Hello!

Welcome to the new subscribers. Quick reminder - name is Dragos, I am an entrepreneur living in Stockholm and every Sunday morning I put together notes and observations from the startup and investment environment from Europe.

This is what I have this week. Enjoy!

Euro strat

❄️ Powder:

🇬🇧 Highland Europe

🇳🇱 Forbion

🇬🇧 Ada Ventures

🇬🇧 Sova VC

🇩🇪 Greenfield One

🇫🇷 Eutopia

🇬🇧 Science Creates

🇩🇰 Plantetary Impact Ventures

🇸🇪 Never Eat Alone

-

🇩🇪 Founders Fund, owned by Peter Thiel, has quietly entered into a partnership with a European tech investment firm called Elevat3.

🇸🇪 Creandum exited its KNL position.

🔥 Interesting deals:

🇸🇪 EQT Ventures announced 5 deals in the first 10 days of December.

2 series B (1, 2), one series A-ish, and 2 seeds (1, 2). They led all of them.

🇺🇸 BVP, which operates in Europe through an Israel office, led deals in two similar contract SAAS developers from the Nordics - one for sales and the other for legal. Made in the same week.

🇸🇪 Tink follows iZettle and Klarna’s unicorns paths in a $800M+ deal.

-

🇩🇪 developers of SAAS technology which makes biometrics usable on websites - link

🇸🇪 a bike subscription biz operating through a marketplace of freelancers - link

🇩🇪 SAAS for the aviation industry - link

🇬🇧 gamified fitness company - link

🇬🇧 social commerce on top of a video-based mobile app - link

🇩🇰 platform for EV owners to share charge points with friends, family, or neighbors on the street - link

🇬🇧 deep tech startup - link

🤓 Observations:

🇬🇧 If you’re an investor or intend to become one, you need to be familiar with Atomico’s report released this week - it’s by far the best and most comprehensive research piece covering the venture business in Europe.

However, turning the tables around, if you’re a startup founder - not that helpful.

Why is that - the research represents a very small subset of people making a living as entrepreneurs. Atomico’s research covers only venture money - i.e. startups that already raised money from professional investors.

Do you know how many entrepreneurs *do not* use risk capital in Europe? Here, I looked it up for you.

EU countries had 23.5 million small companies as per 2015 - EU’s nomenclature considers a SME an org with less than 250 employees.

Assuming 10-15k venture deals in Europe a year and a 30% margin of not covering all the deals - let’s say we have 20k companies per year that we can infer data about from what various vendors track. Let’s assume for the sake of simplicity that in 10 years we have 200k companies having at least once used a risk capital product - this number is pretty much a standard proposition of data venture whole-sellers.

200k in a 23.5M universe. So Atomico’s research is representative for a sample lower than 1% from the European “startups”.

Point is - most of startups don’t or won’t work with professional investors. If you go outside that bubble you will discover that most entrepreneurs don’t build stuff to become filthy rich, or to change the world or because they want to become unicorns in 3 years. That’s the investors narrative because that is their business model.

Most entrepreneurs are usually simple people with a pragmatic mindset, trying to figure out how to make a buck by solving problems and having an independent lifestyle. That's more fulfilling than having 100 million instead of 10 million or even 1 in the bank. And they also built economic mechanisms using tech (which is pervasive in 2021), employing people, paying taxes and planning to grow their business. Just like the startup guys working with professional investors.

For every 1 founder that raised risk money, there’s 10 that didn’t make the cut (conventional wisdom) and 90 that most likely didn’t even consider this.

This is a lot of entrepreneurial value creation not accounted for by Atomico’s research. A research report as comprehensive about those guys would be really cool, wouldn’t it? 😊

🇫🇷 The above observation was triggered by a boring interview about European entrepreneurs given by France’s president Macron, where, among other things, he says:

We need European financing, European solutions, European talent. We have GAFA in the U.S., BATX in China and GDPR in Europe.

No, we don’t. *Macron* does, for a nationalistic rhetoric made by a politician.

That is just another way of saying that Europe needs heavy protectionism, which any undergrad will learn in school that it hinders competitiveness, not encourage it.

The top down approach is not going to work for creating a thriving environment. From a macro perspective, we need a functional economy, access to capital and as little bureaucracy as possible. That is Macron’s job. Other than that it is a market’s problem and usually free markets are efficient in self organizing.

The capital part is there already but we all can see that throwing money at a problem, like Macron did in France in the past years, will not make for more and better entrepreneurs.

The continent is full of money already and the entrepreneurship level backed by investors in Europe is mediocre at best.

Maybe we’re not hungry enough and certainly we could use better incentives and models but the European paradigm of building tech startups seems to converge towards copying things from the Silicon Valley sorts and, if they stick, selling it to media as a success story.

There is more money than projects, the good ones are not too many and Europe lacks entrepreneurs, ideas and a proper overall environment for matching the good ones with the right kind of money.

Sure, it’s not black and white and that is the half empty part of the glass. You can argue that it has some of those elements (hey, we only saw tech unicorns on TV 10 years ago and now we have a good hundred) - but is it enough when your best value creators simply go to US in droves?

And that is also investors fault, as their industry from Europe as a category is pretty old school and narrow-minded, and that is probably top reason for the brain drain - you will go work with people who get it, and Europe doesn't have too many of those in excess too.

And btw, if you don’t go to America, America comes to you. Competition is probably even a better incentive than what Macron can do for the venture investors in Europe.

And listen, Macron and the likes may have good intentions as long their agenda allows them to but will have a hard time to understand that because the job of being a politician has nothing to do with entrepreneurship. It’s the same with him or with my dentist - they may have a cogent opinion when asked, but in particular have little knowledge about specifics.

⚡ Quickies:

🇷🇺 Yandex started using self-driving robots to deliver fast food orders. Available in Moscow and Innopolis.

Meanwhile, in US people already have self driving cars available for taxi rides. In Phoenix, Arizona.

The future is here, but not evenly distributed.

🇬🇧 Good deconstruct of Hopin valuation.

🇩🇪 Great example of how an investor can add value on top of the money. How many in Europe are doing it though?

🇩🇪 Data-driven sourcing and intelligent screening will become key, sourcing will not be a differentiator and the VC brand will be important - good read about the future of VC.

In other words, VCs need to apply to their business what they preach to their portfolio founders.

🇬🇧 What would you do with $44 million? Asking for a friend.

🇩🇪 German guy, former Salesforce chief scientist, takes a crack at a new search engine competing with Google.

🇩🇪 Porsche launches parking app comparing prices, compiling parking recommendations and configured with search functionality by vehicle model type and parking facility features.

🇫🇷 More details on the 50 million deal structure of French publishers made with Google:

We are in France, in which good money doesn’t stink and the notion of amour-propre can easily bend to business necessities.

🇸🇪 H&M started to roll out its subscription business.

🇸🇪 Ikea stopped printing out its yearly catalogue.

🇪🇺 How European personal data ends up at a U.S. government contractor.

🇮🇹 Italy found €10 million for funding the ‘Netflix of Italian Culture’

🇬🇧 7 things to consider when traveling post-Brexit in Europe - that is, if you’re traveling with a British passport.

🇪🇺 Massive list with great newsletters covering the Europe business (yours truly made the cut).

Graph of the week

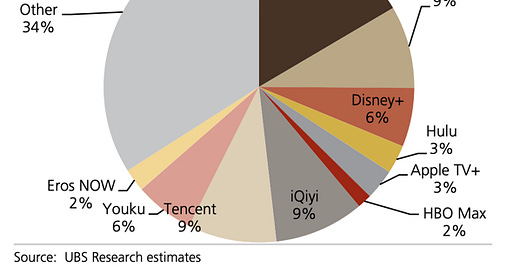

Global market share by streaming provider

Other stuff

Amazon Seller Acquisition Market (Euro context here)

Obama’s blog on Medium. Recommended.

Six ways new social companies will monetize, beyond ads.

The moment Brian Chesky hears Airbnb’s IPO indicated opening price is incredible.

Backers of Sequoia Capital are seeing 11-fold returns on investments.

Great read about how Uber is just a front for Saudi’s laundering money.

What tiny/nonexistent markets today will be trillion dollar markets in 10-20 years?

Big American companies moving in droves from California and NY - Goldman Sachs, Oracle, Tesla.

Bob Dylan sells his 600 songs catalog for $300 million.

Toyota came up with a car battery that allows for a trip of 500 km on one charge and a recharge from zero to full in 10 minutes.

Currently, Cuba has two currencies: the Cuban peso, in which state wages are paid, and the CUC, the local hard currency.

One CUC is equivalent to 25 Cuban pesos for the population, but the government also maintained a fictitious parity with the dollar for state companies.

For the state budget, many sectors also used a fictitious parity between the Cuban peso and the dollar.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.

One more thing this week:

https://orbex.space/news/orbex-secures-24-million-funding-round-for-uk-space-launch

You're saying protectionism doesn't work but then you make an example of Yandex's robots, and there's also obvious success of China - both very protectionist. If it works for Russia and China, why shouldn't it for Europe?

You've said yourself many times that here the culture is different from SV.