 - that’s 18 months from now on. Stop laughing!

🇪🇺 About 10 months ago, EU announced an equity investment fund for AI and blockchain technologies. They said they’d invest €300-400 million in “highly innovative start-ups and tech companies” in 2020 alone.

Anybody familiar with some names of lucky recipients? If that.

🇩🇪 The rental market is a mess, the Berlin edition:

- 25 people queuing for over an hour at 7am on a Monday to see a flat, only for the agent to not turn up

- More than 80 people queuing to see a flat on a Thursday afternoon, and then 30+ apply for it

- An agent won’t give me an appointment to see a flat, claiming 150 people emailed her in 5 mins after the ad was online. She then gives me a slot when someone cancels... but sent me (and everyone else!) the wrong info. The flat she shows us is totally different, worse.

There’s more at the link.

🇩🇪 Bild, Merkel and the culture wars: the inside story of Germany’s biggest tabloid (great long read)

🇬🇧 Overall, London, Oxford and Cambridge — known as the ‘golden triangle’ — account for 60% of student startups from the UK.

🇨🇭 The Swiss political system - good and simple two-part read yet longish about why Switzerland is working great: 1 & 2

🇪🇺 The European Commission confirmed that is looking to treat CBD as a narcotic drug as moves are underway to change the status of cannabidiol (CBD) from a food to a drug. I know a few Nordic investors who will lose quite some money because of that.

🇫🇷 France is Europe's leading consumer of cannabis and comes in third place for cocaine use. From September, illicit drug users, especially cannabis, will be charged with an on-the-spot fine of 200 euros.

🇸🇪 Sweden to have direct daily night trains to Germany and Belgium within two years

🇪🇺 Speaking of the European railway system, which without a doubt is one of the better in the world, its online ticketing system is pretty bad.

🇬🇧 Why I write so much about Estonia

🇭🇺 In Hungary things are getting bad by day. Very bad.

🇩🇰 Following school closures in March, Danish news startup Koncentrat launched a free, interactive, daily TV show to teach teens media literacy skills.

MORE

📇 Corporate recruiters avoid hiring founders. Not surprising for a few reasons:

- founders don’t fit the mold or the patterns used for filling out jobs

- they usually fix problems while wearing multiple hats

- they are usually culture creators not adapters

- they break rules and create new ones when systems suck

The list is longer but founders’ mindsets are usually different than the politics and “cover-your-ass-first” they may find in a corporate life.

Truth is, as a founder, if shit hits the fan and you really need to get a job to make ends meet, it is very difficult to get one. The struggle is real.

🎓 a16z is a media and education company that monetizes through VC. The whole education system is unbundling as we speak and in 3-5 years we will see a different ecosystem than today. US is still lightyears ahead of Europe in terms of innovative thinking about it, here’s an example. And another. And another. I talked about this opportunity a bit.

Oh, and btw, the US government is looking to prioritize job skills over college degree in government hiring. Yup, uni degrees will be less important for getting a job.

💲The last big disruption to Series A was a16z doing $10m at $40m post (circa 2013). The new A trend that's picked up steam over the past year-ish is crossover funds (funds that invest across both private and public companies) moving downmarket and leading $16-20m Series A rounds at $80-100m post, and in some cases, not taking a board seat.

In US of A that is.

🌍 Only 20% of VC money in Africa comes from Africa-based investors. In Kenya, only 6% of startups that received more than $1m in funding in 2019 were led by locals. In Nigeria, 55%. South Africa, 56%.

Encore

📚 BOOKS

No Rules Rules by Reed Hastings (yes, that Reed Hastings)

🗞️ INTERESTING STUFF

Amazon has invested $18B over the past 10 years to turn every major cost into a source of revenue.

Good interview with the Morning Brew founder

Twitter will likely launch a sub feature soon.

The strategy thinking behind Slack acquisition of Rimeto, straight from the CEO (if strategy is your thing)

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac. Please share it with your networks and encourage your colleagues to sign up here - thanks!