followup

#148

Morning guys, welcome to Sunday CET.

Crazy week, huh? Most of the conversations were dominated by the Silicon Valley Bank story unfolding on both sides of the ocean. This week’s edition covers what I found interesting related to it.

SVB observations

As expected, the Brits were prompt to fix the problem and flipped the local branch to HSBC for a symbolic £1 pay announced by the week’s market opening.

It was apparently a convenient choice emerged on a short term notice since HSBC turned out to be the only one taken into consideration - the deal was closed at 3am on Monday, sealed off by phone from the US by the PM himself.

Other contenders that put formal offers included two British neo-banks and the Arab government through one of its funds, likely dismissed since the local market would have perceived them riskier for its well known conventional way for doing business. The SVB containment was a national matter that could have become a very serious situation for an economy already in a precarious state - that means you play it safe and don’t let outsiders in, you work it out with your own people from the circle of trust, in this case former British chancellor George Osborne and Simon Robey as main dealmakers on HSBC’s side.

Fun fact - HSBC’s top shareholders are Chinese through China’s State-backed Ping’An Insurance, controlling 8.3%. Second largest shareholder is Blackrock, with 7.9%. I guess the whole thing was on a too short notice to consider the tech sovereignty aspect of it.

The VC emotion was high on this one, but it turned out to be just a scare with a happy ending and many people learning their lessons. This can happen to anyone and everyone, and the whole context was not an easy one to predict - what stroke me the most though is how the SVB UK was a single point of failure for many VCs administering multi-million funds. They are top tier London-based VCs, considered to be the best at what they do - the very same people who are supposed not only to provide hefty returns for the said money, but also to provide expert advice to rookie startup founders on how to put the money to work. The king was naked - it is a paradox and a good tell of what this young industry looks like.

Also this:

I’m incredulous that some in our industry were thanking the management of SVB UK for an outcome only achieved by the government stepping in. President Biden was right to say that some SVB executives should never work in banking again after they provided false assurances to customers just hours before the Bank of England signalled insolvency.

And this:

The saddest thing is that this [SVB] place is Boy Scouts. They made mistakes, but these are not bad people. […] People are just shocked at how stupid the CEO is. You’re in business for 40 years and you are telling me you can’t raise $2 billion privately? Get on a jet and fly to Kuwait like everyone else and give them control of one-third of the bank.

Fact is that SVB put at risk an entire ecosystem orchestrated by VCs and LPs, with most startup people as innocent bystanders - at early stage you do what VCs tell you to since you cannot afford a CFO. People dealing with risks for their job were at a high risk of a colossal loss caused by SVB’s poor management decisions.

Also true is that, after this week, many fund managers will want to diversify their assets with a big bank as a treasury manager option. However, if I were an influent VC active in Europe I’d try to rally like-minded folks and put together a bank to take over Silicon Valley Bank’s role, which was immense. Can be a for-profit or not, backed by the most important industry players and managed accordingly to serve the industry’s interests - money is not a problem here, competence is.

And a problem can always be turned into a business opportunity - this industry has become too big and too complex not to be served by a specialised bank. Big banks can’t or won’t properly manage too many small accounts per fund - on top of that, the most common case of a capital call line requires frequent big transfers coming in and out but leaves very small average balances at the end of the day. This is an unattractive business for generalist big banks, whose brand is strictly related to the “too big too fail” promise, it is why they are expensive and painful to deal with - and that opens up the opportunity for a well run mid-sized bank with specialist functionality for funds and startups. And if you’re the paranoid type, understandably today, and know how to look at a balance sheet, using a smaller bank is not that risky.

Now that we put the worst behind us, how are people dealing with banking now? The most common setup I have heard of is dual:

- one bank dealing with 3-6 months payroll

- another one dealing with the bulk of treasuryThe second account is usually handled by a big name bank, keeping the money directly in governmental bonds. Some are also paying a premium insurance product on top of it. However, those banks don’t necessarily have to be big names, mid-tier players would do - Wise, Tide and Revolut are examples of frequent names I heard of in the UK.

I also know some people still banking with SVB, at least partly, out of the convenience of dealing with familiar faces supporting (still) good products backed by HSBC’s name in the UK and by the FDIC in the US. Sticking to SVB at least for a while happens also because it’s still freaking hard to open a bank account elsewhere due to redtape and/or high money requirements. In US there’s notably a bunch of VCs publicly encouraging folks to keep at least 50% of their cash at SVB.

I also know of cases using an extra third tier as a buffer account for handling another 3-6 months payroll, and am familiar with a couple of edge cases dealing with more than 5 banks.

In the UK - this is a good overview of what banks you can use as an alternative. In the US, the most frequent not-big-names - some banks, some cash management fintechs - I heard are Mercury, Modern Treasury, Axos, Airwallex, Grasshopper, Brex, Carta, Unit, Meow, Arc, also Angelist scrambled a new banking product. The UK vs US optionality comparison is really unfair, but now it’s not the time to get into it, and folks will gladly pay a premium rather than haggle just to transition to a safer setup ASAP.

Additional reads

SVB’s parent company filed for bankruptcy, part of a process overseeing its attempt to be sold. The FDIC still controls its commercial bank that collapsed from a run on deposits a week ago, while the parent handles the IB and the VC units.

European regulators criticise US incompetence over Silicon Valley Bank collapse.

Union Square Ventures warned startup founders in November to diversify their deposit holdings after alarm over Silicon Valley Bank.

1,074 private equity and venture capital firms - including Andreessen Horowitz, General Catalyst, Accel, and Benchmark - were storing at least some portion of assets from a collective 5,994 funds by year-end in 2021

What happened at the FDIC last weekend, during its failed efforts to sell SVB.

Goldman looked to buy SVB in 2020 but talks fizzled.

Tim Mayopoulos, ex-CEO at Fannie Mae, was the overnight CEO appointed at SVB - here’s his first email to customers.

Another bank CEO dealing with inbound business (Mercury) transitioning from SVB.

Current and former Silicon Valley Bank employees cited the bank's commitment to remote work as one reason for its failure:

SVB’s chief executive, Greg Becker, at times worked from Hawaii, president Mike Descheneaux decamped to Florida, chief risk officer Laura Izurieta was based in a suburb of Washington and general counsel Mike Zuckert worked mostly from New York.

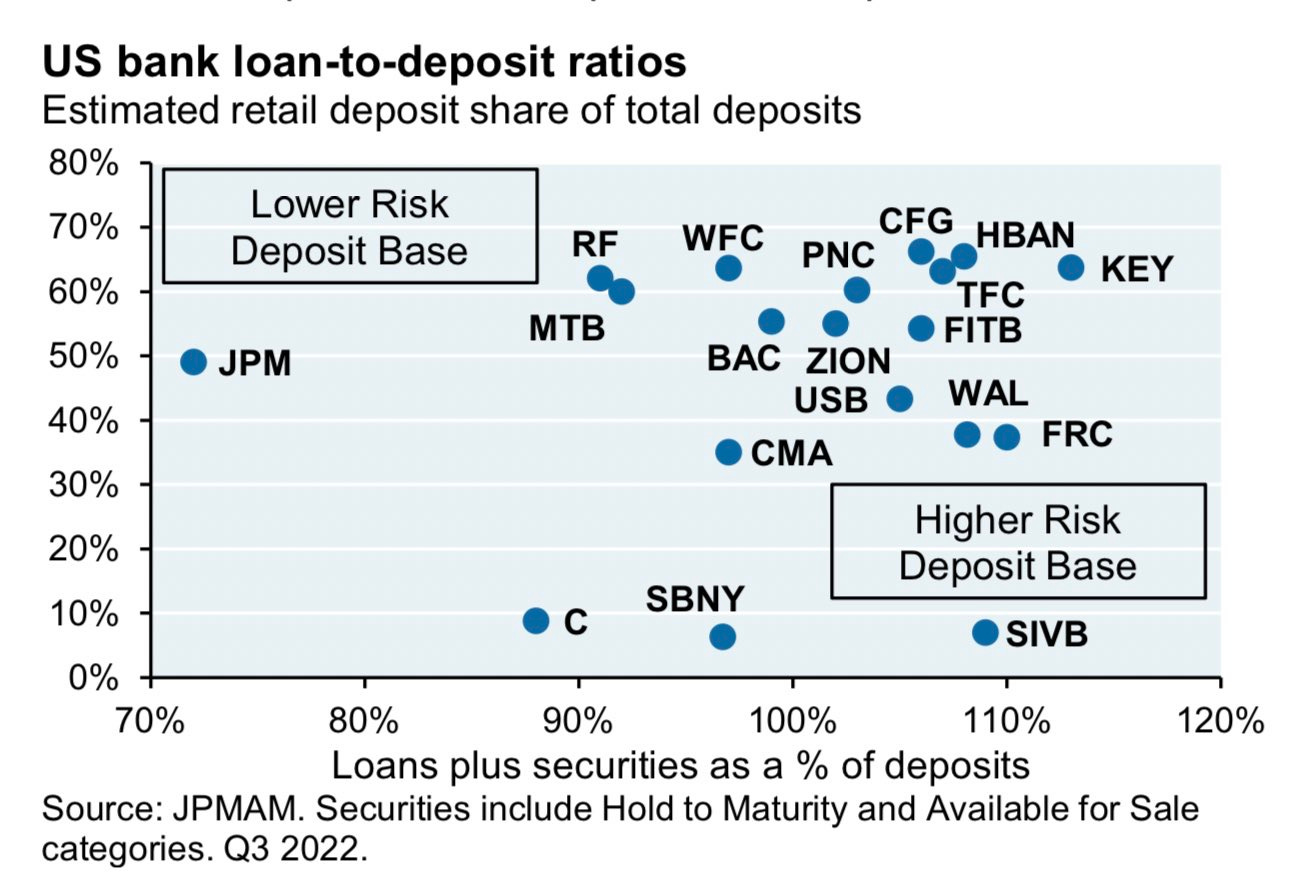

Graph of the week

The Silicon Valley Bank was in a league of its own, with an unusually high reliance on corporate/VC funding, and very low reliance on stickier retail deposits. Bottom line: SVB carved out a distinct and riskier niche, setting itself up for large potential capital shortfalls.

Notes

Good to know basis

👉 Interesting Euro deals this week: RightHub, SemiQon, Tailwarden, Vector Homes + some other early stage curated long tail deals we’re sending tomorrow in the AM to the N9 customers.

100% signal, zero noise, sign up now to get it too.

🇸🇪 Startups guide Sweden - useful stuff

🇩🇪 Startups guide Germany - useful stuff

👋 Building investor signals for a pre-seed startup - basics

☝️ A stepwise approach for your idea to PMF - good theory

👊 Uncomfortable startup truths - periodic reminders

🇸🇪 Nordic Demo Day - be there or be square

Euro cheat sheets

Active European investors: VCs + angel investors

The reports are available for Nordic 9 customers. Become one from here.

Euro money affairs

🇨🇭 The Swiss say that the problems of certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets. Yet Credit Suisse was directly affected by the SVB conjecture, since it had been on a downward mismanagement inertia going a few years back - and so the Swiss National Bank obliged with a 50 billion loan to survive. That was just two days ago, on Thursday - yesterday its local archenemy, UBS, announced intentions to take over all or part of Credit Suisse.

🇦🇹 Make money and war. Meanwhile, Austrians have a different kind of money problem, and got creative about the profits they made in Russia last year - good to keep it in mind when you read Austrian statements about current affairs:

Raiffeisen Bank, which made record profits in Russia last year, is seeking to exchange €400mn worth of profits trapped in Russia against Sberbank’s frozen cash in Europe, in a plan underlining the Austrian lender’s efforts to reduce its exposure to the Russian market.

The swap deal, presented at a Raiffeisen board meeting last week, involves Sberbank receiving roubles from Raiffeisen’s Russian subsidiary, which are barred from exiting the country because of capital controls imposed by the Kremlin, according to three people directly involved in the discussions.

As part of the so-called “project Red Bird”, Raiffeisen would in turn take over a sanctioned legacy cash pile held by Sberbank’s European arm.

🇬🇧 Rolls-Royce raised capital funding from The UK Space Agency for building an initial demonstration of a UK lunar modular nuclear reactor.

🇬🇧 McLaren Group, the F1 team-owner and supercar manufacturer, has received a £70 million equity injection from existing shareholders as part of a capital-raising plan which could now see as much as £500m ploughed into the business in the coming years.

AI eats the world

⚡ First book written with GPT-4 was authored by Reid Hoffman, of Linkedin fame, also a co-founder at OpenAI.

👌 The end of the world as we know it. I gave GPT-4 a budget of $100 and told it to make as much money as possible.

☝️ Why OpenAI risks to become an echo chamber - well, you need data to train it on constant basis. Google, for example, pays media companies for getting their content, and Facebook has its walled content garden - that is a next level business model for the media btw. Meanwhile, Open AI says the current ChatGPT-4 iteration lacks knowledge of events that happened after September 2021, when most of its training data was cut off.

Other pointers to put on Twitter

😲 Copy/paste deal reporting. Someone sent out a fake press release about a European startup raising $16 million series A and got media coverage. link via

🤔 MindGeek, one of the world’s largest and most controversial porn companies and the parent company of Pornhub, has been acquired by Ethical Capital Partners, a newly set-up Canadian private equity firm.

Apart from its funny name, Ethical doesn't appear to have an existing fund, or listed anywhere, or have people in the company management. There are no filings with the SEC, including Form Ds or investment advisor disclosures, or filings with Canadian securities regulators. This is the sort of thing that makes private equity industry lobbyists despair.

⚙️ Signs of storm Recent earnings reports from publicly-traded DTC startups indicate that once-hot brands are now struggling with severely slowing growth rates.

🤔 Marvel Studios is suing Google and Reddit to find out who leaked the Ant-Man and the Wasp: Quantumania script before the movie premiered.

🐐 Michael Jordan is in talks to sell his majority stake in the Charlotte Hornets basketball club.

🎶 Metallica acquired a majority interest in Furnace Record Pressing, one of the largest vinyl pressing companies in the U.S.

👎 Ticketmaster doing business A fan bought 4 tickets priced at $20 each for The Cure 2023 US tour but paid a final sum of $172 due to a service fee of $46, a $40 facility charge, and a $5 processing fee. Robert Smith, the band frontman, was pissed (money doesn't go to the band) and apparently convinced Ticketmaster to back off, kind of.

🐽 Cocaine production reached its highest point ever following a slump during the pandemic.

💲 In New York City, a $100,000 salary feels like $36,000

🇮🇹 It’s 2023 and nothing has changed - Italy's 'Fourth Mafia', little-known but extremely violent, was once underestimated as a backward rural phenomenon.

Did you find this email useful?

Great, will forward • Good • Meh

Dedicated to my mother.

Thanks for reading! Please send me your thoughts or comments by hitting reply.

If you would like to sponsor this newsletter, please get in touch. I am bit biased, but Sunday CET is a great way to reach investors and founders from Europe.

If this email was forwarded to you, please subscribe, it’s free!

Created every Sunday by @drnovac of Nordic 9 with weekly notes and observations from the European startup ecosystem.

You have received this email as you signed up at Sunday CET or are a Nordic 9 registered user.

Good stuff, as always!