SPACs, Clubhouse and Americans in Europe.

#66

Hello and welcome to a new Sunday CET edition.

Let’s get to it.

Euro intel

❄️ Powder:

🇩🇪 Earlybird

🇫🇷 Founders Future

🇭🇺 Flashpoint VC

🇩🇪 Revent Ventures

🇩🇰 Preseed Ventures

🇩🇪 XPRESS Ventures

🇬🇧 Ari and David Helgason and Benjamin Ratz.

-

🇪🇺 Who are the people from Europe doing SPACs.

🇪🇺 Who are the American investors from Europe.

🇺🇸 Iconiq Capital wants to hire its first partner in Europe.

💸 Active this week:

VCs: EQT Ventures, Finch Capital, Cavalry Ventures

Angels: Charlie Songhurst, Nicolaj Reffstrup, Laurens Groenendijk

🔥 Interesting deals:

🇩🇪 electronics operating system

🇸🇪 open insurance platform

🇳🇱 behavioral insights platform

🇪🇪 smart indoor food growing systems

🇩🇪 white label mobile security solution

🇩🇪 bike-sharing service business

🇬🇧 online therapy program for people with ADHD

🇩🇪 mobile app that supports the crew on board ships

🇳🇴 esports business

-

🇪🇸 We screened 200 deals with Spanish startups raising $1 million or less in 2020 and profiled the most interesting 20 of them.

-

🇪🇺 Promising insurtech startups from the Nordics.

-

🇳🇴 Opera the browser company made visible their fintech ambitions in Europe with a digital wallet startup launched in Spain and a $100 million investment commitment.

The plan with details was laid out a year ago.

-

🇳🇴 Also in Norway, there’s a company that sells health and beauty products to more than 400k subscribers. Got acquired by Orkla for $366M.

-

🇬🇧 Startup backed by high profile London-based angel investors raises $13 million.

-

🇬🇧 Americans from GoPuff looking to acquire a British competitor and set up an European operating point for its 15-minute grocery delivery business.

Food delivery startups from Europe were open about following GoPuff’s model and have become popular with local early stage investors in the past 12 months or so.

Looks like the Americans are not as passive about Europe as they were 10-15 years ago - just like Thrasio which went bananas about their European clones a few months ago.

Observations

🇸🇪 A guy who’s into GDPR stuff analysed what Clubhouse does(n’t do), wilfully or not, in order to be EU compliant.

Some of his points makes sense and it is likely that Clubhouse didn’t have time or care to harmonise for the messy EU regulations. If you are a startup, do you optimise for fast user growth which in business we call PMF or for being EU compliant that would take time, resources, energy and even alter strategy? It is a no brainer that some eggs have to be broken in order to get the omelette done.

Other points tough are in uncharted territory due to the innovative nature of the value Clubhouse creates, which Europeans are not really used to and didn’t have time to regulate anyways.

However, the guy ends up his line of reasoning apocalyptically, saying that Clubhouse is a really bad idea, founders should be crucified in the public plaza and advises investors not to back this toxic venture (really), because it breaks the EU laws.

Meanwhile Clubhouse grows like crazy and looks like the next big thing, all the investors and their mothers would die to get into the captable and more than 8 million users don’t really seem to care about how a startup does growth hacking.

Apart from this kind of provincial attitude which is quite frequent in Europe, I’m a bit surprised that Rocket Internet of the startup factory’s fame hasn’t announced a Clubhouse clone yet. I can only guess they’re still waiting to see if it really gets to the $1bn valuation to make sure it’s worth risking their LP’s money.

Or, jokes aside, maybe Europeans simply don’t have what it takes to build this kind of stuff and they’re better off kibitzing, like the guy above. And regulating. 🤷

-

🇪🇺 You did notice a flurry of later stage deals in Europe in the past 12-18 months, didn’t you?

If I were to guess, Europe is in the 2012-2013 part of the cycle from the US. The big question is whether the today’s early stage class is strong enough to command later stage capital in a few years. (I am sure there’s an Euro graph about it somewhere)

-

🇪🇺 Ladies and gents, place your bets.

Person working for a traditional bank:

Fintechs will fail unless they rethink their business.

Traditional banks will look as distressed as traditional media by the end of the decade.

The VC guy is not wrong.

-

🇸🇪 The Local has 40k paying subscribers, 3X since 12 months ago.

Subscriptions are the biggest source of revenue, more than all forms of advertising combined.

They’re doing a great job being focused on a clear niche, with a sub less than 5 euro per month, a really affordable deal.

They have a clean product aligned with the type of content they sell, with a clear content blueprint which works very nicely for their target audience - i.e. expats and people looking to travel or change European residences.

This is what product market fit looks like.

-

🇬🇧 Otoh, a local media business can bring miserable VC returns.

✍️ Other notes

🇫🇷 France’s president Macron continues his grandiose PR campaign to be startup/investor simpatique for the 2022 electorate while his country startup fundamentals are a total mess.

-

🇫🇷 France launches new tools to allow users, regulators and authorities to review and track changes of online platforms’ terms of services (including Facebook, Google, Amazon, Twitter, Netflix and many more)

-

🇳🇴 Norwegian car subscription startup expands to Sweden, challenges Volvo’s M service.

-

🇩🇪 Volkswagen is getting into the e-bike sharing business.

Not as a manufacturer, but as a financier and lessor. Both are now also available for bicycles through the subsidiaries VW Financial Services and VW Bank.

-

🇩🇪 Also Volkswagen is considering a separate listing of its Porsche sports-car unit in a deal that would bring in a significant amount of cash.

Their CEO, known as a confrontational guy, also said publicly that he is not afraid of Apple’s upcoming car, which means either he is afraid or just ignorant.

-

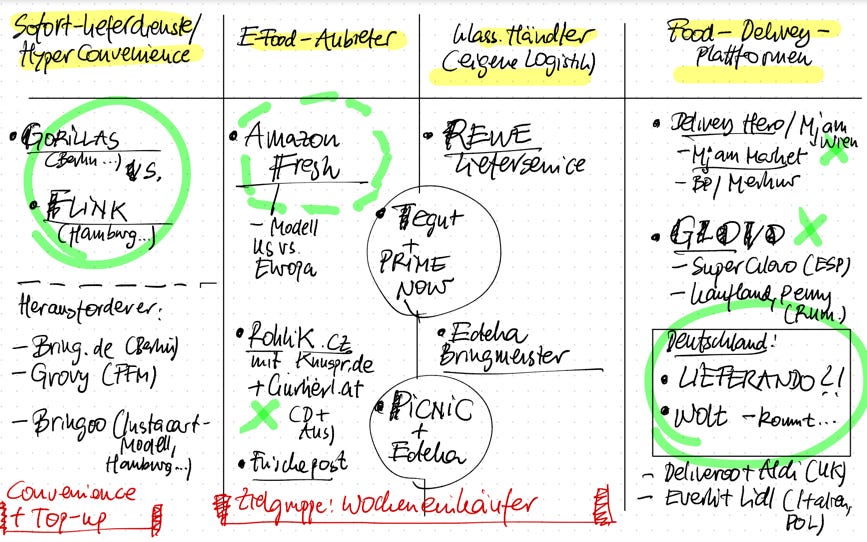

🇩🇪 The German food delivery situation.

-

🇬🇧 Fake reviews for products sold on Amazon's Marketplace are being sold online in bulk - £5 a pop.

-

🇳🇱 Why the Netherlands is one of the world’s most interesting and paradoxical countries.

-

🇪🇺 Goldman Sachs is stalking unicorns in Europe. Who doesn’t?

-

🇪🇺 Great observations about how the French, Italians & Spanish price each train, not the journey.

This means that if you take the train across European cities and change trains that would double your fare as opposed to going direct.

Speaking of railroads, here’s a great visualisation of the railroads of the world.

-

🇮🇹 The story of a line of Italian cities

👓 Good reads:

🇮🇱 Why did I leave Google or, why did I stay so long?

🇪🇺 The EU is facing the most serious crises in its history. Many are wondering if anyone's in charge.

🇸🇪 Swedish VCs talking about the local environment.

🇸🇪 A decomposition of what a climate-tech investment could be.

🇬🇧 Retail, rent and things that don't scale

🇪🇸 Good background story of FC Barcelona facing a big financial crisis.

Charts of the week

People are really buying houses in the US

Who immigrates where

Other stuff

Not really a secret that one of the people behind the official Australian attitude against Google and Facebook is Rupert Murdoch of News Corp fame.

It is true, the Australians are manoeuvred by Murdoch for doing a shakedown in plain sight and what they ask for (media to be paid to be linked for news) has no sense and they are being unreasonable.

But this issue is just a detail in the bigger tech picture, and can have tremendous unintended consequences. Should Google and Facebook not comply and find a compromise, they will get to a situation where they will not be able to have access to huge amounts of consumer data they track from media assets either directly or via the analytics.

Which is suboptimal, to say the least, for a business built on controlling the digital consumer behaviour - Google, for example, already pays a lot of money to owners of closed digital properties just to be able to access their data (think Strava, Uber, DoorDash etc).

And then, given all the brouhaha of the last weeks, you learn this: News Corp announces a multi-year, global partnership with Google to provide content from its news sites "in return for significant payments by Google".

Google kissing Rupert Murdoch’s ring is a sign that a compromise will be reached soon. Let’s see Zuck playing this now.

In other related wars, Zuck wants to inflict pain, speaking about Apple’s decision to shatter the data collection balance from the internet.

This is just like in high school, but for real money.

The best take on Facebook showing the middle finger to the Australian government.

Working for Bezos vs Zuck.

2020 was a record year for US VCs with $70bn new funds raised. Compare this to the SPAC asset class, which surpassed $185 billion last week.

79% of all EVs registered in the US last year were Teslas

Imagine being in the Intel meeting that led to this ad getting the green light.

Are you doing Clubhouse right if you don’t have the right setup?

The story of smoking in the United States.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.