The best European VCs & entrepreneurs, scaling in US and freemium at scale, how VCs cover multiple regions, and why aquaculture is a good investment bet.

The 3nd edition of our notes from the European investment landscape.

This is the third edition of Sunday Central European Time (Sunday CET), a selection with what we found noteworthy in the European investment space.

If you don't already subscribe, sign up here.

MENU

1. More money in the market

2. Learning about how others are doing it

3. Interesting bets

4. Data, research, observations

5. What others think

1. More money in the market

🇫🇷 Ardian has raised $2.5 billion for its latest co-investment fund, Ardian Co-Investment Fund V

The fund is already around 30% invested through 20 transactions.

Ardian, headquartered in Paris, is a private investment house with assets of $96 billion managed or advised in Europe, the Americas and Asia. The company is majority-owned by its employees.

🇫🇷 Schneider Electric sits on a €500 million fund set to invest in startups over the next 5 years

It is a corporate venture fund set up at the end of last year, looking for startups in electric vehicles space and the industrial Internet of Things (IoT). They participate with tickets of between €500k and €1 million euros, or in rounds of series A between €3 and 5 million.

Schneider Electric is a French multinational corporation specialist in energy management and automation.

🇮🇱 83North announced a new $300 million fund raising

This is the fifth fund, bringing total capital under management to over $1.1 billion.

83North started as Greylock IL in 2008, before becoming an independent firm and rebranding to 83North in 2015, is headquartered in London and Tel Aviv and has five partners: Laurel Bowden, Arnon Dinur, Gil Goren, Erez Ofer and Yoram Snir.

It is a generalist fund, investing at all stages, in consumer and enterprise tech companies. To date, they have backed more than 70 companies.

🇪🇪 BaltCap held the first close of BaltCap Private Equity Fund III (BPEF III) at €126 million

The new fund will aim to make 8 to 10 platform investments in the Baltic and Nordic countries with enterprise values of these companies typically being between €10 to €50 million and the fund’s equity investment between €10 to €20 million.

BaltCap, led by managing partner Martin Kõdar, was founded in 1995 and since then launched two funds, BPEF I and BPEF II, with aggregate capital of over €600 million, invested in more than 100 companies and has 30 people covering the region through 6 offices in Tallinn, Riga, Vilnius, Warsaw, Helsinki and Stockholm.

This new fund will coexist with the Miura Fund III closed in 2018 after raising €330 million.

Miura Private Equity is a mid-market private equity firm based out of Barcelona, with more than €700 million assets under management through its two funds and co-investment vehicles.

🇫🇮 Nordic FoodTech VC to raise €25M out of a €50M fund to invest in food startups.

The fund was announced in 2018 by Lauri Reuter, Pekka Siivonen-Uotila, Jari Tuovinen and Mika Kukkurainen and aims to invest in approximately 30 portfolio companies over a five-year period. Its initial investments are between €300k and €1 million - in addition to Finland, it is looking for investments in Sweden, Denmark and the Baltic countries.

2. Learning about how others are doing it

🇪🇸 How do you do freemium at scale (video)

A fireside chat with Joaquim Lecha from Typeform

🇩🇰 How do you decide to scale in the US and how do you go about it?

Why did you decide to scale to the US and when?

What markets were you in before you hit the US?

Where exactly are you in your US journey now?

Those questions about what does the U.S. scaling journey look like are answered by Kasper Hulthin, co-founder of Peakon, an employee retention platform originally from Copenhagen and with Cesar Carvalho, founder of Gympass, a platform for companies to offer fitness classes as part of their benefits program.

Even though 70% of the European deal flow is concentrated in four markets (UK, France, Germany and Israel) it is more and more difficult to keep up with what is going on from an investment and new stuff emerging from all the corners in Europe.

Some of the practices include:

local offices

employees covering specific regions

scouts

LP investments in other funds

data research

local networks, partnerships & friendships

Investment focus and specialisation

Bonus link: Investing internationally is a full time job

In 2015 Streamroot graduated from Techstars Boston and started looking for funding and in 2019 it was acquired by CenturyLink.

Streamroot is a Paris-based video infrastructure company.

🇪🇸 Thoughts on Spanish bootstrapped companies from a VC perspective

Jaime Novoa of K Fund: bootstrap or semi-bootstrap (companies that raise €500k approx to begin with, and continue growing without raising more capital) companies are increasing all over the place, including Spain.

🇸🇪 #KeepTheTalent: Deportation in Swedish Tech sector.

Aniel Bhaga, a Business Developer at H&M Group, received a letter from Migrationsdomstolen with a decision about deportation and a request to leave Sweden within 5 weeks.

After coming to Sweden from Australia 6 years ago, he has worked in digital transformation & marketing at companies including Electrolux, Telia, Nova, Flic, Ungapped, Nyden and H&M.

Aniel is not a single case. There has been a growing amount of skilled labor deportations, affecting the Swedish economy and the costs companies bear to keep the people they have chosen to grow their business.

🇫🇷 The first20.club is a private group of startups which receive 2 exclusive candidates per week.

first20 (as in the first 20 employees in a startup) started as a weekly email by Kerala Ventures, a Seed VC firm based in Paris, and now is a private hiring network connecting the best newly created startups to the most ambitious & skilled candidates.

3. Interesting bets

🇦🇹 Austria

organic juice producer | angel investors

🇩🇰 Denmark

real estate business based on providing co-living spaces | €7.5 million | Cherry Ventures, Founders A/S

🇫🇮 Finland

gaming | $1 million | Sisu Game Ventures, byFounders

🇫🇷 France

smart medical wearables and digital health services to improve walking and posture | €9.4 million | LBO France, Kurma Diagnostics, Idinvest, Seventure, SOSV

manufacturer of silicon photonic integrated circuits | €4 million | Supernova Invest, Innovacom, Bpifrance

3D modeling solution in the field of decoration | €3.2 million | Arthur Media Group, 5M Ventures, Bpifrance, angel investors

🇩🇪 Germany

super-lightweight e-bike drive systems | €15 million

music company that works with artists and produces brand new music tracks that are tailor-made for gaming audiences | $1 million | BITKRAFT Esports Ventures

decentralized identity management solutions for industrial IoT applications | High-Tech Gründerfonds

🇳🇱 Netherlands

digital biomarkers - software translating real patient data into digital treatment support | €600k | Healthy.Capital

🇳🇴 Norway

manufacturer of a digital paper tablet | $15 million | Spark Capital

🇪🇸 Spain

geolocation solutions in indoor spaces | €3 million | Swanlaab, Prosegur Tech Ventures

content-as-a-service platform (online courses) for sports, yoga, dance, hairstyle | €3 million | Nauta Capital

B2B food delivery service | €1 million | Big Sur Ventures, All Iron Ventures

SAAS, AI-based for semantic personality analysis within companies | €455k | The Venture City

door to door storage | €300k | Encomenda

🇸🇪 Sweden

electric trucks manufacturer | $25 million | EQT Ventures, Nordic Ninja VC

financing for solar energy providers | $8.6 million | Creades

manufacturer of electric small vehicles | $2.5 million | angel investors

SAAS for legal | $2.5 million | Point Nine Capital

🇬🇧 UK

online edu platform connecting parents/students to private tutors | £3.2 million | NVM Private Equity

quantum machine learning company | $1.6 million | Balderton Capital

business energy comparison company | £300k | North East Venture Fund

4. Data, research, observations

🇩🇪 Scooter company Tier raised $60 million in new financing

Well, why is this hot for VCs, you may wonder - a graph is better than a thousands words:

Helsinki has a detailed plan to be carbon-neutral by 2035, & knows what it needs to transform to get there. Overall emissions reduction by 80% from 1990 levels. Emission from traffic specifically reduced by 69% from 2005 levels.

11% of all #Helsinki trips & 14% of work/school trips are by bike (in summer; big winter drop is a lot about lack of #bikelane maintenance). They want 20% by 2035. Low & slow by Europe standards. A big problem is they’ve been mixing peds & bikes instead of taking space from cars.

In Oulu, Northern Finland, 22% of work trips and 51% of school trips are made by bike. And almost 20% of all trips.

Yup, kids go by bike to school during the winter

🇪🇺 Nordic tech, trends and deals

As covered by the fine people from Standout Capital

🇪🇺 61 deals and $272 million in investments tracked in Scandinavia in September

🇸🇪 Sweden: 32 deals

🇩🇰 Denmark - 15 deals

🇫🇮 Finland - 9 deals

🇳🇴 Norway - 5 deals

Top deals include:

ePassi Payments (financial services): $45 million

Simple Feast (food industry): $33 million

Happy Or Not (competitive intelligence): $25 million

Disclaimer: I am the founder of Nordic 9, which tracked this data.

🇪🇸 29 deals and €81 million in investments tracked in Spain in September.

Top deals include

BNEXT (financial services): €22 million

Lookiero (fashion retail): €17 million

Tiendanimal (pet products retail): €12.5 million

🇪🇺 The European Commission released the results of the 2019 Digital Economy and Society Index (DESI).

DESI monitors Europe’s overall digital performance and tracks the progress of EU countries in their digital competitiveness - loads of research data to chew by geography, verticals or practices.

🇸🇪 Creandum has been awarded the European VC Fund of the year.

That is according to Investor Allstar, which claims to be like an Oscar event for the European entrepreneurial and investor community.

The Swedes have been among the better ones in Europe for a while - in 2018 their fund, Creandum II, was the best EU institutional venture fund to date, with exits including Spotify (IPO), iZettle (PayPal), SmallGiantGames (Zynga).

Other winners:

CEO of the Year: Sara Murray (Buddi - UK health tech)

Entrepreneur of the year: Timo Soininen (Small Giant Games - Finland mobile gaming)

Young entrepreneur of the year: Dave Bailey (Mediatonic - UK games developer)

Investor of the year: Frederic Court – Felix Capital (UK)

Seed fund of the year: Pro Founders (UK)

Exit of the year: Adyen (Index Ventures)

The study adds to growing evidence that diversity at a company, in leadership, and in staffing, leads to better financial results.

Bonus link (pdf): what is the gender diversity like in the 🇳🇱 Netherlands Tech Ecosystem.

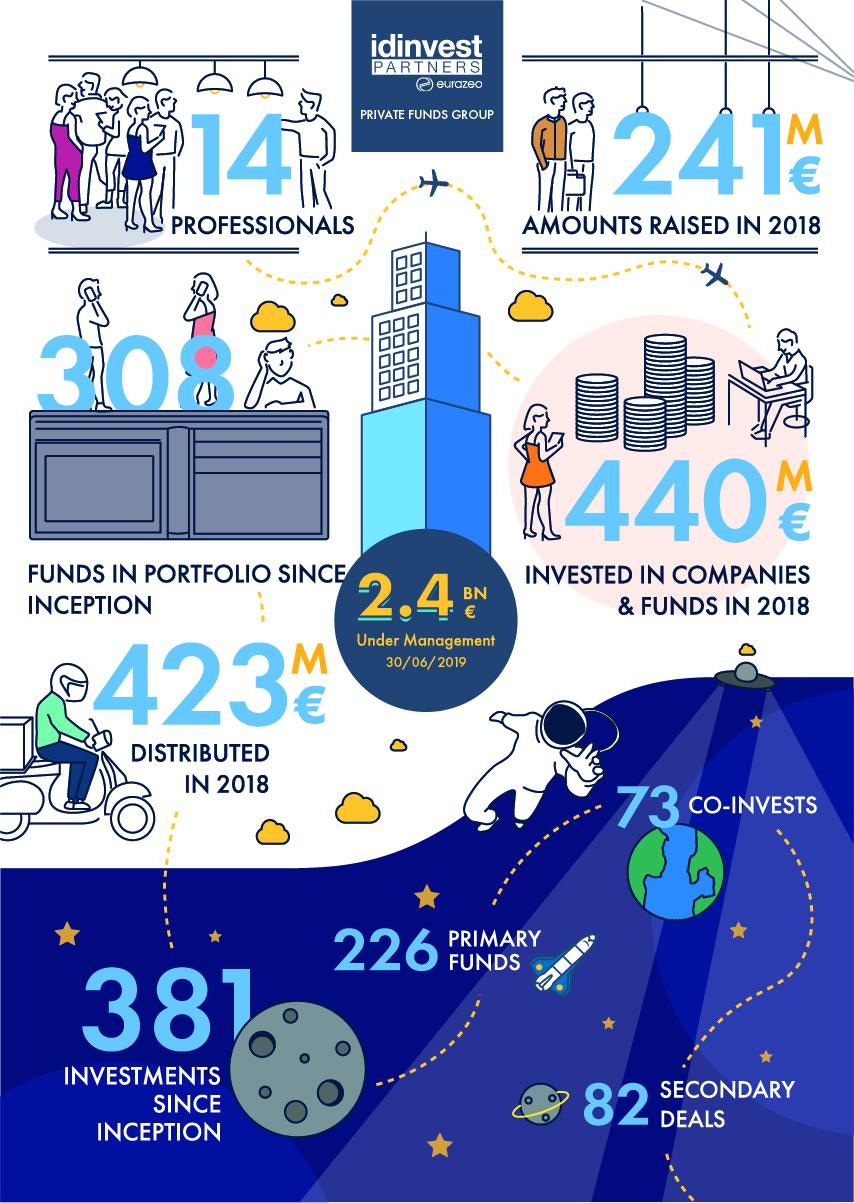

🇫🇷 A nice drawing about Idinvest’s business

🇪🇺 The 2019 Nobel Prize announcements

5. What others think

🇮🇪 Why aquaculture is the fastest growing sector in animal farming (podcast)

That is according to Carsten Krome, the CEO of Hatch, the first global aquaculture accelerator program started from Ireland and operating across Norway, Hawaii and Singapore and an investor into aquaculture with the fund Alimentos Ventures.

Interesting European startups in the space: Aquabyte, Optimeering Aqua, Planktonic, SeaSmart

Dedicated investor based in the Netherlands: Aqua-Spark

🇬🇧No Deal: A Guide for UK Startups facing Brexit

What are the top ten issues facing tech startups in the case of a no deal exit and plot the immediate steps startups should take to mitigate them as best they can.

It is complicated.

🇪🇸 Do’s and don’ts when building early stage startups (from an Engineer’s point of view)

Over the past 24 months, we have talked to hundreds of startup CEOs, CTOs, CPOs, etc; run dozens of due diligence analyses on companies; and worked side-by-side with a bunch of founders.

🇩🇪 The investment background of an investment in an alternative fusion technology manufacturer

Alternative fusion technologies can increase the probability of achieving a scalable fusion model in our lifetimes while being neutron free and safer. By taking advantage of maturing technologies, Marvel Fusion intends to provide a new approach that is neutron free, and suited for commercializing baseload fusion electrical power. The Marvel Fusion path to commercial fusion energy is based on short pulse and high energy and electrically efficient lasers.

🇫🇷 Solidification of the digital world

There are two reasons why digital tech is starting its solidification. The first one is the possibility to bring new interfaces in the physical world, while the second one is the technological barriers of the current components used. Of course, the one focusing on changing interface are more B2C focused, while the enablers one are more B2B focused.

Happy Sunday!

Thanks for reading 🙌

Created by @drnovac every Sunday. Feedback at dragos@nordic9.com.

Please share it with people who may find it interesting - thanks!