Happy Sunday from Stockholm and welcome to another edition of Sunday CET!

Let’s get straight to the good stuff.

MENU

Observations, research and data

Interesting bets

Books and other interesting reads

Observations, research, data

🇪🇸 Freepik was acquired by EQT in a deal estimated at 250 million euro, roughly 8X revenues.

Multi brand business, operating a marketplace of vector graphics and stock photos, with Brazil the largest market and Spanish-speaking countries as core market. 300k recurring sub payers out of 20 mil registered users. A decent business, remarkably grown out of Malaga by their founders in roughly 10 years, and which exploded in 2018 when grew from 3 to 30 mil in revenues.

A few quick notes:

i) a good confirmation that Spain is a gem, beyond the Euro VC view that Southern Europe’s deal flow is not as interesting as in other parts of Europe.

ii) big payout for the founders which is great for them and for the Spanish entrepreneurial ecosystem. Super important to have such stories in Spain - more money back in the ecosystem, more experienced angels, more people to look up to etc.

iii) interesting loss for the VCs who were not able to get into this deal at early stages - the company was actually bootstrapped. It’s either a miss or there’s some background stories here.

The fact that EQT competed with other PE houses like KKR and did the deal by itself and not through its VC arm, also quite active in Europe, makes me think it was rather a miss.

It’s a bit odd as to why this was a PE deal rather than a venture one. Sure, it’s an exit and the path is as good as any but conventional thinking says that the trajectory for a tech company with the potential of an “European Google for images” to be either to a strategic acquisition or to an IPO if it flies.

Not flip it to PE, which usually has a different role than a VC in the investment ecosystem. And EQT is not exactly famous as a tech investor in Europe.

iv) “Freepik’s underlying market […] is backed by favorable secular megatrends” - the press release is a fun read. (secular megatrend has exactly 125 hits on Google)

A deal a bit unusual for EQT’s portfolio - here’s what else is there, if you’re curious like me:

high-speed ISP provider - Spain

automation solutions for complex manufacturing - Germany

IT services provider - Sweden

boots manufacturer - Netherlands

pharma manufacturer - Denmark

IT networks security provider - Switzerland

turnkey security solutions for telecoms and ISPs

music-tech company - Sweden (this was actually bought off from early stage VCs after the company raised a mere $7M)

🇪🇺 Antler wants to raise $600 million by the end of next year to use it for followon investments. Reminder - Antler, like EF, invests in companies founded by individuals they train to become entrepreneurs. Just like business schools.

🇸🇪 In Sweden, the projected number of companies that go bankrupt per day in May is 22, compared to the average of 20 bankruptcies per day in 2019.

🇫🇷 In France online platforms will have to remove within 24 hours illicit content that has been flagged. Illicit means anything that would be considered as an offense or a crime in the offline world.

🇸🇪 Horse tech startups made in Sweden - Sweden has the highest number of horses per capita. Maybe I should follow up on this one.

🇩🇪 Christoph Janz’s take about the state of affairs on the capital fundraising front.

🇸🇪 How FoodTech goes beyond convenience and is becoming more about climate, people and health

🇬🇧 How do you do virtual hiring and people onboarding remotely. link

🇪🇺 EU wants to introduce a digital tax for the big tech firms from US. Because of coronavirus.

🇷🇺 This is what a good investment deal looks like. Made by an outsider at that time btw.

In 2009, DST’s Yuri Milner invested in Facebook $200M in primary at $10B, then aggressively went down the cap table and scooped up all of the secondary he could find, ultimately investing another ~$400M at $6B.

6 months later, many firms were buying secondary shares on the open market at $15-20B.

🇩🇪 B2B marketplaces are the next generation of marketplaces to be built. link

🇮🇹 American VCs in Europe: Benchmark led a Series A of $6 million in Commerce Layer, which built a “headless” e-commerce platform.

Quick reminder: Benchmark once had a full European arm based in Israel, which separated in 2007 and now goes by the name Balderton, based in the UK.

🇸🇪 Most streamed track of the day on Spotify by country.

🇨🇭 Companies must pay share of rent for employees working from home.

🇫🇮 Finland is officially in recession.

🇬🇧 Majoring in sciences instead of the humanities triples earnings.

Economics degrees have returns around 20% greater than the average degree.

According to British researchers.

More:

Trailhead flips the usual application process for startups raising capital:

We provide value to you first in exchange for every bit of information we ask for. You'll receive a series of emails over the next few weeks with exercises designed to be helpful and thought-provoking.

How do you successfully bootstrap your company.

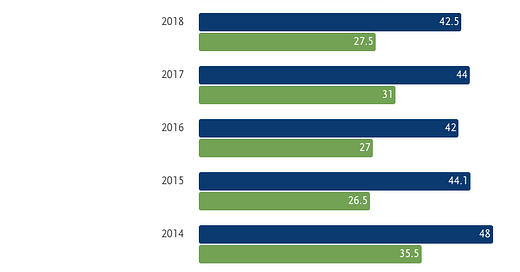

The average CMO keeps his job for 41 months (median at 30 months).

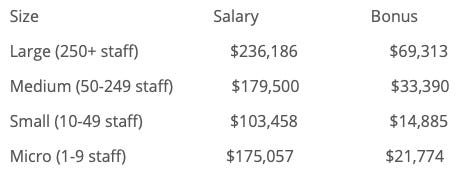

And here’s CMOs compensation:

A good thread about the average number of Instagram accounts w/ 50k+ followers. Tl:dr: about 25 million people have more than 50k followers!

Facebook launches CatchUp, an audio-only calling app that shows who’s ready to chat now.

Now that VCs validated the market by investing in Clubhouse, how many engineers should throw FB to be in that market? Name is good too :-)

Here’s the first M&A deal between two Substack accounts: Double Sided was acquired by Forward Thinking Media. No further details, it’s probably the emails database.

Layoffs.fyi advanced quite a bit since last time I linked to it, a month ago. Really good

Since we’re at data tools, check TV Chart also, if that’s your cup of tea

Brave is building a private and unlimited video conferencing service into the browser, based on open source. US only for the moment.

In just two weeks, Google got 12,000 applications from newsrooms in 140 countries looking for financial help. It rejected 50 percent of them for not meeting the criteria (had to be news, and more than 2 employees). Grants are from $5,000 to $30,000.

Interesting bets

🇩🇰 SAAS solution to automate all your privacy requests and management

🇩🇰 SAAS for planning in shipping as it maximizes utilization and capacity for terminals and carriers

🇩🇪 B2B conversational marketing platform (chatbots for corporate clients)

🇩🇪 healthtech recruiting platform

🇩🇪 developer of a sentiment analysis algorithm for cryptoassets

🇩🇪 virtual reality-based psychotherapy treatment for anxiety disorders

🇮🇹 new wave of tech for the deaf and hard of hearing

🇫🇷 some French guys want to build perfect quantum computer. They raised.

🇳🇱 a digital matchmaking dance party: find the person dancing to your song

🇸🇰 e-commerce platform for fitness, nutritional supplements, functional foods and equipment (good niche)

🇸🇪 producer of fungi-based, next-generation vegan protein

🇬🇧 ad agency that does 3D and AR campaigns on demand

More money in the market:

henQ announced its 4th fund with a first close of €70M, with focus on pre-seed up to Series A rounds in B2B software companies across Europe.

Books and other interesting reads

📚 Books

If you only wanted to read one thing that would affect the way you live or do business, what would that be?

🗞️ Interesting reads

The most common question prospective startup founders ask is how to get ideas for startups.

Nobody talks about startup failure. Here’s a very good story about that.

How Apple Decides Which Products Are ‘Vintage’ and ‘Obsolete’

Happy Sunday!

Thanks for reading 🙌

This email is a labour of love - please reply with comments and feedback, or helpful suggestions for future editions.

Created every Sunday by @drnovac. Please share it with your networks and encourage your colleagues to sign up here - thanks!