Hey there!

Big welcome to Sunday CET for the new subscribers!

Short reminder - Sunday CET is produced by Dragos Novac of Nordic 9 and covers weekly notes and observations from the European startup ecosystem.

Here’s what we cover this week:

Americans disrupting startup ecosystems in Europe

Chess is a huge market market overlooked by investors

The most read piece in the VC world this week

Let’s get to it.

✍️ Observations

Startup ecosystems in Europe

LocalGlobe

Here’s a good overview made by the fine people from LocalGlobe about the startup ecosystem they have built in a few years. Nothing short of remarkable!

If you didn’t know yet, LocalGlobe was started in 2002 by father and son Robin and Saul Klein, as an investment vehicle for the family. At that time, besides actively investing, Robin was a partner at Atlas Venture (2007-2010) and at Index Ventures (2010-2015) while Saul was working for Index also as a partner (2006-2015) and in parallel launched and further built Seedcamp from 2006 on.

They decided to dedicate full time to LocalGlobe in early 2015 and raised LocalGlobe 7, a fund of £45 million announced on October 2015.

Apart from being good at their job, the Kleins thing is their network - even prior to LocalGlobe, they were incredibly connected to all sorts of grassroot layers from the London society that, one way or another, led to finding super interesting people they funded and consequently became huge startup value creators (and returners too).

After launching LocalGlobe, they also had this thing (European obsession really) of recreating a Silicon Valley in Europe - they started building it bit by bit in London (got a good real estate deal for it too) and it became one of the most interesting startup ecosystems in Europe.

Who else is doing this?

In London, there’s also Brent Hobberman, a former internet entrepreneur from back in the 90s w/ lastminute.com, and who’s built a few ecosystem pieces since then - started with PROfounders about 9-10 years ago, and then Founders Forum, Founders Keepers, the Founders Factory, and culminating with a seed fund called firstminute capital.

Fun fact: both Hobberman and Robin Klein were born in South Africa.

Other than those two, in Europe you will find smaller ecosystems with local reach - Rocket Internet in Germany, Xavier Niel’s Station F in Paris or Carlos Blanco’s work in Barcelona are quick examples that come to mind.

In Europe it’s also notable the ground work EF and Antler are doing by reconverting corporate people into startup founders.

The model

All of those have in common the focus on investing in fast growing startups producing sizeable returns, as well as creating an interesting ecosystem around their work subordinated to supporting the startups as a mean to sell the equity when the time is right.

However.

What those businesses have also in common is not having a digital consumer side of their business. All their work, one way or another, is mostly offline centred and geo-location based. They invest in the future out of an old school model.

Next level

So what is the next level for startup ecosystems, if any? As always, the answer comes from the Americans.

Let’s put aside what YC is doing, which doesn't even bother to explicitly focus on Europe while all the Euro best are applying to join their program. They are that good.

Look at the work the super hungry OnDeck is doing, pushing aggressively for growth, have hired people in Europe and are fuelled by $20 million from Founders Fund.

OnDeck is not the first thing that comes to mind when thinking about startups, is it?

They are building a startup ecosystem but from a different direction with a light and straightforward model - digital first, geo-agnostic, investing heavily in tech infrastructure, understanding it and committed to make a dent.

You may argue as an investor that OnDeck ain’t the same cup of tea as they have a D2C model, charging their users, radically different than how investors are operating.

Fair - their output is qualified employees for the new economy as they compete with schools, even call themselves Stanford for startup people. Investors have a different model, they buy cheap assets and sell them at 5-10X after 5-10 years.

But… Google was also once a software startup doing a search engine and now it is the biggest media company in the world.

If you’re building the same kind of ecosystem but get there differently, ultimately you will collude. Not right now, of course, but imagine the trajectory for a bit. And, you know - if it quacks like a duck, and looks like one, then it is a duck.

Do the change or be the change

On the other hand, let’s be honest - all those European startup ecosystems have enough business and a foreseeable secure future. Kinda.

Why would they even consider about reinventing the future?

They’re comfortable, sitting on Europe’s highest record of funding - when you have enough food on your plate, it is hard to get at the edges and out-innovate yourself as if you were poor and hungry. Sure, iterations are being made, little by little i.e.

Hey, we are streaming online pitching sessions now! We’re on Clubhouse too, here’s a thread with what we learnt from it!

But the bigger picture is - the investment business is already going through dramatic shifts, a number of players already nervous about the status quo being disrupted, with crossovers already altering the rules at the top of the market, going as far as to seed levels, where it is so crowded and competitive that most local asset managers will find themselves with second tier portfolios at best or losing the money of their LPs at worst.

And so if you’re an investor, you either do the change or be the object of the change. And building a solid ecosystem around your work, with different revenue streams, seems like a reasonable way out, doesn’t it?

PS. Wrote more about this very subject applied to EF 11 months ago. They’ve just made their site prettier since then.

How big is the chess market?

Kasparov launched an online subscription platform -- Kasparovchess -- where users can share tips and tricks and learn from other legendary chess players.

Really like the idea - chess is the kind of huge market neglected because investors don’t get it and is out of their comfort zone.

There’s more than 600 million chess players in the world, and the money is spent almost exclusively at the top of the market i.e. pros, which are probably less than 1% of the whole market.

And so the opportunity is to build an economic model that creates value for the rest of 99%. Kasparov is building just that, and from the pre-launch look of it, it seems he is working with people who understand 1. tech and 2. the kind of business they need to build.

The question you have to find an answer for is really simple: will he be able to get 1 million people pay a $100 per year? Hint: Kasparov has 600k+ followers on Twitter.

Fwiw, the US-based Luxor Cap has made a sizeable investment in a similar business from Europe. They either get it or they’re chess players too. :-)

🔥 Interesting deals

Britain

🇬🇧 Tripledot, a mobile gaming studio w/ a $100M run-rate, scores $68 million from Eldridge, Access Industries, and Lightspeed Venture. (Paul Murphy of Lightspeed must have been involved in this one 😊)

🇬🇧 Bloom, which operates a B2B marketplace, raised $20M.

🇬🇧 Oxbotica, which does SAAS for autonomous vehicles, added strategic investment from Ocado, the British retailer.

🇬🇧 Clim8, which builds an impact investment platform, raised $8M from high profile angels.

🇬🇧 Pai, a D2C ecommerce business selling organic skincare brands, raised from the Famille C Venture from France.

🇬🇧 Fanvue, a direct-to-fan content monetisation solution launched by a Youtuber, raised $1 million.

Nordics

🇳🇴 Norway's largest bank DNB, made a $1.3 billion offer to acquire Sbanken, the first pure-play digital bank in Norway.

🇸🇪 NA-KD, which operates a fashion e-commerce biz, raised $40 million from a family office from Sweden.

🇩🇰 Area9 Lyceum, which builds and sells adaptive learning platforms, raised $22.5 million from Lego Ventures.

🇫🇮 Carbo Coal, which turns local waste biomass into high carbon content charcoal, raised $6.2M in a round led by an American investor.

🇩🇰 Monta, which builds a marketplace for EV chargers rental, raised $4.7 million.

🇩🇰 Forecast added funding from Balderton and existing investors.

🇱🇻 Exponential Technologies was pre-seeded.

DACH

🇨🇭 CeQur, producer of devices for a simple insulin-delivery process, raised $115M.

🇩🇪 Studitemps, employer for 10,000 students every month @ $100M+ turnover, raised €9.2M.

🇦🇹 inoqo, building a consumer mobile app tying grocery shoppings to the climate footprint, raised $2.4M.

🇩🇪 tech 11, which developed a cloud-based insurance software suite, raised from HTGF.

Other hubs

🇫🇷 Sunday, which does restaurant checkout SAAS for 1000 customers, raised $24M in seed from American investors.

🇵🇹 Coverflex, developer of SAAS for employees benefits management, raised $6M.

🇫🇷 Zefir, which builds a real estate business by pre-purchasing properties, raised $4.8M from Stride, Heartcore et al.

🇫🇷 Onepilot, developer of SAAS for customer ticketing, raised $3 million from GFC, Kima and angels.

🇮🇪 Nory, which does a SAAS for restaurant management, raised $1.9M from Cavalry and Playfair

🇪🇸 Shapelets, SAAS developer of big data time series analysis, raised $1.2M.

🚀 Quickies

🇸🇪 Spotify finally launched their wearable for cars - let’s just hope they will not end up like Apple’s smart speaker products, which were a flop.

🇬🇧 Zego signed up a contract with Dija as it will insure their fleet. New gen startups working with each other means compounded growth for the economy.

🇩🇪 Berlin renting exploded because it was poorly regulated by the local government. Some tenants will have to pay retroactively thousands of euros.

🇩🇰 The electricity map got much better since last time I checked it out (made by those guys)

🇩🇪 A look at the personal finance management space.

🇬🇧 Brexit & the City – the impact so far on the City and the emerging post-Brexit landscape of financial centres across the EU.

🇫🇷 France is offering car owners the chance to trade aging vehicles for €2500 toward the purchase of an electric bike.

🇫🇷 Also in France, Air France ordered to curb competition with rail in France.

🇩🇰 The largest Danish grocery chain, Nemlig, is under investigation due to miserable working conditions of the warehouse employees, which experts have called illegal and harmful to health. Not looking good.

🇪🇺 A good city guide to help US startups select their Europe HQ - London, Dublin, Amsterdam, Paris or Berlin?

🇪🇺 A great podcast with an American perspective about Europe by Tyler Cowen, one of the smartest people whose work you can follow on the web.

Charts and data

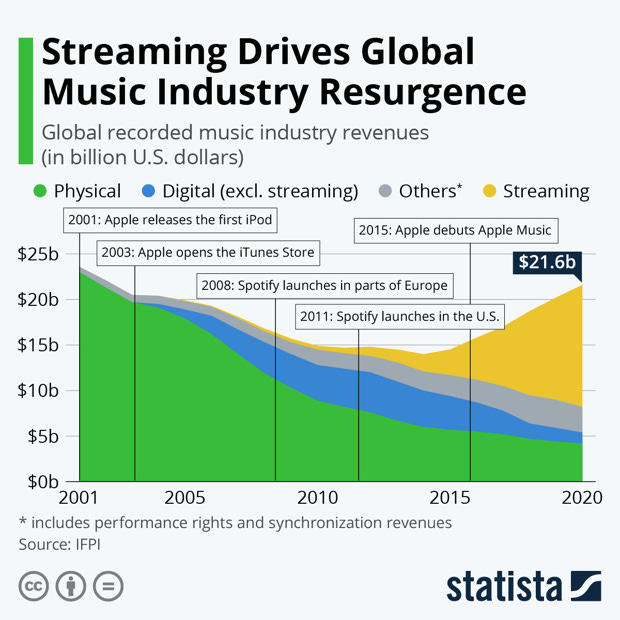

Apple and Spotify’s timing

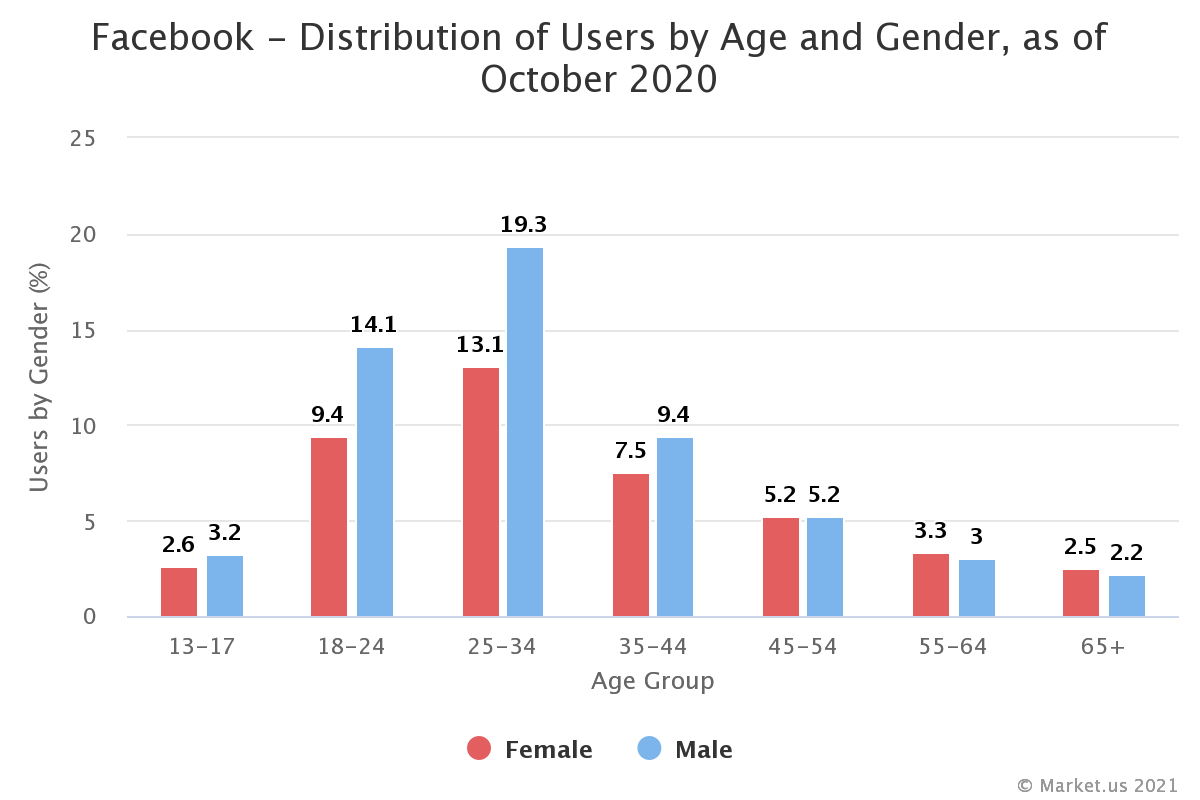

Who are the people who are still on Facebook

Other stuff

Probably the most read piece in the VC world this week about how Tiger Global (and other crossover funds) is disrupting the VC business as we speak and which reminded me about a famous movie quote:

Losers always whine about their best. Winners go home and fuck the prom queen.

How people get rich now.

CSR became ESG, which became impact investment, which became climate change focus: Apple launches $200 million fund for climate change.

Google Earth did a 3D time-lapse feature that lets you observe how Earth has changed from 1984 to 2020, with devastating effects of climate change.

Jeff Bezos letter to his shareholders at Amazon. As always, super insightful - dude is one of the greatest business men of all times.

Traditional IPO vs SPAC

NB: MorningBrew got serious about original content now that they hired a super editor in chief at the beginning of the year.What it means to have strategic investors on your captable.

Lil Nas X chooses PornHub to stream his next single. Smart.

Ben & Jerry's x Nike Collab looks awesome.

Boomer wisdom alert: 7 pieces of wisdom most people don’t learn until their 40s

Tomorrow morning on Monday CET

Review of early stage European startups backed by American VCs.

Startup profiles: 2x (!) AirBNB for EV chargers (both from the Nordics), digital-only fashion producer, B2B fintech coaching, B2B marketplace for used EV batteries.

Active investors: 2 Brits, 2 Americans, 2 Spanish

8 new funds announced: 2x UK, NL, Russia, Malta, Estonia, Finland, Sweden

Not a subscriber yet? You can become one from HERE.

Monday CET is provided complimentary by Nordic 9 together with access to Euro deal flow, active investors databases and intel reports.

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.