Monday CET

#71

Hey guys,

Welcome to a new edition of Sunday CET!

Let’s get to it.

Introducing a new newsletter

The need of a new product.

The Sunday CET has become a bit too complex and long for a newsletter, at the cost of lacking focus and consistency.

And with all the tweaking I am making, every week I have to put stories and interesting stuff away just because the length of the mail is unfitting, and, more often than not, it doesn't make for a consistent topic timeline or focus.

I always advise founders not to build a product that is everything for everybody - and I kinda gotta put my money where the mouth is.

So I have been thinking about this for a while…

A Sunday CET spinoff.

Sunday CET is a byproduct of my Nordic 9 work - every week I come across a ton of information and get to see hundreds of deals, startups, teams or business models. Some of them have interesting potential and deserve more coverage than the standard PR published by the media.

Besides screening startups (we process manually 1000+ deals per month), my work includes doing cheat sheet reports. That is data-based snackable content providing quick guidance and actionable insights for both investors and startup founders.

All of this is included as specific sections in the Sunday CET every single week. How about making it a standalone product?

A few reasons for considering this:

i) this idea would separate the more technical stuff, deals and data-based, from stories and opinions.

ii) a spinoff would be focused more on pure data-based intel, appealing for people exactly looking for this kind of content - there’s many of you appreciating exactly this.

iii) it would make Sunday CET more interesting, as it would make place for more stories and topics sent every Sunday. Even the opinion pieces could be a bit more thorough and detailed.

iv) at the same time, the intel-based product would be more complete and comprehensive, allowing for context added to a plain link.

The Euro Intel Updates

I am excited to launch a new product that will cover exactly this: interesting deals, insights and data-based cheat sheet reports.

The product is going to be a weekly newsletter, called tentatively Euro Intel Updates (Monday CET an option also), which will be sent every Monday morning. It will have the following structure:

1. A weekly report. The reports usually cover current topics from the Euro ecosystem. Examples include market landscapes, specific intel, a company valuation or the mechanics of an investment deal. They are also published on Nordic 9.

2. Interesting startup deals. The startup section will cover 5 to 10 interesting early stage deals that we tracked in Europe that week. The main focus is on curation as I don’t intend it to become yet another transactions aggregator or a media monitoring service.

The criteria for selecting those startups is their business fundamentals and the potential to grow. That means economic model, market and TAM, team or other drivers that are competing differentiators. Also important, they are very early stage, meaning they raised less than $1-3M.

3. Active investors (VCs and angels). Learning who some of the more active deal makers are and what they fund is a good signal showing how the market is behaving and where it is going.

-

This is a tentative structure and nothing is set on stone. It is a starting point based on which I will further experiment every week - maybe more opinion, or specific analysis, maybe different kind of intel. We will see.

The Euro Intel Update newsletter is going to be a paid product, and a subscription will cost 149 euro per year.

What does that mean?

Nothing changes for you - you will keep getting Sunday CET every Sunday morning, like you did in the past 70 weeks or so. It will always remain a free product.

In addition, every Monday morning for the next two weeks, you will receive the Euro updates, at no cost. That is tomorrow in the AM and on the week after Easter Monday (April 12).

If you like it and would like to receive it after that, you will need to subscribe.

One more thing

The idea of doing another newsletter came naturally as an extension to my work and my experience.

My objective is to research, understand, and explain the fast-changing Euro startup ecosystem, and bring to attention interesting and innovative businesses and practices.

This kind of stuff you don’t find in the media - valuable, not-the-average kind of intel for investors, founders and - as I’ve discovered - a great bunch of people.

Join in! Your support for creating something valuable means more than you imagine and, frankly, it gets me going every week.

Last but not least, since I don’t want this to be yet another paid newsletter, which kind of is tbh, here’s what I’m thinking:

For the same money, subscribers will automatically benefit from the Nordic 9 intel and data - meaning that they will also get free access to the Nordic 9 Insider package, also worth 149 a year, with all the (many) perks that are described here. Two times the value for the same money.

And so, if you would like to support my work in advance, just get the N9 Insider from here and you will be on the list. Gracias!

Hope it makes sense and that you like the idea. Can’t wait to send you the first one tomorrow! :-)

-

Now, onto the today’s Sunday CET.

✍️ Observations

More on the online grocery front in Europe

2 big deals announced this week - Getir and Gorillas. Here’s what March looks like:

🇹🇷 Getir - $300M | $470M

🇩🇪 Gorillas - $290M | $334M

🇨🇿 Rohlik - $230M | $261M

🇩🇪 Flink - $52M | $64M

🇸🇪 Matsmart - $41M | $80M

🇳🇱 Crisp - $36M | $45M

🇬🇧 Bother $6M | $6M

🇬🇧 Jiffy - $3.6M | $3.6M

Total: $959.8M | $1.3bn

Others that raised: Dija, HungryPanda, Cortilla, Weezy, Cajoo, Corner etc - a total of about $200 million.

Some online grocery market size estimates for 2023:

🇬🇧 $22.1bn

🇫🇷 $17.2bn

🇩🇪 $3.8bn

🇮🇹 $3bn

🇪🇸 $2.2bn

🇳🇱 $2bn

Total: $50.3bn

All of those guys seem to have a top down approach, meaning they focus on the largest cities from the largest markets to get their model going.

The deeper-pocketed players already started geo expansion, across smaller geographies, swallowing smaller players or putting their own flag.

The European market is actually much bigger than the figures from above but it’s good to have a context. Less than $1.5 billion in investments deployed for conquering a $50 billion market growing double digits yoy is very little. Expect more (much more) VC money thrown in.

France! A sizeable market with only one local VC-backed contender that raised some 7 million! Allez, les Bleus!

Spain - nada! We actually have a small contender from Barcelona announced this month and backed a German (!) VC (Cavalry). Vamos, amigos!

The list above includes only the corona startups i.e emerged in the past 12 months because of corona. Less Getir (focused on Turkey pre-corona) and Matsmart which i) has been around since 2014 and ii) only does Sweden.

Glovo, Deliveroo and Wolt are the big deals in town, with deeper pockets and unfair advantages - i.e. an established brand, already logistics in place, and market relationships. They will move aggressively since their core markets don’t grow as fast.

It is a gold rush that feels like the history repeating, when there were a few companies working to put railway tracks across America. The question is what’s the end game and who is going to run the trains after the infrastructure work is done?

Doing grocery startups requires an undifferentiated strategic play in a market that will reach an equilibrium soon, in the hands of a few players that will control sizeable segments.

This is Amazon’s opportunity to purchase an established player in a few years that will give them a better Euro share. Subject to the EU gods’ regulation, of course - it’s easier and cheaper to buy than build from scratch in Europe anyways. Amazon already has a chunk in Deliveroo, btw.

Meanwhile in the US: GoPuff raised $1.15 billion, available in more than 650 cities. The small cities from US are smaller than the small cities from Europe though.

Are the European investors traditional and risk averse?

🇬🇧 Deliveroo’s IPO has become a political game that basically involves a power struggle. The reason:

[Post listing] Will Shu, co-founder and chief executive of Deliveroo, will hold a stake worth about £500m and retain 57 per cent of the voting rights. That dual-class control will allow him to veto any attempt to oust him from the board by other investors, as well as block a takeover for up to three years after the IPO.

This is not to the liking to some of the largest asset managers that deal on the London Stock Exchange, which would like to have more control, including firing the CEO, if so they wish.

As such, they decided to boycott Deliveroo’s IPO, a big deal since guys like M&G, Aberdeen Standard Investments and Aviva Investors control a considerable chunk of the buy side from the stock exchange.

However, this political game was publicly wrapped up in being cautious about the business risk of “gig economy” and “market regulations” that an op such as Deliveroo may present.

I mean, sure, macro risks exist, and can affect business, but those risks can be managed, like in any other business. It is the CEO that cannot.

All this brouhaha is in the context of LSE trying to attract more business on the exchange and consequent tech startups looking for liquidity events on their platform. Efforts are being made.

My take? Maybe investors are right and have a point, any professional would like to protect their equity positions as much as possible even though they have no idea about running, say, a food business.

But this risk averse attitude also sounds like a story you hear frequently from founders speaking about European investors - old and traditional, a combination representing a rather systemic Euro problem and part of a larger context including exit environment issues.

And this type of situation is a big incentive for Euro tech founders to go over the ocean and talk business to America.

🇬🇧 Staying on the Deliveroo topic - I wanted to write a bit more details about their business and analyse their model.

Contrary to what I am reading, I just don’t see it as a huge success story, my gut instinct tells me that it’s just a highly undifferentiated business that has no substantive defensible moats while the future upside is a pivot to an adjacent market which is in fact an empty online grocery space quickly to be filled by VCs dying to flip them their holdings.

And as I started to delve into materials to understand more about it, I ran into this, so there was no reason for me to write anything.

Happily married but divorced.

🇬🇧 Crowdcube and Seedrs had their marriage called off by the authorities. The reason:

A merger would result in a substantial lessening of competition and the only effective solution at this stage would be to block the deal.

When fabricating this kind of deal, such a big risk should have been flagged by the due diligence. You don’t go forward unless you have backdoor channeling back and forth that would give you some sort of assurance for going ahead.

I assume that this channeling has been worked but apparently it wasn’t enough.

It’s just awkward for two startups to open up their kimonos and share their future ambitions and fears and all of a sudden to have to compete with each other. Especially since they deal with precarious profitability in a business that would require scale in order to make sense.

A bit of the deal breakdown here.

Show me your PR, I’ll tell you about your business.

🇪🇺 There is an old joke saying that engineers and dogs have in common an intelligent expression on their face but they cannot convey their opinions.

I was reminded of it while reading a decision of the EU Council about the strategy of the EU-wide payment solutions.

Imagine you work in PR and that your boss asks you to produce a press release that looks like this. What kind of materials do you have to compile so that you produce a 2000-word masterpiece that hardly makes any sense even if you are in finance and know the lingo…?

And so, like in the joke above, could it be that the EU guys are some sort of smart dudes that cannot put into cogent words the fruits of their work?

No, I don’t think so. I think there is a strong correlation between the quality of such a press release and how the EU is acting and thinking strategically. Wooden language, hardly intelligible, made out of pompous words that don’t mean anything.

A strategy is good and viable if you are capable of putting it in simple words that even a 10 year old kid can understand. Hardly the impression you get when dealing with the EU work.

Micropayments for media

🇮🇱 Former Waze CEO, who in February said that working for Google is horrible unless you like being a cog in the machine (dully reported in #66), is now doing a media startup that will be based on micro payments:

Users will pay for each article or other content that they access, without the need to buy a monthly or annual subscription to the news site in question.

After joining the platform, users will have to load their accounts with a balance of at least $3. They will then be able to pay for content that they access via the site. Reading an article, for example, will cost $0.15 while viewing a video clip will cost $1. The platform will take a percentage of the price of each transaction.

It is an interesting experiment that has been tried repeatedly in the industry for many years, to no success.

The reason is the hyper fragmentation on both sides - if this were to work, the platform would have to replicate and capture a consumer reading behaviour that has at least a few scalable patterns to make sure it would make an economic sense for a reader to create a wallet account.

On the other side of the marketplace you have the content producers who would have to be strongly incentivised to provide their content for being accessed via other channels on a retail model.

Interestingly enough, they’re not the only guys trying to do the same thing - a corporation as big as WaPo, owned by Jeff Bezos, also has built a multi-publisher, shared-subscription system that allows users to sign in once and get access to multiple publications, buying articles “per click.”

It is a tough nut to crack, definitely interesting to follow how it’s going to work out.

✍️ Other notes

🇪🇺 Last week, US-based scooter sharing Bird announced deploying $150 million for grabbing market share in 50 new European cities. Looks like the strategy includes conquering mid-sized and small cities.

🇩🇪 SellerX raised €26 millions more in equity on top of the €100 million in (mostly) debt secured at the end of the year.

Speaking of which, Amazon SKUs aggregators keep popping up, here’s another one started by two students (!) who just raised $55 million and had the following to say:

Benitago is different because it’s not just focused on financial arbitrage. Instead, it has created a detailed, repeatable blueprint to continue growing these business.

Also on topic - the private investors risk tolerance is starting to get friendlier to the Amazon platform because of Covid.

🇪🇺 Here’s a good overview of the InsurTech market in Europe.

🇫🇷 Good interview with Accel's Philippe Botteri, who’s an old timer VC in Europe.

🇫🇷 How FJ Labs evaluates startups - useful and transparent, you will not find too many investors so upfront with their internal process.

Bonus link: a guide to raising a Series B.

🇸🇪 H&M got f*** in China for good over human rights concerns. H&M simply doesn't exist anymore in China. Really.

🇸🇪 Spotify surveyed some users about Clubhouse this week.

🇬🇧 Dating a founder. I laughed.

🇳🇱 Booking.com is not a good place to work at, according to what people say online.

🇪🇺 In 2020, biking in France grew by 27 % year-on-year. In Oslo it went up by 36%.

🇩🇪 Germany increased its birth rate by 0.8% in December 2020 and January 2021.

🇮🇹 Giorgio Armani:

I design through subtraction. I take away to leave the essential. This goes right back to advice my mother gave me: if you wish to create beauty, only do what is necessary, and no more.

Charts of the week

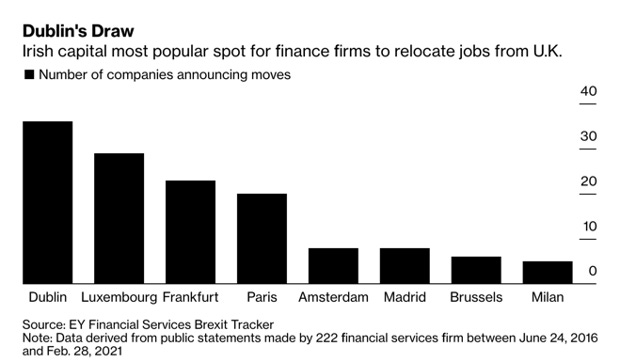

Dublin!

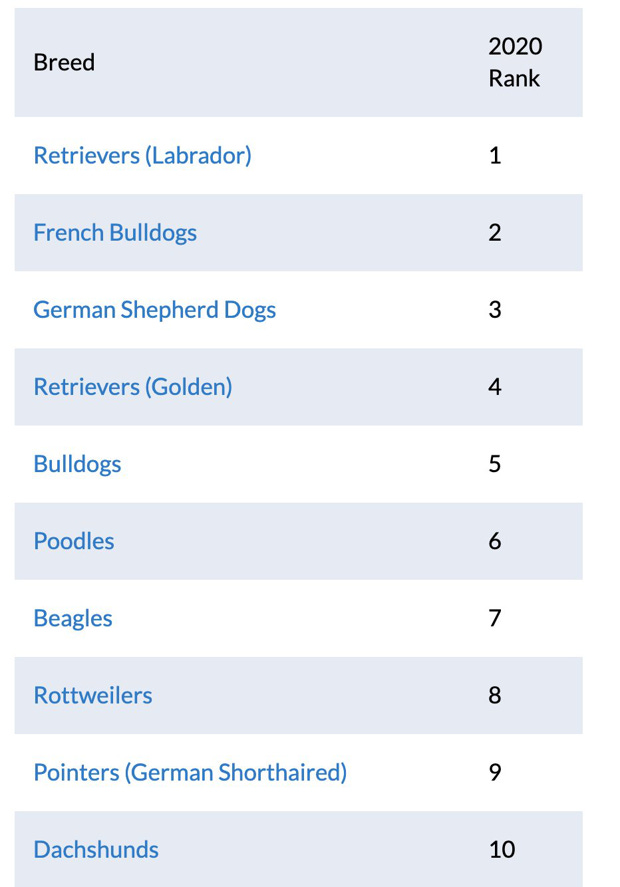

Puppies!

Other stuff

Here’s one of the hottest YC graduate this winter, valued at $100 million pre-revenue.

So hot that it got VCs to complain on Twitter that if they wanted on the ticket, they would get a “take this deal on our conditions or leave”, with zero power of negotiation.

Competition is an uncomfortable situation for investors, since they have the money they’re used to have the leverage.

Remember last week I mentioned about the Goldman employees making a ppt complaining to their bosses they work too much? Here’s how it’s working out in the accounting business (Ernst & Young, Hong Kong):

You let people stop work at 7:30pm on a Friday so they can have dinner with friends or family before going back to work till midnight + one day of the weekend (in the office) & another half day from home. Every weekend.

A few years ago, in Romania, EY actually had an employee that died because of being exhausted from working her ass off.

Every SaaS company should have a media arm with a newsletter that gives industry news.

Just acquire an influencer in your space with a solid following.

Make them editor-in-chief.

Bundle their content for free with your software subscription.

And make all customers readers.Makes sense, right?

If you put together the flagship streaming services from the biggest media and tech companies, (Amazon, AT&T, Netflix and Disney), it would now cost you $92 a month in the U.S. That’s almost as much as a typical cable-TV subscription, at $93.50.

Business 101 in simple words for Substack haters and media orgs.

You can now buy a Tesla with Bitcoin. Only if you’re in the US.

Citigroup CEO bans Friday Zoom calls, encourages vacations. Me too!

Amazon’s PR started trolling the US Congress members on Twitter.

Startups Axios and the Athletic discuss merger, consider SPAC deal.

The 2021 a16z Marketplace 100 list is out.

Here’s a good spreadsheet tracking all the SPACs out there.

How much people writing on Substack are making.

The world's most popular electric car is the $4500 Hongguang.

Happy Sunday!

Thanks for reading 🙌

Created every Sunday by @drnovac.

Please share it with your networks and encourage your colleagues to sign up here - thanks!

Feel free to reach out if you have any questions, comments, feedback, or if I can be helpful.