Hi there,

Warm welcome to the new subscribers!

Today we’ll talk Euro M&A, VC innovation and copying other people’s ideas.

Enjoy.

✍️ Observations

The Euro M&A market is alive and kicking

Glovo acquires Delivery Hero’s operations in Bosnia and Herzegovina, Bulgaria, Croatia, Montenegro, Romania, and Serbia.

That’s clearly the result of a strategic decision to focus on strengths for both parties.

Glovo is already in a significant position in the said markets, and now they will be a dominant player, making tight margin economics work.

Delivery Hero went all in on the grocery delivery opportunity as they already operate 600 dark stores. And it is wary of the VC-backed competition.

The Australian BNPL Zip acquired Twisto from Poland/Czech Republic, after leading series A back in January. That shows they’re super serious about giving Klarna a run for their money in Europe.

Twisto has an op of 1.3 million customers, 14,000 merchants and $230M processed in the first 4 months of 2021 in only two countries - Czech Republic and Poland.

Meanwhile, Klarna’s value is eyeing a $9 billion jump in two months - from 31 to 40 - as Softbank is said to lead another capital raise. And it is still under-valued!

Tink acquires leading German open banking technology provider FinTecSystems.

Tink is part of Nordic fintech unicorn wannabes list - last year it raised $120 million and is backed by strategics such as Paypal or ABN. This deal gives them a strong position in DACH, an important step in getting more European business.

-

Those are just some random recent M&A examples - what all those guys have in common is that they’re part of the new class of entrepreneurs, young blood not afraid to do cross border deals and take risks when the strategy book dictates.

This effervescence and strategic moves are unusual for the European M&A private market, and it is a great sign of evolution. You can go out and play when you have resources - the market is full of money to be put to work.

Innovation VC

Here’s a random job ad listing from a high profile European investment house:

Fullstack Engineer

Software Engineer

Data Engineer

Team Lead - Investor Products and Digital Channels

It’s 2021 and investors finally discovered software!

And this makes you wonder - what are those guys building? Is it something *innovative*, maybe?

Btw, when is the last time you heard about something innovative in the investment business in Europe? Here’s some random examples from the top of my head:

We aggregate jobs on our website for our portfolio cos.

We have a Medium account and publish *insightful thoughts*

We send the said thoughts via newsletters and social media

We scrap Crunchbase and Linkedin to gather signals (usually called “we use a tech-based approach on our investment process”)

Affinity (a CRM widely used by the industry) is a game changer

We’re on Clubhouse!

Am I missing any? They’re all doing the same innovative things. Investors have good ideas about other people’s business but not about their own business. :D

Jokes aside, increased competition forces this industry to start inventing differentiators.

Now, using software to achieve operational efficiencies is hardly an innovation, it’s a mere sign of a traditional industry impacted by technology.

It’s surviving. It is a good thing and it was bound to happen.

But, if you come to think a few steps ahead, like in any industry, you win with a smarter business model or with unfair product-related advantage.

The business model innovation is relatively easy to do and can show results quickly. Examples include crossovers i.e. money deployed at different stages and geographies without taking a board seat. Or selling the money via different products than standard VC - can be revenue-based, can be investing in smaller funds (funds of funds), can be investing via angel programs etc.

Product-based innovation involves investing in different means of production, namely proprietary applications used to improve the decision process or support the asset portfolio.

Will this money spending justify the ROI in the future? Is the consequent value extraction reflected on a model solely based on risky returns on a 5-10 years timespan? Are those costs or expenses?

Doing tech is not cheap, and a lean income statement of a dozen consultants shop can easily by burdened by super high operational expenses, because hiring software developers does not come cheap. Keeping them on the payroll is even more challenging because the VC industry is boring and doesn't really present challenges for talented developers. Not paying well either.

And all of a sudden the balance sheet will have some items other than the core of your investment business. Will those asset-incurred costs justify the same existing business model or will they require a different one?

Now, imagine combining smarter business model with unfair tech-based products. They used to call this reinforcing competitive advantages back in the 80s. :-)

Your product is great, I just copied it.

Got a bit of feedback calling me hater about all those Thrasio clones popping up in Europe.

Listen, I have no problems with people trying to make an honest buck. On the contrary - building startups is one of the most difficult life choice there is, I have been doing it for about 20 years myself, after all. It seems easy from the outside, but unless you have done it, you have no idea what it takes and how hard it is.

And I have uttermost respect for people giving it a shot. Especially for newbies, nobody teaches you how do it, and finding people to believe in you is super hard.

Because being an entrepreneur means seeing something that most others don’t.

Which brings me to the point - Europe seems to have gotten the rep of a place where building startups means copying American startups.

It’s not seeing what others don’t, it’s following what others envisioned already. It’s not inventing stuff, it’s imitating stuff. It’s not about taking risks, it’s about playing it safe. It’s not about making impact, it’s about getting rich.

And no, it’s not only the Germans that are doing it, even though, in fairness, Rocket Internet is a true pioneering school. It’s happening all over in Europe.

It’s gotten to the point where investors specifically mention they don’t invest in Euro clones from the US.

I truly think Europe can do much better than that.

Copying other businesses is undoubtedly a way to compete, has been happening forever, and can be very successful - just look at Mark Zuckerberg, that’s his business model, he has zero business vision and yet he is one of the most powerful tech entrepreneurs out there.

Being that guy that copies other people’s work is a personal intellectual choice and, all labelling aside, this kind of contribution has only one way of being validated: by the customers wallet.

💡 Did you get the intel?

Last week, Nordic 9 customers received intel about a Finnish startup in stealth that just raised $5 million from high profile angels, a startup building a Superhuman (the mail client) out of Europe, Sequoia’s new London hire and about a German serial entrepreneur who’s made 20 early stage SAAS investments recently.

Other recent reports includes profiling the new wave of European VCs and a comprehensive list of the pre-seed and seed investors backing European startups.

Nordic 9 is an independent project supported completely by founders and investors like you. Subscribe for the full experience now and you can help make it even more useful and relevant.

🔥 Interesting deals

Nordics

🇸🇪 Yabie, which calls itself Klarna on steroids, raised $26.2 million.

🇫🇮 Fiksuruoka, ecommerce grocery delivery operation, raised $23.2 million.

🇳🇴 Bookis, which operates an ecommerce marketplace for books, raised $7 million from American investors.

🇩🇰 Chromologics, developer of natural colorants for the food market, raised $7.3 million.

🇸🇪 Meme.com, an NFT company (Marble Cards) spinoff building a crypto-economic system based on memes, raised $5 million.

🇩🇰 Reshape Biotech, a robotics startup which was part of YC in winter, raised $1 million.

Germany

🇩🇪 Cosuno, operator of a B2B marketplace for the construction industry, raised $15 million.

🇩🇪 Origin.Bio, a synthetic biology company, raised $15 million.

🇩🇪 re:cap, which sells financial loans products to startups against revenue, raised $1.5 million.

🇩🇪 Makersite, which does SAAS for manufacturers tracking a product’s emission footprint throughout the entire supply chain, also raised.

France

🇫🇷 Zaion, SAAS developer of a voice-based customer relationship solution, raised $11 million.

🇫🇷 TradeIn, developer of collaborative SAAS for customer risk management in insurance, raised $2.4 million.

🇫🇷 Café, developer of a mobile app used for team collaborations, raised $1 million.

🇫🇷 Purchasely, a developer of mobile in-app purchase SAAS, raised a seed round.

UK

🇬🇧 Traydstream, developer of SAAS replacing the manual paperwork of trade finance, raised $8 million.

🇬🇧 Algbra, building a mobile banking business for 500 million Muslims, raised $5.3 million.

🇬🇧 Boundary, developer of a DIY smart home security system, raised $5.2 million.

🇬🇧 Kitt, a B2B real estate marketplace operator, raised $5 million.

Other hubs

🇷🇴 SeedBlink, operator of an equity crowdfunding platform, raised $3.6 million.

🇳🇱 Fraudio, Portuguêse team in NL doing SAAS for payment fraud detection system, raised $3.3 million.

🇨🇭 EarlySight, producer of a medical device for eye diseases diagnostics, raised $2.6 million.

🇪🇸 Idoven, SAAS developer for preventing cardiac diseases, raised $2.5 million.

💡 Charts and data

Top ecommerce retailers

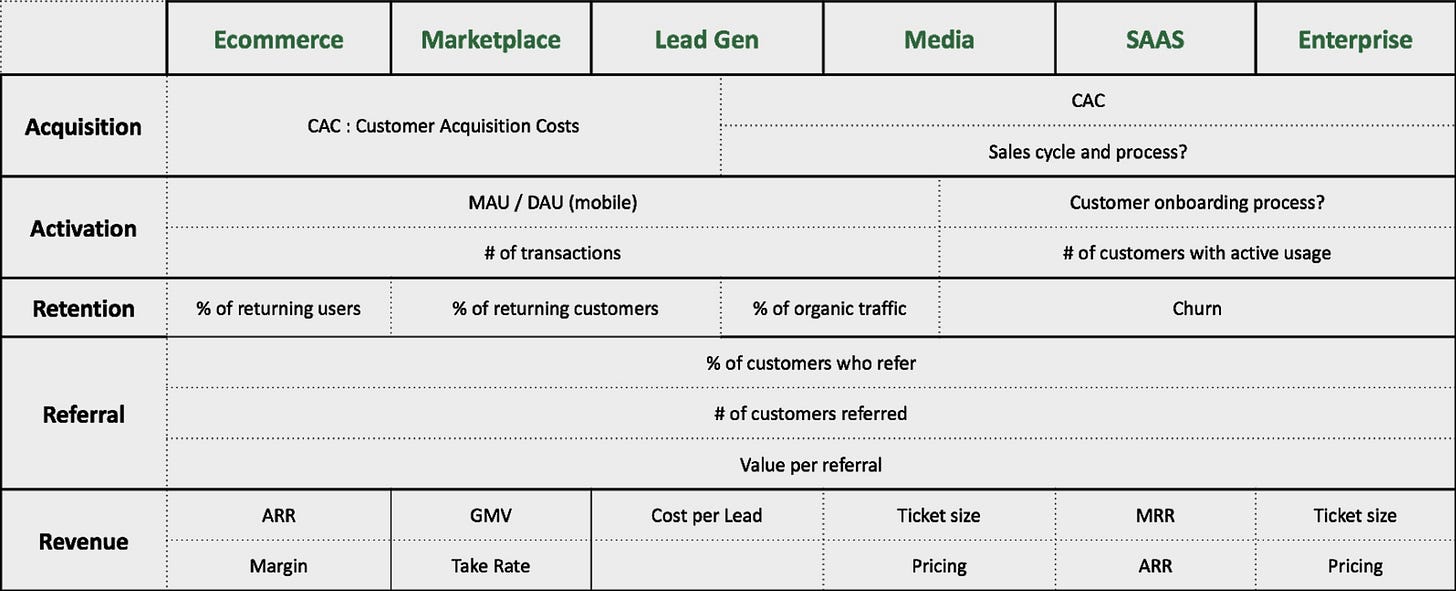

Metrics VC care about

Equity schadenfreude*

*pleasure derived by someone from another person's misfortune. Context.

🚀 Other notes

🤔 Food for thought:

Each time a founder meets with an investor, the investor is evaluating whether or not to make an offer. Founders who realize this know that no cup of coffee is entirely between friends.

What can you do when you get a preemptive offer from an investor.

Founders' sophistication has increased in the US - and also globally. Many run auctions effectively, and pick the right partner conducting similar diligence to the investors themselves.

Rather than burn dictating when to raise capital, founders elect to raise when inbound interest arrives, or immediately before launching to sell the dream rather than the metrics, or at other strategic inflection points. link

If you are introducing two people without using a double opt-in intro, you have a high likelihood of being a terrible person - email introduction etiquette.

🇩🇪 Enuu launched in Berlin, super cool.

🇩🇪 Germany has adopted legislation that will allow driverless vehicles on public roads next year, laying out a path for companies to deploy robotaxis and delivery services in the country at scale.

🇪🇺 55% of French, and 53% of Germans say "I don't know” when asked who they would prefer Europe to side with in the increasing competition for economic and technological dominance between the US and China.

🧮 AngelList built a Techmeme. If you didn’t follow, AngelList has been allocated a lot of resources in the past years, and is one of the better resources for the investment community.

🦋 Playing the long game in Venture Capital

🗽 Mini hotel toiletries will be illegal in New York from 2024

Thanks for reading 🙌

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.