The market for investment research, budgeting for 20 people by city, conflicting deal data and thoughts about menopause.

#19

This is the 19th edition of Sunday CET, a weekly curation of what we found interesting in the European investment tech landscape.

MENU

1. More money in the market

2. How others are doing it

3. Interesting bets

4. Data, research, observations

5. What others think

1. More money in the market

🇬🇧 Oxx, a B2B software investor, has raised $133 million to back Europe’s most promising SaaS companies from series A and beyond.

🇫🇷 HEC launches its investment fund HEC Ventures together with Idinvest.

🇬🇧 Praetura Ventures, a Manchester, UK-based investor that backs early-stage businesses in high-value sectors, closed its second EIS fund, at £7 million.

2. How others are doing it

🇳🇱 Dealroom raised €2.75 million at a 10 mil. valuation.

Dealroom is the underdog trying to grab a piece of the market and build a comparable business with Crunchbase and Pitchbook, the standard tools for most of the venture investors.

For context, Crunchbase raised $30M series C last year and almost $60M in total since being spun off from AOL and Pitchbook was acquired for $225M by Morningstar three years ago.

The market for this kind of business is quite crowded and fragmented, with a bunch others having raised VC, including Owler (almost $30M) or Tracxn (about $15M). CB Insights raised only $10M in 2015, after having bootstrapped the company for about 5 years.

Add in the mix other vertical and horizontal service providers trying to grab market share with similar products - accounting cos such as KPMG or PWC or big guns such as Dow Jones or Bloomberg.

It is a delicate business, as data needs to be accurate, not easy particularly when you have a bottom-up approach (i.e. user-generated or scrapped data). I am aware of a few product methodologies, combining tech and manual curation which can be done in multiple ways. It is a thorough and skill-based process, if done right. On top of it, the tech stack and UX are equally important for crafting a good overall product.

I find both CB Insights and Dealroom to be more decent products, with better fundamentals, as opposed to, for example, Pitchbook and Crunchbase, which casually scrap other databases via their India-based offices. A personal note for Crunchbase, whose front end (website and mobile app) is also quite bad.

However, business-wise and in the great scheme of things, these details don’t really matter as long as you have an average product. The GTM and sales approach are much more important, and can make or break a company.

Otoh, Dealroom is the only one with a better European value proposition because, well, it is in Europe and because all others started from US and focused on US. At the end of last year, Pitchbook announced that it opened an UK office though, obviously hungry for more biz - their sales ppl are quite aggressive afaik.

The industry is very competitive and a tad boring, not really touched by what you can do with data and tech these days. That is actually the upside of it.

All companies have the same model - on-demand data and API access and ocasional research to build up rep and sales support. It is rather a zero sum game with lower switching costs.

Obviously they compete the same way, on price, which will likely lead to a bit of market clean up and consolidation. A special reminder for newbies about Mattermark which pissed away about $20M and failed spectacularly.

As mentioned last week though, Europe has a lil’ extra money which creates demand for better data and Dealroom has a little local edge compared to the Americans. So far.

Does this edge alone justify the investment bet? What is the end game and what makes this market interesting? Is Europe alone a good enough place for creating 3-5X value increase for a 10 million asset today in the following 3-5 years? How much is growth capturing and how much is share from the others?

5-10k potential clients (let’s just say) seem a reasonable number when doing Excel modeling - but… the next period will presumably see a market correction as it kept going up for 10-12 years now. Competition is fierce, sales cycles are long and investors are very difficult customers.

Will Dealroom go after business overseas? The sales process is way easier with Americans tbh, and Dealroom certainly started adding non-European deals in their dbs. It’d be a bold tactic but probably they will not, focus is key and not sure 3 mil is enough muscle for building a solid b2b sales force on both sides of the pond while strengthening the product.

As always, the better strategy makes the better players and there are a few cards to be played in this game. I am certainly curious about how the following 2-3 years will unfold.

Disclosure: I built a similar biz which covers the Nordics and, lately, Spain.

🇪🇺 Why did the chicken cross the road? The European startups edition:

🇪🇸 The Travelperk way for providing customer support has always been to follow the #1 company value: Provide a 7-star experience to customers & own team.

🇩🇪 N26 (German neobank) has to pull out of the UK market due to Brexit, and are closing all 200k UK accounts in 2 months. They claim 250k accounts in the US already and 5M globally.

🇪🇺 Budgeting for your team of 20-30 people

Bonus

successful invite-only product launches

Twilio’s board deck from 10 years ago

So what makes users stay and integrate a new experience into their lives in a more permanent way? Likely the same elements of what has created lasting success in the very best social networks to date but with new twists.

1. “The user as the producer”

2. Identity Effects

3. Interesting bets

🇫🇷 France

developer of an online meeting system | €5 million | Sofimac Innovation, Brighteye Ventures, M Capital Partners

neobank for SME traders between Europe and Asia | €4 million | Ally Capital, SwiftPass, Geoswift, Huashan Capital, Unity Assets

startup doing targeting advertising without cookies | €2 million | Normandie Participations, West Web Valley, Apicap, Crédit Agricole Innove

manufacturer of connected equipment for training horses | €1.5 million | Peiker Consumer Electronics Evolution

🇮🇹 Italy

developer of a Mobility-as-a-Service (MaaS) platform | €5.6 million | P101 SGR, Invitalia Ventures, LVenture Group

🇩🇪 Germany

developer of a central communication platform, on which teachers, students and parents can exchange information in a GDPR-compliant manner | €2 million | HTGF, angel investors

manufacturer of a drinking bottle system that can only give water taste through scent | €2 million | Oyster Bay Venture Capital

elderly care marketplace | Creandum, Ananda Ventures, Atlantic Labs, Axel Springer, Plug and Play, Spark Capital.

car subscription startup | Vienna Insurance Group, Vector Venture

🇳🇱 Netherlands

SAAS provider of a startup data and research platform | €2.75 million | Knight Venture Capital, Shoe Investments, angels

a sustainable same-day delivery platform | ASIF Ventures

🇷🇴 Romania

Cashback app for online shoppers | €1.2 million | GapMinder Venture Partners, ROCA X

🇬🇧 UK

virtual reality therapy developer | $12.5 million | Optum Ventures, Luminous Ventures.

esports betting startup | $2.5 million | Makers Fund, Venrex Investment Management

human risk intelligence platform preventing data breaches caused by employees | £1.2 million | Forward Partners

4. Research, data, observations

🇪🇺 Both Crunchbase and Pitchbook made available their European Venture Reports:

Please note that one of the two has 700+ fewer transactions tracked and an extra $1bn in value. One goes upwards yoy, another goes downwards since 2017.

Both trend downwards in 2019 though, indicating that the number of transactions went down in Europe last year.

It's fun because you’d assume the one with higher numbers is better, right? Not really - there may be lots of explanations behind the differences, including methodology or the data gathering process. Rather both datasets may be, uhm, incomplete - last year Pitchbook’s numbers were way lower than Dealroom’s, for example.

Investment tracking is a complicated process, this ain’t easy business. Scrapping other people’s work, which those guys do, may be a scalable model but it comes at a high quality cost.

To add a bit of salt and pepper on it - over at N9 we tracked 434 deals in Sweden (vs CB’s 278), 337 in Spain (270 CB), 144 in Finland (111 CB) etc - see the CB numbers below.

🇪🇺 Dealroom finalized its research aimed to find out who are Europe’s most prominent Series A investors. No surprises.

🇫🇷 Idinvest Partners claims to be “the most active VC in Europe”. They’re #6 in Dealroom’s prominent thingie though. Reconcile egos at will.

🇫🇷 Startups from France raised €773 million from 65 transactions in January.

🇷🇴 The Evolution of the Romanian Tech Startups ecosystem

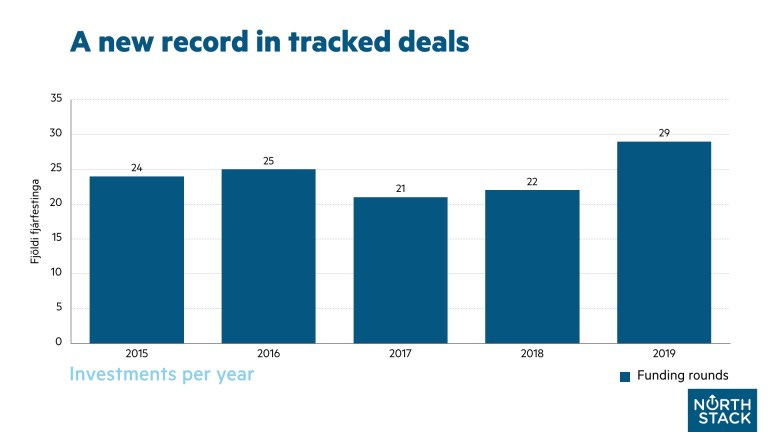

🇮🇸 Iceland - the 2019 (venture investment) funding & exit report

🇪🇺 Pitchbook made a nice picture with unicorns from Europe.

🇪🇸 The Mobile World Congress this year has been canceled after a bunch of companies pulled out fearing the coronavirus. The loss for the entire ecosystem is huge - €300 million.

Speaking of coronavirus:

🇪🇸 MWC was canceled but locals are still trying to put up something. Should definitely be cheaper.

🇪🇸 And speaking of Barcelona, a city that lives off its tourists, it just f-ed up their scooters market. Politics.

🇪🇺 Facebook was forced to postpone the European launch of Facebook Dating.

🇪🇺 A group of companies, including TripAdvisor, Expedia and eDream, wrote to EU competition commissioner Margrethe Vestager to complain that Google is favoring its own vacation rentals product in search listings.

🇬🇧 A bloke over in UK uncovered an Airbnb scam running riot on the streets of London.

🇮🇹 Domino's Pizza to open 850 outlets in Italy.

🇪🇺 Patent wars

Bonus:

32% of workers run out of cash before payday, even those earning over $100,000 (in US)

Apple Pay accounts for about 5% of global card transactions and is on pace to handle 1-in-10 such payments by 2025 (that was fast)

WhatsApp hits 2 billion users, up from 1.5 billion 2 years ago

Children terrified by active shooter drills (in US)

State of Remote Work 2020. Some top stats from the report:

* 97% would recommend remote work to others.

* 80% primarily work from home.

* 32% say having a flexible schedule as the biggest benefit.

* 20% say loneliness and collaboration/communication as the biggest struggle.

5. What others think

🇸🇪 The Menopause Market (Creandum)

🇩🇰 The Role of the Board (byFounders)

Bonus

Debt is Coming (one of the better reads I’ve had this year!)

Kevin Kelly suggested you only need 1,000 true fans to make a living online. Andreessen Horowitz says you can do it with 100

Happy Sunday!

Thanks for reading 🙌

Reply with submissions, comments, corrections, and ideas.

Created every Sunday by @drnovac. Please share it with people who may find it interesting - thanks!